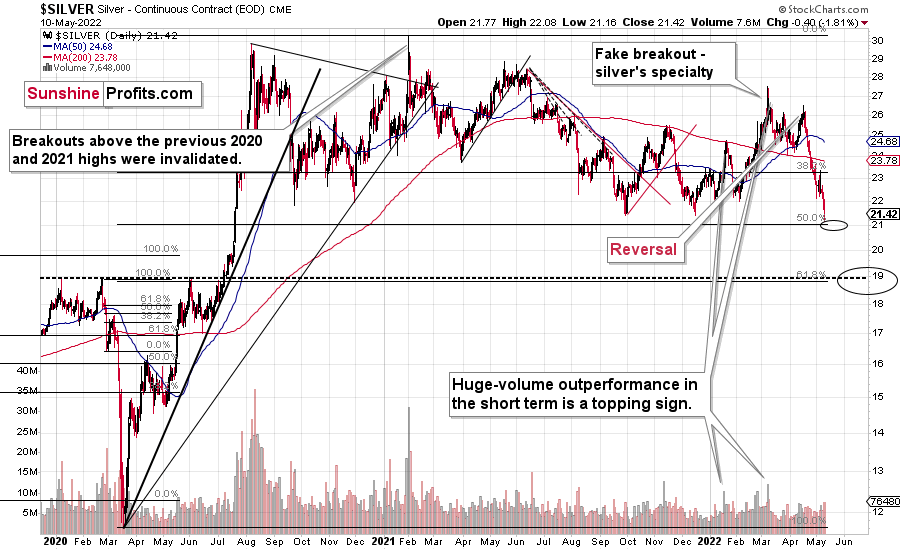

In short, practically everything that I wrote earlier this week and hear remains up-to-date. The profit-take levels in silver were hit, so those of you who chose to hold a short position in silver have likely reaped nice profits yesterday. Congratulations!

In Monday's analysis, I commented on silver in the following way:

The white metal moved lower, and its intraday low was just 2 cents above our profit-take price.

Since gold is likely to move lower, and the general stock market is likely to move lower, I’m moving the downside target lower – slightly above the 50% Fibonacci retracement level based on the entire 2020-2021 decline. That’s the next strong support that’s below the 2021 lows, and that would more or less correspond to the size of the above-mentioned short-term decline in gold (at least that seems realistic to me).

The downside target that I featured was $21.23 (for silver futures, which some might choose to call a form of “paper silver,” by the way), and it was reached Tuesday—the intraday low was $21.16.

The downside targets for related ETFs were reached too. Will silver soar immediately? This might or might not be the case, as the general stock market might decline some more in the near future. Since silver (and mining stocks) are quite correlated with the former, they could move even lower.

Still, it doesn’t mean that it’s worthwhile to stay in position at all times. Since silver moved so close to its 50% Fibonacci retracement level Tuesday, it could be a situation where the downside is very limited and the upside (for the short term) is bigger.

For now, I’m not suggesting going long (to profit not only on the decline, but also on the rebound), but this might change very soon.

Please note that despite all the “peak silver,” “silver is manipulated so it has to rally,” and “silver shortage” theories, the white metal is now much lower than it was when it got really popular in early 2021.

Don’t get me wrong: I think that the silver price will move into the three digits, but I would like to emphasize that just because something is likely to happen eventually doesn’t mean that it has to happen right away.

Silver’s purchasing power can decline before soaring, and that’s exactly what it's been doing for more than a year now. It doesn’t seem that the medium-term decline in silver is already over.

