On Semiconductor Corp. (NASDAQ:ON) is currently a well-performing technology stock and a increase in share price and strong fundamentals signal its bullish run. Therefore, if you haven’t taken advantage of the share price appreciation yet, it’s time you add the stock to your portfolio.

The company has performed well so far this year and has the potential to carry on the momentum in the near term.

Here are a few reasons why the stock is worth a buy.

An Outperformer

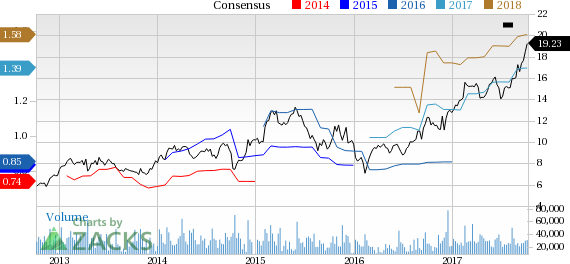

A look at the company’s price trend reveals that the stock has had an impressive run on the bourse year to date. On Semiconductor has gained 50.7%, significantly outperforming the industry’s gain of 24.0%.

Solid Rank & VGM Score

On Semiconductor currently carries a Zacks Rank #2 (Buy) and has a VGM Score of A. Our research shows that stocks with a VGM Score of A or B when combined with a Zacks Rank #1 (Strong Buy) or #2 offer the best investment opportunities for investors. Thus, the stock appears to be a convincing investment proposition at the moment.

Northward Estimate Revisions

For the current year, eight estimates have moved north over the past 90 days against no southward revisions, reflecting analysts’ confidence in the company. Over the same period, the Zacks Consensus Estimate for the current year has increased 6.1%.

Strong Growth Prospects

The company’s Zacks Consensus Estimate for 2017 earnings of $1.39 reflects year-over-year growth of 75.95%. Moreover, earnings are expected to register 13.73% growth in 2018. The stock has long-term expected earnings per share growth rate of 18.1%.

Solid Growth Drivers

On Semiconductor is an original equipment manufacturer (OEM) of a wide range of discrete and embedded semiconductor components.

Notably, the company’s acquisition of Fairchild, which was completed on Sep 2016, has aided top-line growth. Management expects to witness further growth in Fairchild’s revenue contribution in the near term, driven by the company’s strong foothold in the power semiconductor market post the acquisition.

Moreover, the Advanced Driver-Assistance Systems (ADAS) is growing at a steady pace and is expected to reach $42.4 billion by 2021, per MarketsandMarkets. We believe the accelerated growth of the ADAS market has increased the adoption rate of the related applications provided by On Semiconductor, thereby improving its growth opportunity in the automotive market.

Further improving end markets, less customer and product concentration have aided the company’s impressive performance. Growing demand for the company’s CMOS image sensor is also a key catalyst.

Key Picks

Other top-ranked in the broader technology sector are Applied Materials, Inc. (NASDAQ:AMAT) , sporting a Zacks Rank #1 (Strong Buy), and NVIDIA Corp. (NASDAQ:NVDA) and ASML Holding (AS:ASML) N.V. (NASDAQ:ASML) , holding a Zacks Rank #2 (Buy). You can seethe complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for Applied Materials, NVIDIA and ASML Holding N.V. is projected to be 17.1%, 10.3% and 21.4%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

NVIDIA Corporation (NVDA): Free Stock Analysis Report

ON Semiconductor Corporation (ON): Free Stock Analysis Report

ASML Holding N.V. (ASML): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research