The dollar traded close to session highs against most major currencies on Tuesday, as sentiment remained positive following the upbeat comments from the Federal Reserve while a slump in the pound supported further upside momentum.

A drop in sterling pushed the dollar to session highs, after Bank of England Governor Mark Carney dampened rate hike expectations, saying that now is not the time to raise rates, pointing to “anaemic” wage growth and mixed signals on consumer spending and business investment.

Further support on the dollar came from comments by New York Federal President William Dudley on Monday as he boosted expectations of more rate hikes, warning that halting U.S. interest rate increases could be dangerous for the economy, insisting continued progress in the jobs market will push wages higher, reviving the recent slowdown in inflation.

For today, the U.K. will publish public borrowing numbers while later in the day, the U.S. is to release industry data on existing home sales.

GBP/USDThe pound fell below $1.27 Monday as Bank of England chief Mark Carney warned against rate hikes.

Carney explained that the surprise dissent of three BoE members last week was due to different views on the outlook.

However, the BoE governor clearly explained that his view was that “now is not yet the time to begin that adjustment.

The U.K. public borrowing data will be in the spotlight for today, while later in the day, the U.S. is to release industry data on existing home sales.

Pivot: 1.2675

Support: 1.26 1.255 1.25

Resistance: 1.2675 1.2725 1.276

Scenario 1: short positions below 1.2675 with targets at 1.2600 & 1.2550 in extension.

Scenario 2: above 1.2675 look for further upside with 1.2725 & 1.2760 as targets.

Comment: a break below 1.2600 would trigger a drop towards 1.2550.

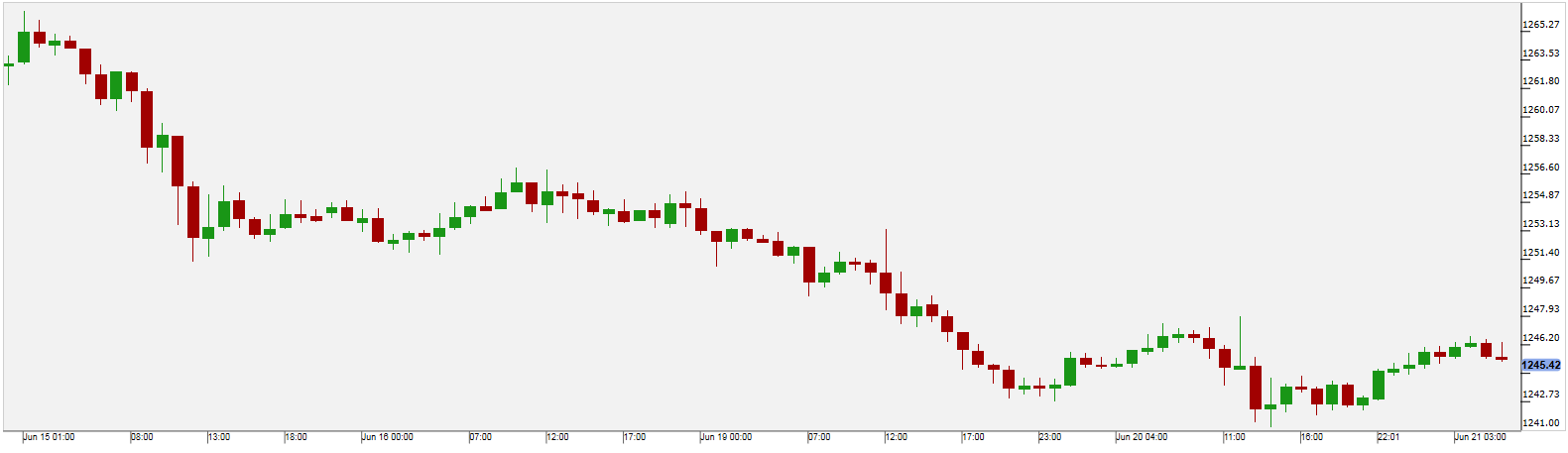

Gold prices remained weak on Tuesday, as the dollar continued to advance amid rising expectations that the Federal Reserve would hike interest rate by the year-end

However, some expectations that inflation is not strong enough for a third hike this year could provide some support to the precious metal.