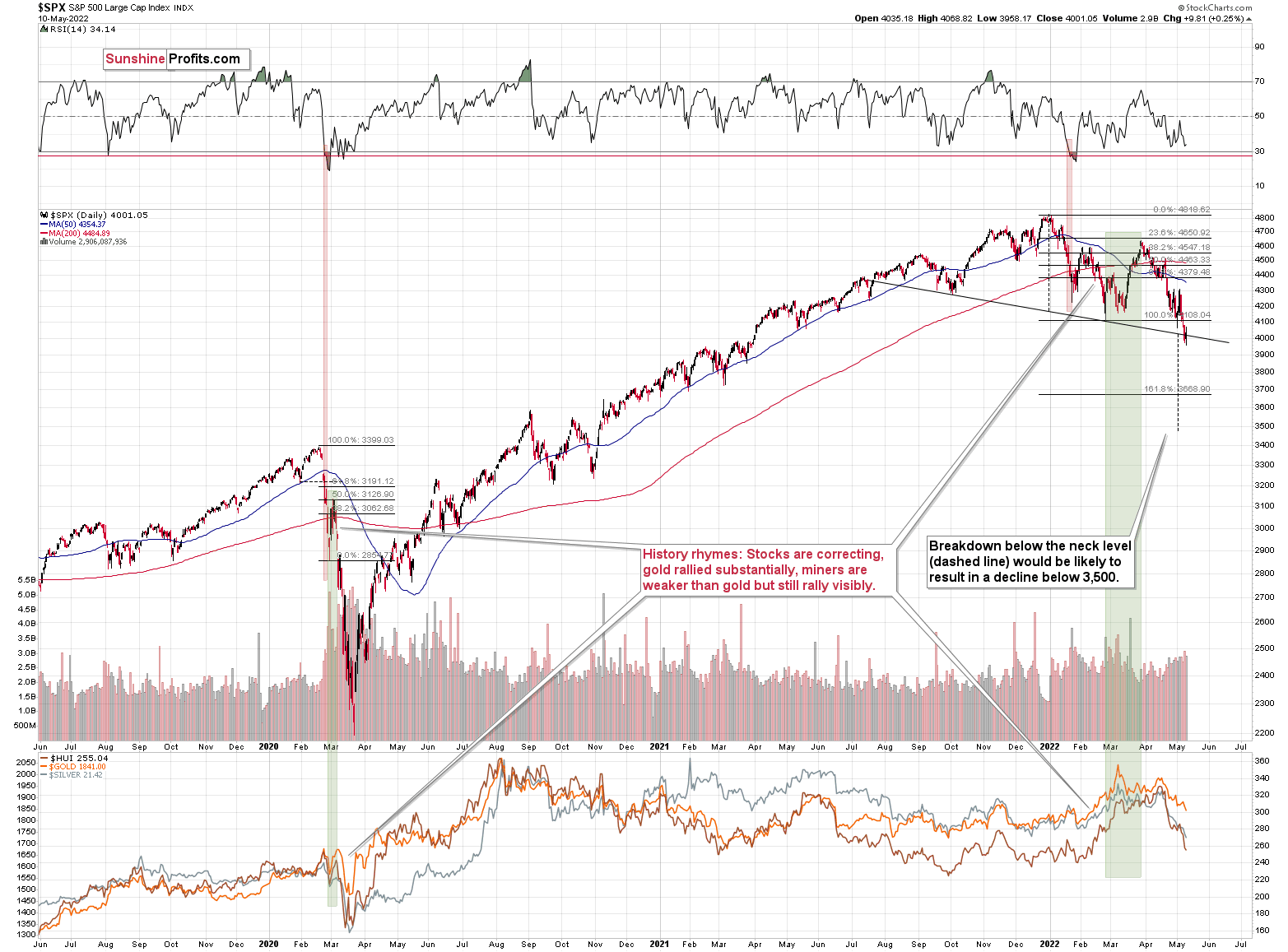

Speaking of the general stock market, it moved slightly higher Tuesday (in terms of closing prices), but the move was not significant enough to invalidate the breakdown below the neck level of the head-and-shoulders formation.

Therefore, the breakdown is now almost confirmed, and the situation is already more bearish than it was Tuesday.

At time of writing, stocks are once again trying to rally, but so far the rally is not as big as Tuesday's pre-market rally that was just erased. Thus, I doubt that stocks will be able to avoid falling in the near term.

The S&P 500 is currently confirming a breakdown below its head and shoulders pattern. Once confirmed (just one more close below the neck level is required), the formation will be complete, and the next target will be below 3,500. So, yes, I expect the S&P 500 to decline below its 2021 lows in the near future.

On May 6, I wrote:

Still, it doesn’t mean that we can’t get another brief rally in the meantime. In fact, the head and shoulders formations are often immediately followed by a brief corrective upswing – one that takes the market close to or right back to the previously broken neck level of the H&S pattern. Seeing this kind of rally would perfectly correspond to the scenario in which S&P rallies when the RSI indicator reaches 30, and it would perfectly match other potential price moves that I mentioned earlier today.

In other words, if stocks decline somewhat and then correct, it could translate into the same thing in gold, silver, and mining stocks. Given the stronger link between stocks and silver and miners’ duo, the latter could correct more visibly.

On Friday (May 6), the S&P 500 had its lowest daily close of the year. While investors might not see many technical patterns, they’ll definitely notice something like that. That’s bearish – it could trigger some panic selling among investors, and today’s pre-market decline indicates that it might already be taking place.

