Bitcoin’s relentless rise in the past year forced even some its most vocal critics to throw in the towel. Kevin O’Leary, for example, used to call Bitcoin “garbage”, but recently said that he has 3% of his portfolio in BTC and ETH. And indeed, many, us included, have been calling Bitcoin a bubble for years, yet it keeps going higher. It’s becoming increasingly hard for the skeptics to resist the pressure, especially as some big names appear to be embracing crypto.

Elon Musk’s Tesla (NASDAQ:TSLA) poured $1.5B in Bitcoin and said it is thinking about allowing customers to pay for its cars with it. Mastercard (NYSE:MA), the payments giant, announced it is about to start supporting select cryptocurrencies on their network. PayPal is doing the same. Goldman Sachs (NYSE:GS) is restarting its crypto trading desk and Bank of New York Mellon (NYSE:BK) is forming a new unit to help clients hold and transfer digital assets.

An Attempt to Stay Rational about Bitcoin

With the big guns warming up to the idea, how can one argue?

We, at EWM Interactive, remain skeptical. We see Tesla’s Bitcoin purchase as nothing more than another speculative bet by its eccentric CEO. As for Mastercard’s, Goldman’s and Bank of NY Mellon’s involvement, note that none of these huge financial companies is actually using Bitcoin for its own business operations. They are simply going to earn fees from clients trading crypto. This is a big difference. In other words, none of them is actually “embracing” it. They are just taking advantage of the current mania to fatten their bottom lines.

So if you think about buying Bitcoin because the big names are buying it, think twice. At one point during the dot-com bubble in the late-1990s Amazon (NASDAQ:AMZN) owned 54% of Pets.com. Many saw this as a validation of the latter’s business model. Alas, Pets.com went bankrupt and was liquidated in 2000. The big guys can fall for a fad just as easily as everyone else.

As the father of value investing Ben Graham put it, “the investor is neither right or wrong because others agreed or disagreed with him; he is right because his facts and analysis are right.“

So what are the facts? Can Bitcoin really become a global payments network and replace the US dollar as the dominant currency?

The Real Problem With Bitcoin ‘s World Domination Ambitions

Bitcoin becoming a global currency is physically and mathematically impossible. Here is why.

Bitcoin is an extremely inefficient payment method. Forget about all the risks its high volatility poses to any real business or person. We’re talking about the number of transactions the Bitcoin network can process and the energy it consumes.

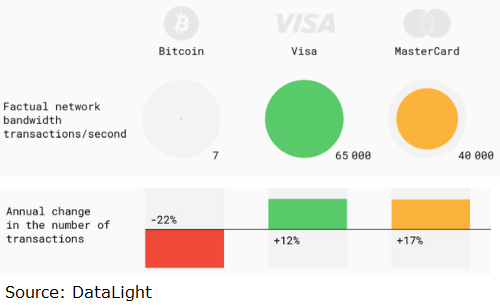

The payments network of Visa (NYSE:V), Mastercard’s main competitor, has the capacity to process up to 65 000 transactions per second. Mastercard itself, can handle around 40 000 transactions per second. Bitcoin, on the other hand, manages just 7.

You read that right. Not 7000, just… 7, by design. What is worse is that hardly any of those 7 transactions per second is an actual purchase of goods and services. Instead, they are just transfers from the accounts of one speculator to another.