On Tuesday, Boston Fed President Eric Rosengren said low interest rates do pose financial stability concerns that central bankers and the private sector must take seriously. On Monday, Bill Dudley, head of the New York Federal Reserve downplayed the recent slowdown in inflation, adding that halting rate increases at this point would be dangerous.

Existing home sales data from the U.S. are in the spotlight for today, while for the rest of the year, Fed views on rate hikes will be in focus.

Pivot: 1248

Support: 1241 1237.5 1232.5

Resistance: 1248 1252 1257

Scenario 1: short positions below 1248.00 with targets at 1241.00 & 1237.50 in extension.

Scenario 2: above 1248.00 look for further upside with 1252.00 & 1257.00 as targets.

Comment: the RSI is mixed to bearish.

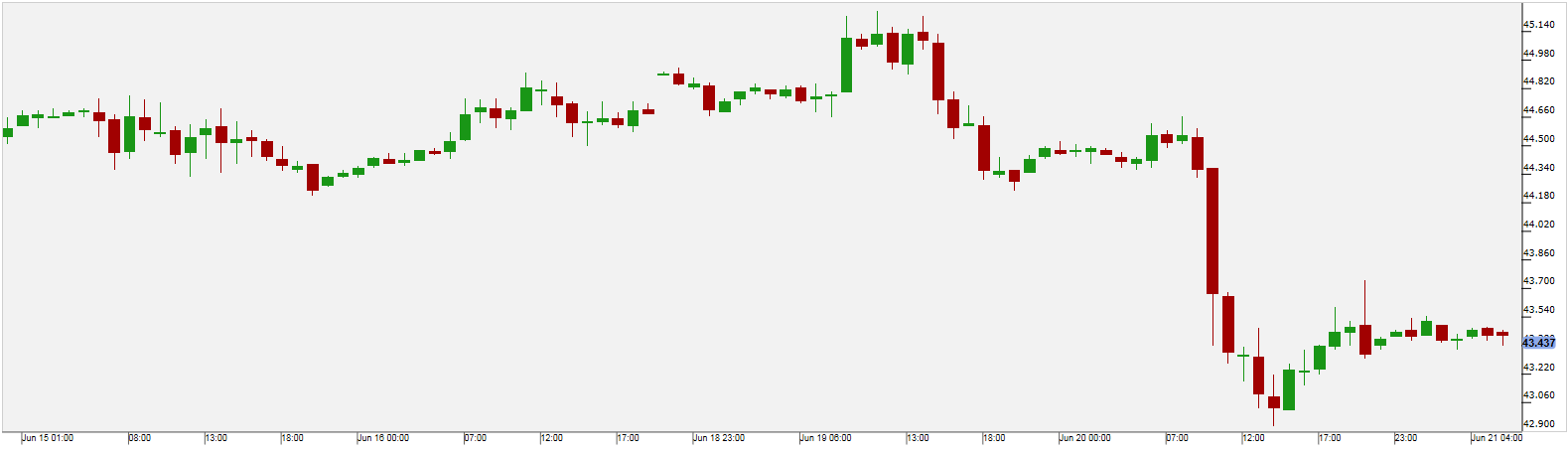

Despite a larger than expected drop in inventories on Tuesday, crude prices settled at a seven-month low on concerns about a rise in global production.

U.S. crude oil inventories fell 2.720 million barrels, the American Petroleum Institute said on Tuesday, more than expected compared to an expected drop of 2.106 million barrels seen.

Gasoline inventories rose 346,000 barrels and distillates edged up 1.837 million barrels. Forecasts were for a build of 465,000 barrels for distillates.

