The exuberance in the US stock market of late may or may not be irrational, but the party atmosphere in the value corner of equities (companies that are inexpensively priced) is subdued vs. the celebratory surge for growth shares (firms expected to grow at above market rates). Although both measures of US companies in the large-cap space are posting solid gains, the gap in favor of growth has become conspicuously wide lately.

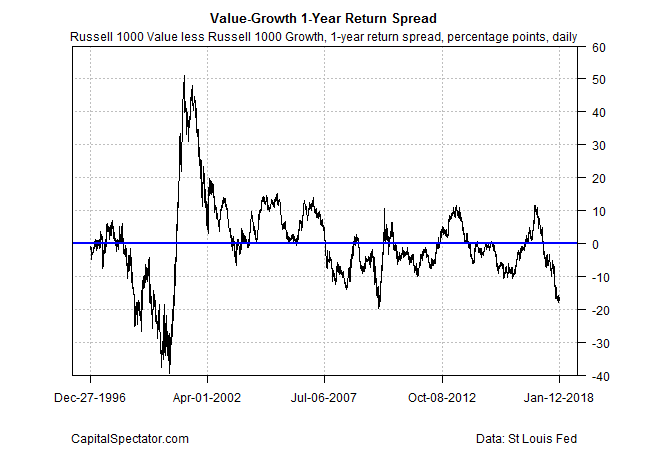

Consider how rolling one-year returns stack up. As of last week’s close (January 12), the Russell 1000 Growth Index was ahead by a strong 33.4% vs. the year-earlier prices (based on 252-trading day results). That’s roughly double the 16.7% increase for the Russell 1000 Value Index. In other words, value is in the hole by nearly 17 percentage points compared with its growth counterpart – the deepest setback for value on this front since late-2009.

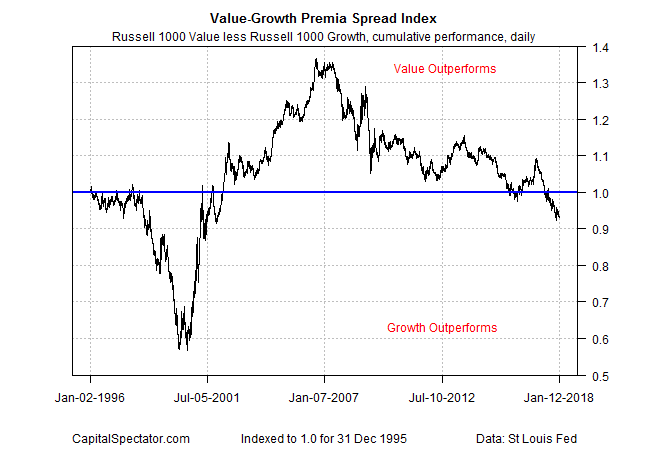

For another perspective on performance, the next chart tracks the daily return spread for Russell Value less Russell Growth, indexed to 1.0 at 1995’s close. When the index rises, value’s relative strength dominates, and vice versa. But as you can see, value stocks have fallen on hard times recently, according to this relative performance benchmark: the daily spread index is currently near a 17-year low.

The tough times for value investing inspire some analysts to forecast a turning point in the horse race in the foreseeable future. These two sides of this broad market coin have a long history of waxing and waning in relative terms and so value’s comparatively weak performance implies that better days are coming for the strategy. Indeed, over the long run, value investing enjoys a clear performance advantage over growth, or so history tells us.

“Value will have its day in the sun,” advises John Buckingham, a value investor who’s the chief investment officer at AFAM Capital Asset Management.

Perhaps, but for the moment growth’s bull run casts a long shadow over value.