Here at Contrarian Outlook, we love to get questions from readers, and I recently got one from a CEF Insider member about commercial real estate after Bank of America (NYSE:BAC) recently said the sector could be the next one to tumble.

Let’s dive into that, because this fear has been driven by the same kind of overwrought media coverage we saw with regional banks (an issue that’s been addressed, with no depositors or taxpayers losing money).

And that fiasco, you no doubt know, gave us a nice “buy the dip” opportunity on, well, pretty well, everything.

The media has set up these commercial real estate worries, too, and that’s highlighting the value of an 8.1%-paying closed-end fund (CEF) holding real estate investment trusts (REITs) we’ll talk about below.

Work From Home’s Rise Is an Old Story

On the surface, Bank of America’s report makes sense. Work from home is still up a lot, and many firms are finding they need less office space than they used to. Add in the fact that interest rates have soared, and you can see why some people would be nervous about the future of commercial real estate.

Plus a lot of reporters are trying to tie commercial loans to the banking system and its recent crisis: “The next domino to fall in the ongoing banking crisis could be commercial real estate loans, according to a Friday note from Bank of America” is how Business Insider spun the report, and they weren’t alone.

Let’s get into the facts here.

To be sure, rising interest rates are going to make commercial real estate more expensive; that’s undeniable. But that has nothing to do with banks. While some commercial real estate is held by banks, it’s treated differently than their U.S. Treasury holdings, and higher commercial mortgage rates don’t make a bank more or less solvent.

But what about real estate companies and REITs that operate in the mortgage business, or those that depend on mortgages to fund their operations? Surely they’ll suffer as work-from-home continues to prompt companies to cut back on office space.

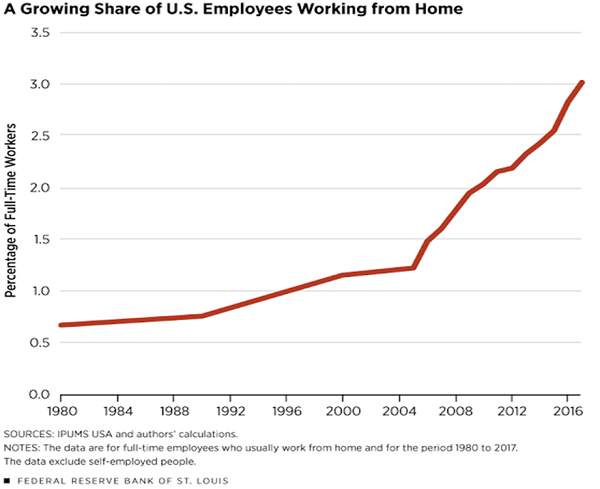

Well, not exactly. The truth is, we’ve known about the work-from-home trend for years now, going way back to before the pandemic.

Of course, the pandemic kicked this into overdrive, with the total number of Americans working from home soaring. “Between 2019 and 2021, the number of people primarily working from home tripled, from 5.7% (roughly nine million people) to 17.9% (27.6 million people),” the Census Bureau reported back in 2021.

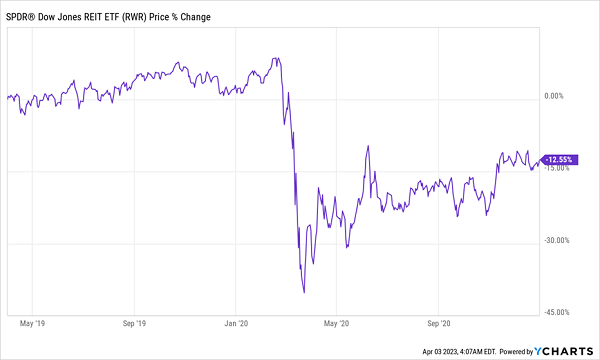

In short, we know work-from-home has changed real estate demand, which is why REITs, as shown by the performance of the SPDR Dow Jones REIT ETF (NYSE:RWR)—a reasonable proxy for the sector—priced this in during the pandemic:

