With options and futures, you can go broke and then some in minutes.

Thanks now to leveraged ETFs you can produce some amazing results in a day. Vanguard 500 Index Investor

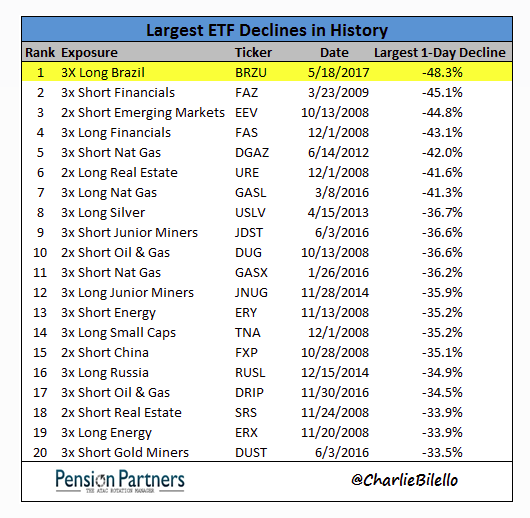

Pension Partners reports How to Lose 40% in a Day.

Losing 40% or more in a day was always possible using futures and options, but before June 2006 it was nearly impossible to do so using an exchange-traded fund (ETF). What happened in June 2006? The first leveraged ETFs were introduced.

Fast forward to yesterday and we witnessed the largest one-day decline in history for an ETF: -48.3%. The 3x long Brazil (NYSE:BRZU) ETF now holds this ignominious distinction.

Thanks to leveraged ETFs, the 1987 crash has become child’s play. For a number of these ETFs, a 20% decline has become a non-event. The 3x long Gold Miners ETF (NYSE:GDX) (NUGT), for instance, has had 15 days in which it has declined 20% or more since its inception in late 2010. Its counterpart, the 3x short Gold Miners (DUST) bests this with 16 days with declines of at least 20%.

Before this week, the 3x short Financials ETF (FAZ) had held the record for largest one-day loss, at 45.1% (on March 23, 2009). The record stood for over 8 years. But records, as they say, are made to be broken.

Who will be the first to lose 50% in a single day? The casino is open – place your bets.

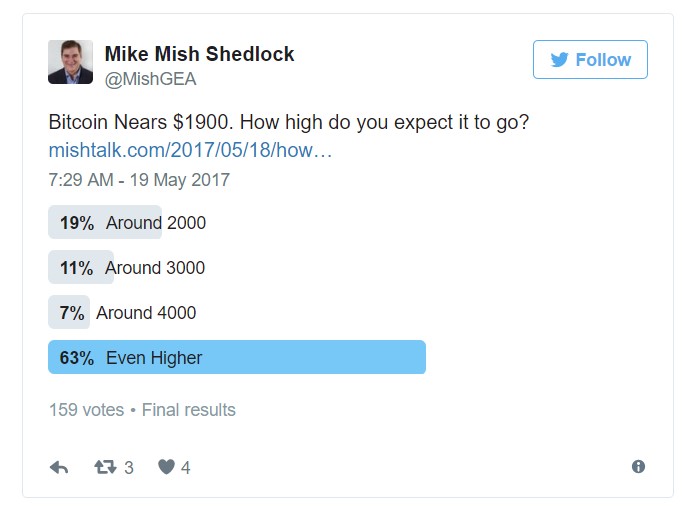

One person commented they did not understand the point of my post How High Will Bitcoin Go?

It would have helped if I included the Twitter poll I meant to insert.

Trade of the Century

I was curious where people thought it was headed. So far, 67% think it will more than double from here. Not many readily buyable things go from well well under a penny to $1900.

As late as June 2012, you could have gotten Bitcoin for $7. I didn’t.

Blockchain Technology

For the record, blockchain technology will become widespread. It is perfect for recording things. Mortgages, deeds, titles, etc, are a perfect fit for starters.

Bitcoin itself is widely used as a capital flight mechanism out of China. Outside of that, it is mostly a speculative plaything.

Why not a triple-leveraged Bitcoin ETF? Perhaps Bitcoin could then eventually take out the above ETF records.