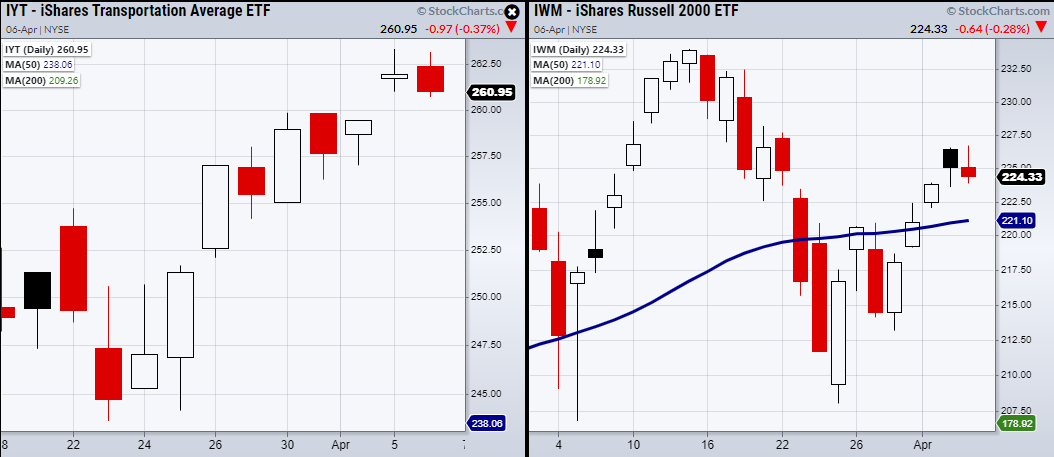

Monday, we talked about the momentum in the Transportation (IYT) and Semiconductors (SMH) sectors, which showed strength when compared to the Russell 2000 (IWM).

Tuesday, IYT closed near Monday’s low, making it a potential bearish engulfing day. Meanwhile, SMH failed to clear resistance at $258.59. Additionally, because IWM (as mentioned on Monday) has weak momentum, the market might need more convincing to move upward.

This is where the infrastructure plan could help but also comes with the risk of rising taxes which the market tends not to favor. It could also be that the market has already priced in what the infrastructure plan brings to the table.

With that said, last Friday, IWM cleared over resistance from its 50-day moving average at $221. While IYT and SMH have been strong market leaders, they will need support from the small cap index IWM.

Furthermore, if IYT and SMH cannot hold their current price levels, watch for IWM to hold $221 as key support.

ETF Summary

S&P 500 (SPY) Doji day. Holding near highs.

Russell 2000 (IWM) support 221.45.

Dow (DIA) Doji day. 329.72 support.

NASDAQ (QQQ) 338.19 high to clear. Support 321.33.

KRE (Regional Banks) Holding over the 10-DMA at 66.22. Support 64.13.

SMH (Semiconductors) 258.59 resistance.

IYT (Transportation) Watch to hold 260.

IBB (Biotechnology) 145 support.

XRT (Retail) 88.27 support the 10-DMA

Volatility Index (VXX) doji day.

Junk Bonds (JNK) support 108.57.

LQD (iShares iBoxx $ Investment Grade Corporate Bond ETF ) 129.91 support the 10-DMA.

IYR (Real Estate) Holding highs.

XLU (Utilities) 64.19 support.

GLD (Gold Trust) 164.15 to clear.

SLV (Silver) 22.99 support the 200-DMA.

VBK (Small Cap Growth ETF) 282.41 pivotal.

UGA (US Gas Fund) 30.64 support area.

TLT (iShares 20+ Year Treasuries) 134.97 support.

USD (Dollar) Doji day. Needs to get back over 92.39.

MJ (Alternative Harvest ETF) 21.55 support.

WEAT (Teucrium Wheat Fund) 5.97 pivotal area.