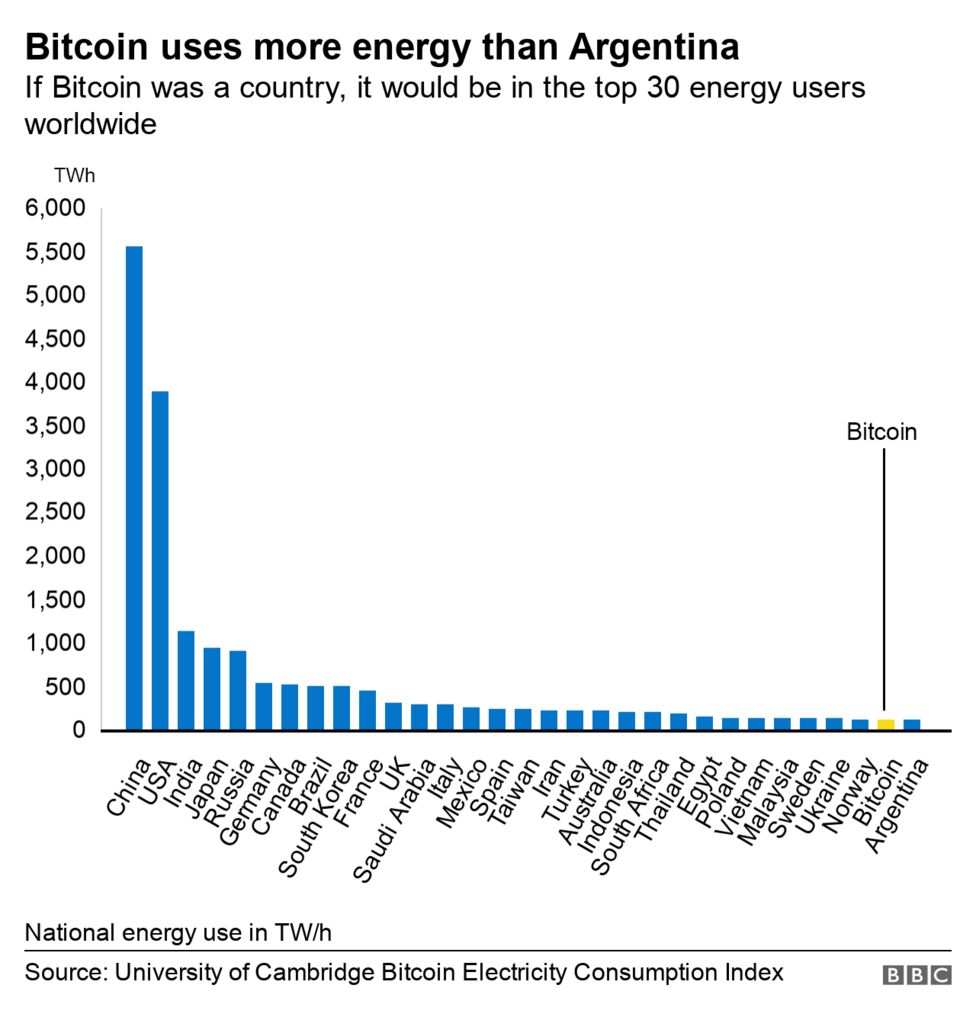

But the worst thing about the Bitcoin network is the amount of energy it uses to make those puny 7 transactions per second possible. According to the chart below, published by BBC on Feb.10, if Bitcoin was a country it would be in the top 30 in the world by energy consumption.

A month ago, Bitcoin was using more energy than Argentina. Over 121 terawatt-hours per year, to be exact. But one month is a long time for Bitcoin. Since the difficulty of the mining process, which validates the transactions, is designed to increase with time, the Bitcoin network is actually getting more inefficient, not less. According to the Cambridge Bitcoin Electricity Consumption Index, the biggest cryptocurrency is now using 128 TWh a year, already more than Norway and closing in on Ukraine and Sweden.

Not Enough Energy in the World

So, in order for Bitcoin to compete with an actual global payment network, it would need to magically increase its transactions capacity by a factor of roughly 10 000, to 70 000 tps. The problem is that its electricity consumption would rise proportionally. Simple math tells us that 128 TWh times 10 000 equals 1 280 000 TWh. The entire world, by the way, consumes about 24 000 TWh of electricity a year.