The API estimates are followed by more-closely watched figures from the Energy Information Administration (EIA) on Wednesday. The API and EIA figures often diverge.

Pivot: 44.3

Support: 43 42.5 42

Resistance: 44.3 44.7 45.3

Scenario 1: short positions below 44.30 with targets at 43.00 & 42.50 in extension.

Scenario 2: above 44.30 look for further upside with 44.70 & 45.30 as targets.

Comment: as long as the resistance at 44.30 is not surpassed, the risk of the break below 43.00 remains high.

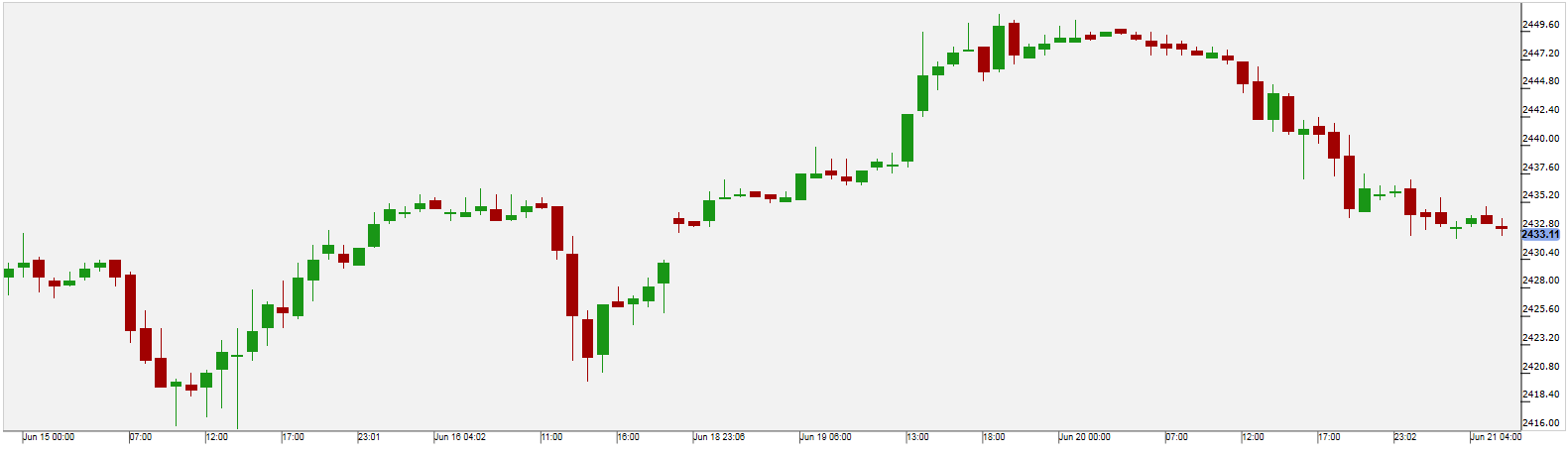

The main U.S. indices closed lower on Tuesday, as losses in the Oil & Gas, Consumer Services and Industrials sectors led shares lower.

A 2 percent drop in oil prices hurt energy stocks and retail stocks were pulled down by concerns about Amazon’s plan to boost its apparel business, while investors also worried about future Federal Reserve rate hikes.

The S&P technology sector fell 0.8 percent, with the biggest drags from Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL).

At the close in NYSE, the Dow Jones Industrial Average lost 0.29%, while the S&P 500 index lost 0.67%, and the NASDAQ Composite index fell 0.82%.

Pivot: 2446

Support: 2428 2421 2416

Resistance: 2446 2451 2458

Scenario 1: short positions below 2446.00 with targets at 2428.00 & 2421.00 in extension.

Scenario 2: above 2446.00 look for further upside with 2451.00 & 2458.00 as targets.

Comment: the RSI advocates for further downside