A recent research paper from Morningstar concludes that retirees should only withdraw 3.3% of their money annually. In other words, a million-dollar portfolio should only be relied on for $33,000 in annual income.

That is a sad ending for a seven-figure nest egg!

Scary, too. This $33,000 salary isn’t delivered in cash flow. No, this is a “withdrawal rate”—which means the retiree is tapping principal. Which means the retiree is buying stocks and hoping they’ll go up.

But “hope” is not a strategy. The volatile weeks we’ve seen recently have no doubt forced some terrified retirement investors into selling low.

This is “reverse dollar cost” averaging, unfortunately. Selling after pullbacks is a way to burn through cash quickly. It’s no wonder that two in five Americans believe it will take “a miracle” to retire.

We contrarians prefer a “No Withdrawal” portfolio that pays us 6%, 7% or 8% per year in dividends. These are safe and secure yields that can be found in lesser-known pockets of the income universe.

For example, let’s consider bonds. Most retirees think that they can’t own bonds because they don’t pay enough. Even investors following the depressing Morningstar advice won’t get to 3.3% with vanilla fixed-income vehicles.

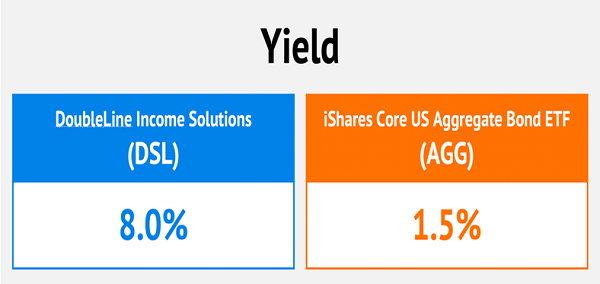

Yet as I write, the DoubleLine Income Solutions Fund (NYSE:DSL) yields an excellent 8%. Plus, it trades at a 5% discount to its net asset value. This means we can buy the bond portfolio handpicked by “bond god” Jeffrey Gundlach and his excellent team for just 95 cents on the dollar. Not bad for a portfolio that pays a very rich 8%.

DSL pays so much more than the sleepy bond benchmark iShares Core US Aggregate Bond ETF (NYSE:AGG):

An 8% Retirement Solution

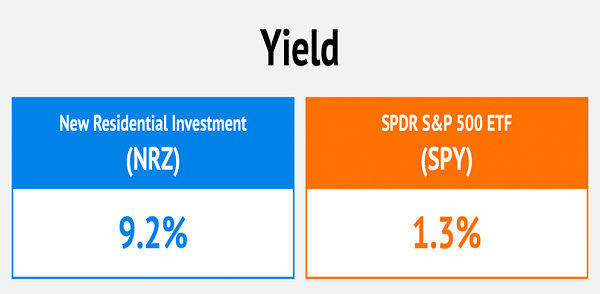

We can use stocks for cash flow, too—especially big dividends that will directly benefit from rising interest rates. New Residential Investment (NYSE:NRZ), for example, is the largest non-bank owner of mortgage service rights (MSRs) in the world. MSRs aren’t the loans themselves; they are the rights to service these loans—a subtle but important difference.

MSRs typically earn 0.25% of the payments that they collect. My wife and I recently refinanced our house and our mortgage service company, Truist Bank, is making easy money for the right to service our mortgage. We already have our account on autopay!

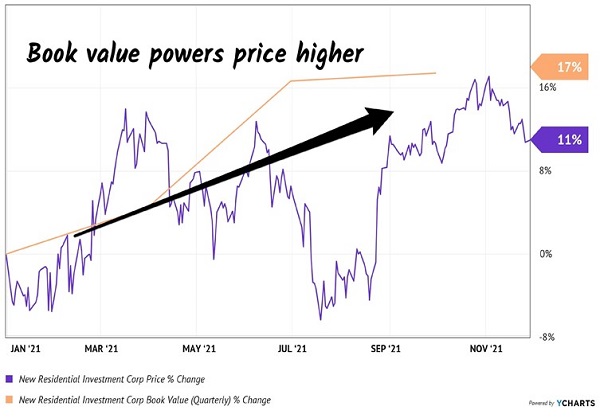

These assets are the ultimate inflation play. And it shows in NRZ’s book value, which has risen 17% year-to-date:

As MSRs Gain, So Does NRZ’s Book Value (And Stock Price)

With mortgage rates trending higher again, no wonder NRZ’s book value is rising. I anticipate management will report an even higher number on its next earnings call.

Since our July buy, NRZ has already hiked its dividend by 25%, from $0.20 per quarter to $0.25. For a moment, shares paid 10%+, but investors scrambled to bid the stock’s price up and yield “down” to 9.2%.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."