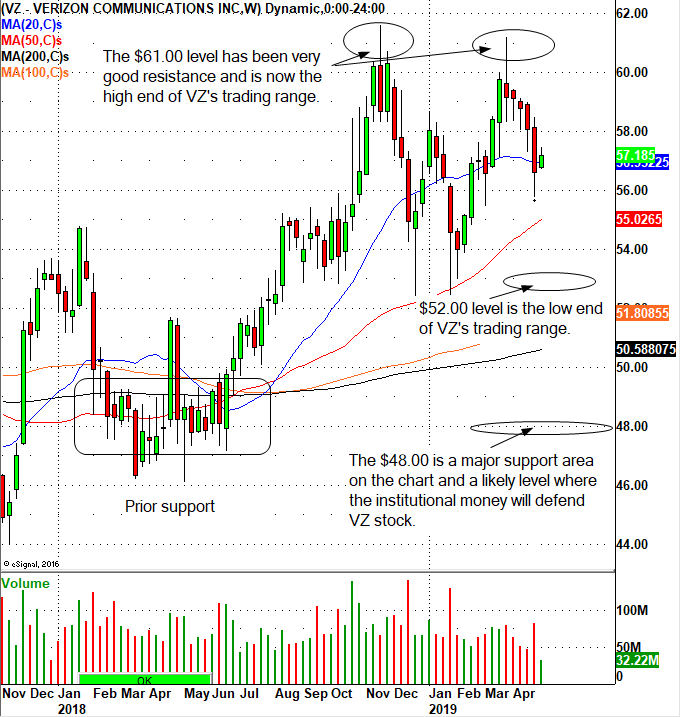

Taking a look at Verizon Communications (NYSE:VZ) from a technical perspective, we see that the stock will be range bound throughout 2019 with one opportunity for a great buy level. As seen on the chart, the high end of the stock's trading range has been near $61 while the low end of the range is near $52. This range is where investors should focus. Recently the company reported earnings and raised its FY 19 EPS guidance to low single-digit growth. That tells me that the stock is not poised to take off anytime soon. The weekly and monthly chart trends are still up, so any major sell off should lead to a buying opportunity in the stock, however the upside expected on the trade would be limited to the upper price range.

While everyone continues to talk about the rollout of 5-G, the technology still appears to be somewhat down the road. Also, other fundamental drivers such as the acquisitions of AOL and Yahoo! (NASDAQ:AABA) do not seem to be major stock-price movers for the company in the near term. And I'm not sure they ever will be.

All You Need To Know

The one thing to watch closely is the stock's lower range. If it breaks lower through the $52 price point and tests $48, I believe that would be a screaming buy level. After all, while Verizon's performance may be on the range-bound/dull side, the company is still the number one mobile provider in the United States and its long-term performance leans in the upward direction.