The recent rise in real yields for inflation-indexed Treasuries (TIPS) looks compelling for locking in relatively attractive payout rates, but the usual risks with bonds still applies. That inspires looking at a somewhat unorthodox strategy of holding TIPS and conventional Treasuries as a hedging strategy.

The issue is that while buying and holding a TIPS security when it offers a comparatively attractive positive real yield is tough to ignore, there’s no way of knowing if that payout rate will rise further (or fall) in the future. For example, buying a 5-year TIPS currently offers a 1.72% real yield (as of Nov. 7). Buying and holding through maturity guarantees that you’ll earn that rate. The question is whether higher or lower real yields await? No one knows, but one way to mitigate the risk is by diversifying the allocation to a 5-year maturity with an equal mix of real and nominal yields. (A similar case applies to other maturities, but we’ll use 5-Year Treasury as an illustration.)

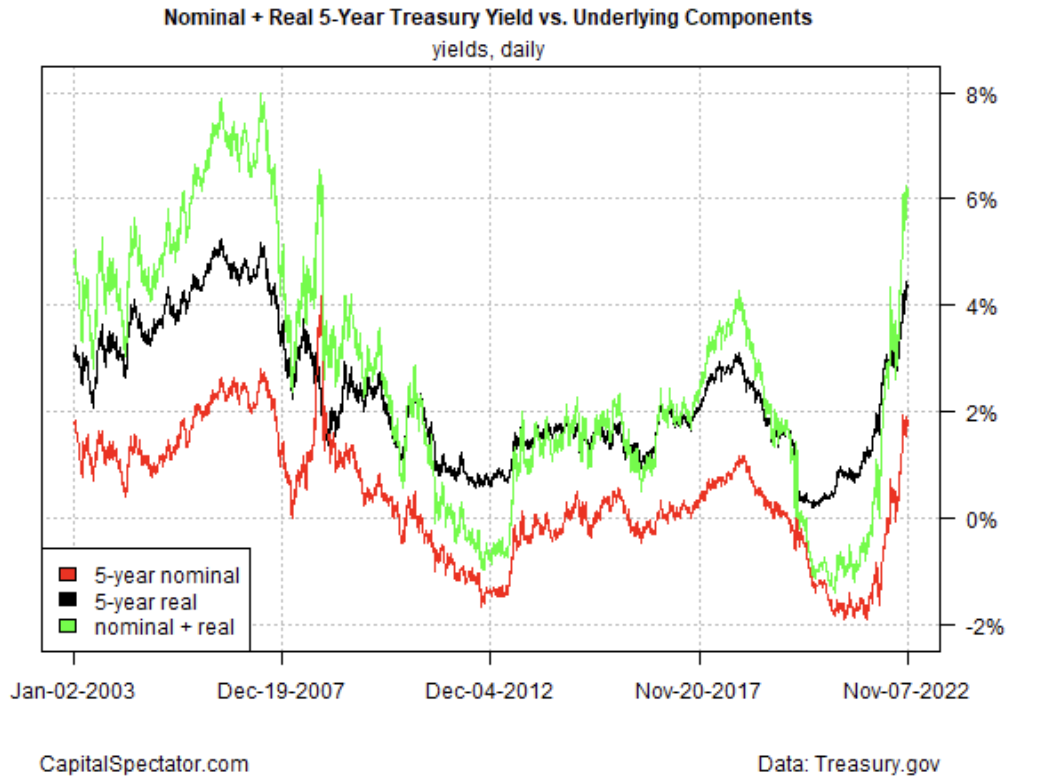

The logic here is that real and nominal Treasury securities are complimentary in that the former offers a constant real yield with a fluctuating nominal yield. By contrast, standard Treasuries offer the opposite: a constant nominal yield and a fluctuating real yield. By holding both securities you tap into both features. Does the combination offer a stronger risk-adjusted profile than holding either Treasury security alone? To explore the possibility consider how an equal weight of real and nominal yields compares with the components in isolation for the 5-year maturity.

At various times over the past two decades the sum of real and nominal yields for the 5-year Treasury exceeded the underlying rates (green line in chart above). But this is not a constant. Quite often the sum was below the nominal yield. The implication: there are times when holding a mix of real and nominal yields is the more attractive option.

Is this one of those moments? Possibly. An equal mix of real and nominal yields offers a combined rate of around 6%, which exceeds the current 1.72% real yield or the 4.39% nominal rate.

History suggests that buying and holding this 50-50 mix is attractive when the sum of the two yields trades a substantial premium vs. the underlying rates in isolation – a condition that currently prevails. The reasoning is based on the tendency for relatively high premiums to mark peaks in rates.

There’s no way of knowing if history will repeat this time. Note, too, that the historical record for these two rates is relatively short – TIPS have only been trading since the late-1990s. What is clear is that buying and holding an equal allocation of 5-year TIPS and its nominal counterpart currently offers a 6% payout, the highest since 2008 and there’s a reasonable case for expecting that beating this implied return will be challenging over the next five years from a Treasury-investing perspective.