One of the biggest stories since the last edition of the Market Overview, is inflation reaching the Fed’s 2-percent target. As we analyzed in the Gold News Monitor, The latest report on the Personal Income and Outlays revealed that the annual rate of the PCE Price Index rose 2.3 percent, while the core inflation hit 2 percent, the Fed’s target, for the first time since April 2012.

We don’t have newer data on PCEPI, but the report on the CPI was released in the meantime. It turned out that consumer prices rose 2.9 percent in June on annual basis, a slight increase from 2.8 percent in May. It was the highest yearly rate since 2012. Meanwhile, the core CPI edged up to 2.3 percent. As one can see in the chart below, the core index hasn’t increased faster than 2.3 percent since the Great Recession.

Chart 1: U.S. annual CPI rate (blue line) and core CPI rate (red line) from June 2008 to June 2018.

What does it imply for the economy, Fed’s stance and the gold market? Well, the acceleration in inflation shows that inflationary pressure has settled for good in the US economy. As the chart above shows, inflation has been in an upward trend since 2014 (2015) when it was in the deflation zone. And the PPI also increased. The wholesale cost of goods and services rose 3.4 percent in June on annual basis, the highest rate since almost seven years. It’s really important, because the rise in the PPI should translate into higher CPI after a few months.

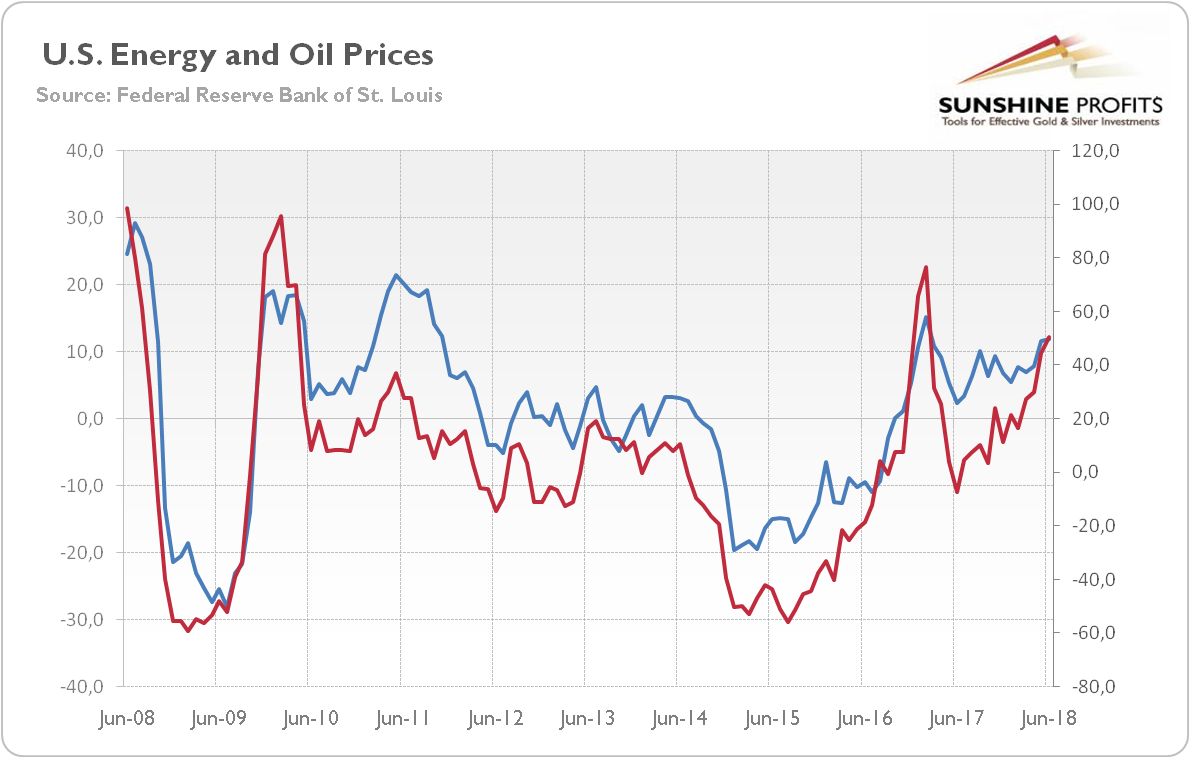

What next? Nobody knows for sure, but we expect that rising energy prices will support higher inflation further. As one can see in the chart below, the annual rate of energy inflation has been recently in an upward trend, hitting 12 percent in June. It shouldn’t be surprising as energy is highly dependent on the price of crude oil, which has been in a bullish mode in the last months. A tightening labor market and rising input costs, partially due to the new trade tariffs, should also help inflation to overshoot the Fed’s target.

Chart 2: CPI Energy Index (blue line, left axis, annual % change) and the WTI oil prices (red line, right axis, annual % change) from June 2008 to June 2018.

Investors should remember that the central bankers have signaled their expectations of inflation overshooting their target. They wouldn’t be, thus, too concerned with inflation temporarily above 2 percent.

Hence, the upcoming rise in inflation shouldn’t radically alter the Fed’s stance. However, if we see an upward surprise, the US central bank might be forced to tighten its stance even more and hike interest rates more decisively. It should lead to further flattening of the yield curve, which could raise some worries in the marketplace.

But what about gold? At first glance, it seems that gold, as an inflation hedge, should shine during rising inflation. However, there are several problems with that view. First, inflation isn’t surging so far, but it is rather gradually climbing. It is an unpleasant development for gold bulls, as the yellow metal shines the most during high and accelerating inflation.

Second, with the full employment practically achieved, the Fed focuses on inflation. It means that changes in the price level affect the Fed’s reaction function. With rising inflation, the US central bank will be adopting more hawkish stance (but not too hawkish), putting the gold prices under downward pressure. Another bad news for the yellow metal.

Third, inflation has been rising, but also the real GDP. It means that although inflation is on the rise, there is no risk of stagflation, at least not in the near future. Although the growth in Eurozone has slowed down recently, the global growth will continue. Actually, the growth in the US has speeded up, while the growth in China remains solid. The US growth may average around 3 percent in 2018. Once again, gold bulls can be disappointed.

The yellow metal loves the combination of high inflation and economic stagnation most. The consumer prices have recently risen, but inflation will stay contained. And the economy is far from being stagnant – on the contrary, there are signs that it may speed up a bit, or even start running at one of the highest paces since the Great Recession. The bottom line is that inflation should rise further in the near future, but it should not help the gold prices.