REITs Priced in Work-From-Home Three Years Ago

Of course, commercial real estate goes beyond the work-from-home trend. Soaring interest rates have also made real estate harder to profit from—but that’s a trend that’s been around for nearly a year and a half now. And again, REITs priced in rising rates last year:

Higher Rates Are Also Priced Into REITs

The bottom line here is that yes, real estate may require higher occupancy rates and savvier management to be profitable. But that just means there will be fewer amateurs in the market, giving the best property managers the most opportunities to profit. And that, again, points to REITs, and well-run REIT CEFs, winning in the future.

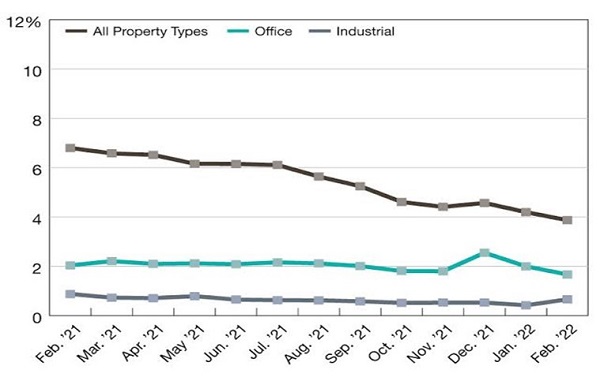

In fact, we already have evidence of this happening. Despite work from home and higher rates, office mortgage-default rates haven’t risen:

Office Mortgage Defaults Stay Low

Source: Trepp

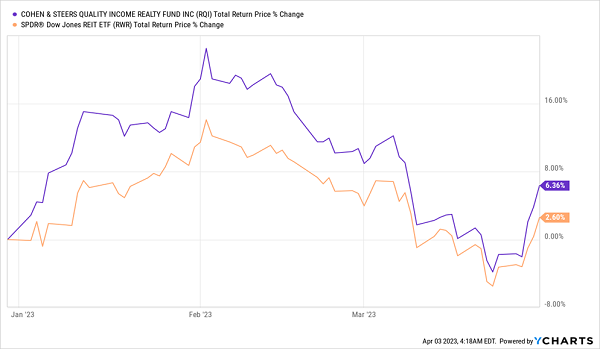

The good news here is that markets have finally started to reward good REITs—and REIT CEFs—as a result. Below is a chart of both RWR and the REIT CEF I mentioned earlier, the Cohen and Steers Quality Realty Income (NYSE:O) Fund (RQI), which yields 8.1% today. Both have caught a bounce, with RQI outperforming RWR year to date.

Real Estate Recovers as REITs See Cash Flow Rise

This is a nice setup for a buy of RQI, with the fund picking up momentum while still trading at a 3% discount to net asset value (NAV), as I write this.

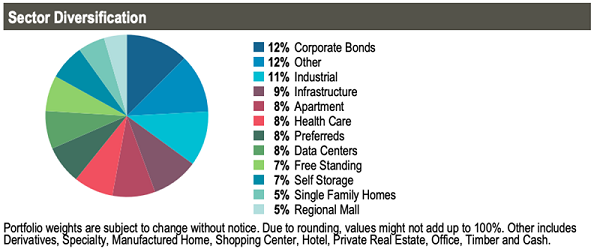

Source: Cohen & Steers Quality Income Realty Fund December 31, 2022, fact sheet

Finally, as you can see above, RQI actually holds only a small allotment of office REITs (they’re grouped under the 12% “Other” category), with infrastructure REITs, like cell-tower owner American Tower (NYSE:AMT), and apartment REITs, including Mid-America Apartment Communities (NYSE:MAA), being its biggest sectors (not including a 12% devotion to corporate bonds). Those are areas that are in extremely high demand these days, with no end in sight.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."