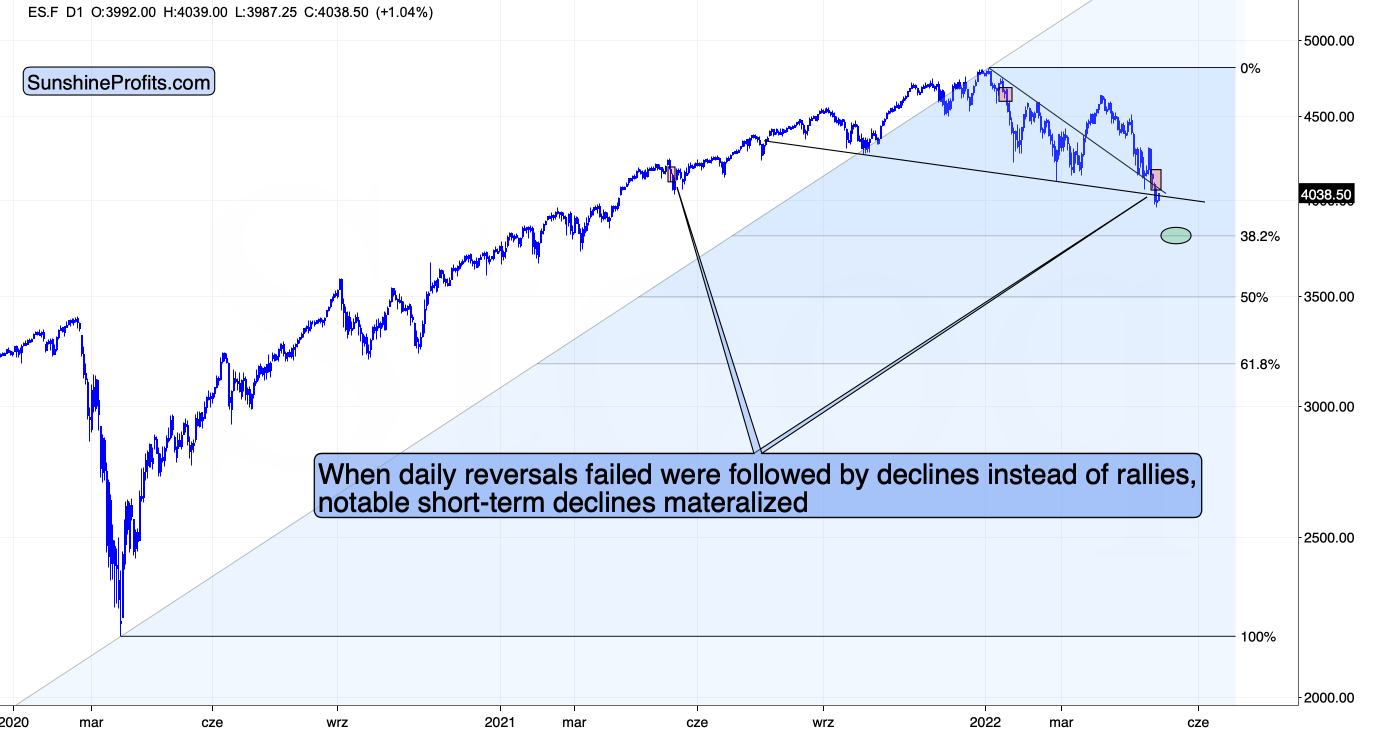

Interestingly, last Friday’s session was a daily reversal, so it seems that stocks should be rallying today, but… they are not. Technically, it’s the futures market that shows declines, not the index itself, but futures can be used as the index’s proxy here.

That’s where the situation gets really interesting. There were very few cases when a daily reversal was followed by a decline below the reversal’s low. In fact, in the recent past, there were just two such cases, and I marked them with red rectangles. In both cases, short-term declines followed. What’s notable is that this was the way in which the January decline started, and the decline that followed was sizable.

If stocks are about to decline (continuing their recent decline), then they would do so after a consolidation that took the form of a flag. Thus, the price would be likely to fall by about the same amount as it had fallen before the pattern. One could argue when the previous short-term decline started (at the recent top or at the very recent top before the decline accelerated), but overall, it seems that stocks would be likely to decline below the neck level of their head and shoulders formation, and then decline some more.

Is there any nearby support level that would be strong enough to stop this short-term decline? Yes: it’s the 38.2% Fibonacci retracement level based on the 2020-2022 rally.

Back in 2020, the very first decline erased 50% of the preceding rally, but back then the market was much more volatile than it is right now, so it’s understandable.

If we see a decline to the 38.2% Fibonacci retracement and then a comeback to the previously broken neck level of the head and shoulders pattern, it would fit practically everything that I wrote above and in the previous days / weeks.

It would trigger another immediate-term decline in silver and mining stocks in the near term that would be followed by a (quite likely tradable) rebound.