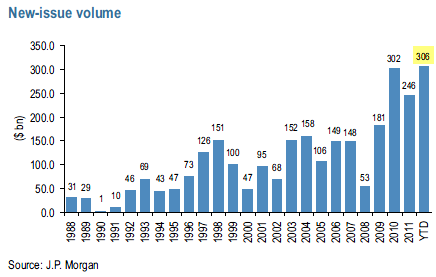

High yield bond issuance hit an all-time record in 2012, with $306 billion worth of new HY bonds coming to market by the end of October. In fact September was an all-time record month for new issue - on the back of the Fed's latest action.

Leverage finance space as a whole also hit a new record. Adding new issue HY bonds and institutional loans (see discussion) puts 2012 ahead of 2007, the previous record.

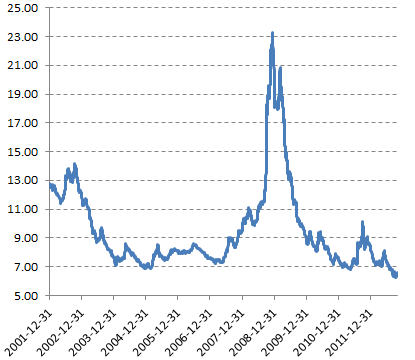

Demand for yield remains strong, pushing non-investment grade yields to record lows.

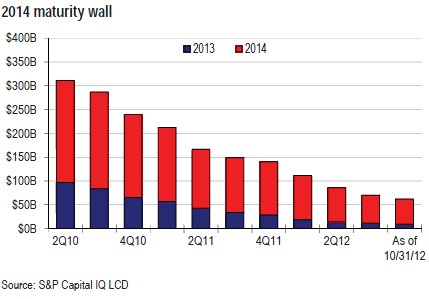

One of the reasons for this optimism has to do with new issue market pushing out the leveraged finance maturity wall, as companies refinance into longer maturities. Back in 2009 the wall looked quite scary (see this post from 2009), with the largest concentrations of maturities in 2013 and 2014. But the markets have been chipping away at those two years. This reduced the risk of near-term liquidity problems in case the HY new issue market suddenly dries up, lowering expected default rates in the near-term.

We are, however, starting to see some signs of speculative primary market activity. According to JPM, six toggle notes have been issued in October ($2.6bn). These are debt securities that give borrowers the option to skip coupon payments, increasing the face value of the debt instead (payment in kind or PIK). It is roughly the corporate equivalent of option ARM mortgages. Also October saw 11 so-called dividend deals in which the proceeds from a bond sale are used to pay a dividend to the shareholders.

This is considered a more risky transaction because rather than using cash to refinance existing debt or acquire a business, the company simply pays it out, causing its leverage to increase. In the mortgage world this is the equivalent of using a home equity loan to take a vacation rather than to put an addition to the house or to repay credit card debt.

In spite of some of the more risky transactions, on average the deals have been far less speculative in nature than during the 2006-07 period. This trend of potentially loosening lending standards (such as toggle notes or dividend deals) in the leveraged finance markets will be important to watch going forward.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

High Yield Debt Issuance In 2012 Hits An All-Time Record

Published 11/11/2012, 01:29 AM

Updated 07/09/2023, 06:31 AM

High Yield Debt Issuance In 2012 Hits An All-Time Record

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.