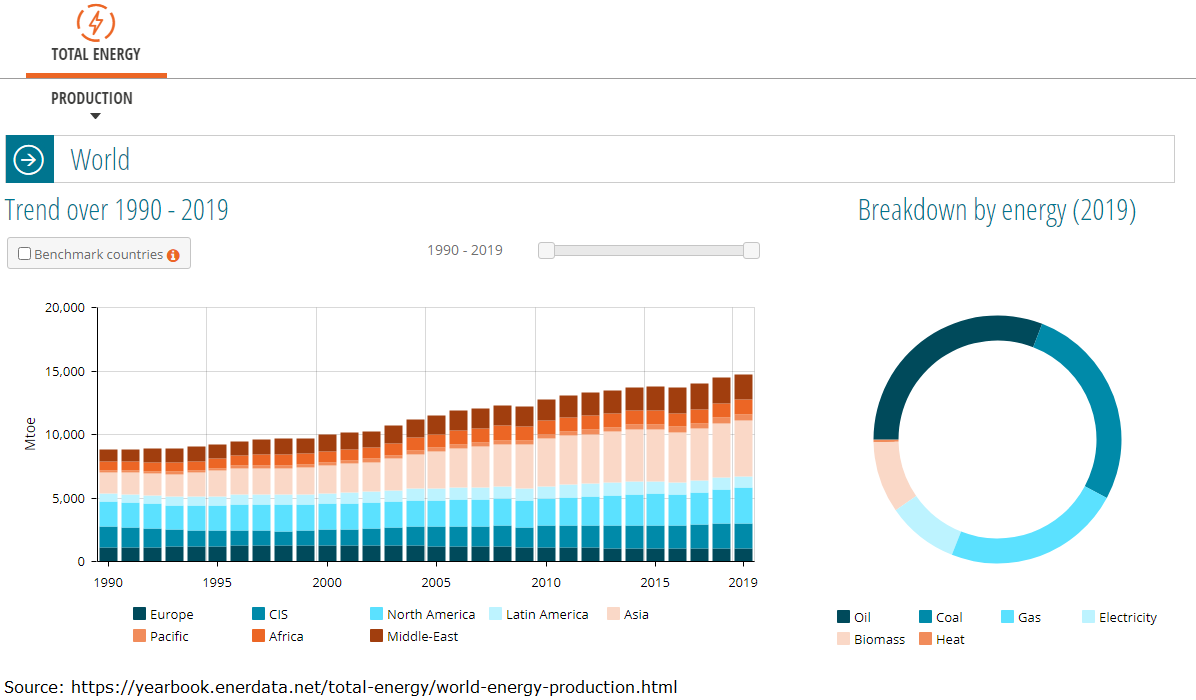

That’s right. If Bitcoin was to become a true global payment system, it would need over 53 times more electricity than the entire world. Let’s take this a step further. There are other energy sources besides electricity. There’s coal, oil and gas, heat and biomass. To put all the energy produced from different sources on an equal footing, people use the metric tons of oil equivalent, or toe. According to Enerdata, the total amount of energy produced in the world in 2019 was slightly below 15 000 million toe.

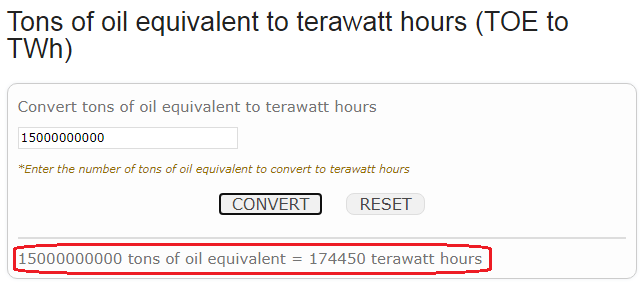

Our math skills are not up to the task when it comes to converting Mtoe to TWh, but fortunately, there is a free online calculator for that. 15 000 Mtoe equals 15 000 000 000 toe, which equals 174 450 TWh.

That is the total amount of energy produced in the world from all sources in a given year. And it is still 7.3 times lower than the amount Bitcoin would need in order to scale up to a decent global payment network.

In other words, even if we put all the energy currently used for mining of raw materials, transports, farming, food processing, manufacturing of all types of goods and services into the Bitcoin network, it would still not be nearly enough to turn it into a global payments system. In December 2017 we debunked other pro-Bitcoin arguments, but the energy consumption issue strikes us the most.

The Stuff of Bubbles

So if the cornerstone argument of the bullish thesis, namely that Bitcoin is the future of money, is physically and mathematically invalid, what is pushing the price up then? Our answer: irrational behavior. The collective voluntary suspension of disbelief. The stuff of bubbles.

Every bubble needs a story. And not just any story, but a world-changing story. It doesn’t matter whether the story is plausible or not, since most market participants won’t check its factual validity anyway. People are emotional creatures, evolved to live in groups and tribes. If enough people within your close social circle believe something, or if some prominent, famous individual expresses support for it, chances are you are going to believe it too. It is called social validation bias, also referred to as peer pressure.

In the modern world, this bias leads to irrational behavior and, among other things, the inflation of financial bubbles. It is extremely difficult for a person to watch his neighbor getting rich investing in hot tech stocks or cryptocurrencies and not give in and buy too at some point. But trees don’t grow to the sky and every bubble in history has collapsed. Eventually, there are no more greater fools left to push the price higher.

The fact that Bitcoin has been called a bubble for years and is still rising doesn’t mean it is not a bubble. It only means it is a bigger bubble now than it was some years ago. And it too will burst. The only question is when.