With the general stock market back in bull mode, meme-stock fury has returned to Wall Street. With the riskiest corners of the financial markets performing the best in recent days, it’s like the summer of 2020 all over again (remember what happened to gold in August 2020? It topped…).

However, while investors have performed random risk rallies since the pandemic erupted, the fundamental environment is much different now than it was then.

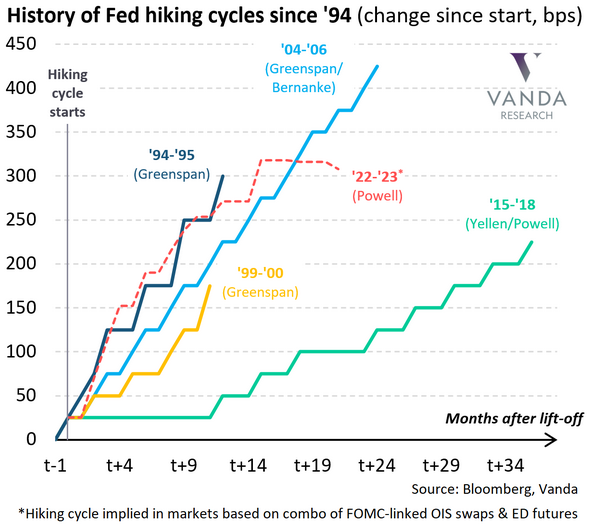

I’ve been bullish on the U.S. economy for some time. Since strong economic growth increases the Fed’s hawkish disposition, good data is profoundly bearish for the PMs. Moreover, with investors coming around to our way of thinking, the futures market is pricing in one of the fastest rate hike cycles in modern history.

The various lines above track the length of time it took the U.S. federal funds rate to reach certain levels. If you analyze the green line above, you can see that the path to 225 basis points (2.25%) occurred gradually over three years.

However, if you focus your attention on the red dashed line above, you can see that a sharp move above 300 basis points (3%) is expected in early 2023. As a result, while investors assume that the Fed will fire all of these hawkish bullets without any collateral damage along the way, they’re likely in for a major surprise.

To that point, Fed Chairman Jerome Powell has talked a lot about a "soft landing." For context, the phrase implies that the Fed can reduce inflation without impairing U.S. economic growth or the U.S. labor market. However, the expectation is much more semblance than substance.

For example, stimulus checks, record commercial bank deposits, and record job openings create an environment where consumers are flush with cash and willing to spend. However, this environment also created ~8% annualized inflation. Thus, should we expect the latter to decline without impacting the former? For context, I wrote on Mar. 28:

When the Fed tightens monetary policy, it's actively trying to slow down the U.S. economy. As a result, the tradeoff to calming inflation is less consumption, lower growth, and pressure on asset prices. However, while investors think the Fed will pull a rabbit out of its hat and materially slow inflation without hurting the U.S. economy, the prospect is unrealistic.

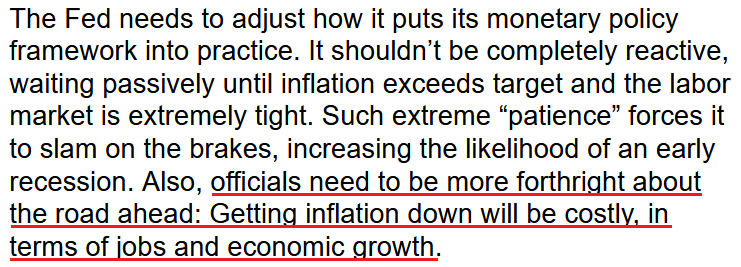

To that point, former New York Fed President Bill Dudley explained it perfectly on Mar. 29. He wrote:

"Powell is correct that the central bank tightened monetary policy significantly in 1965, 1984 and 1994 without precipitating a recession. In none of those episodes, though, did the Fed tighten sufficiently to push up the unemployment rate.

"The current situation is very different. Consider the starting points: The unemployment rate is much lower (at 3.8 per cent), and inflation is far above the Fed’s 2 per cent target. To create sufficient economic slack to restrain inflation, the Fed will have to tighten enough to push the unemployment rate higher. Which leads us to the key point: The Fed has never achieved a soft landing when it has had to push up unemployment significantly."

As a result:

Source: Bill Dudley/Bloomberg

Thus, while the bulls rampage on Wall Street, they're missing the forest through the trees. The Fed needs to reduce asset prices to calm inflation. If not, higher equity and commodity prices will only contribute to the inflationary spiral.

Furthermore, I highlighted on Mar. 29 that the bond market is well ahead of the stock market in understanding what lies ahead. I wrote:

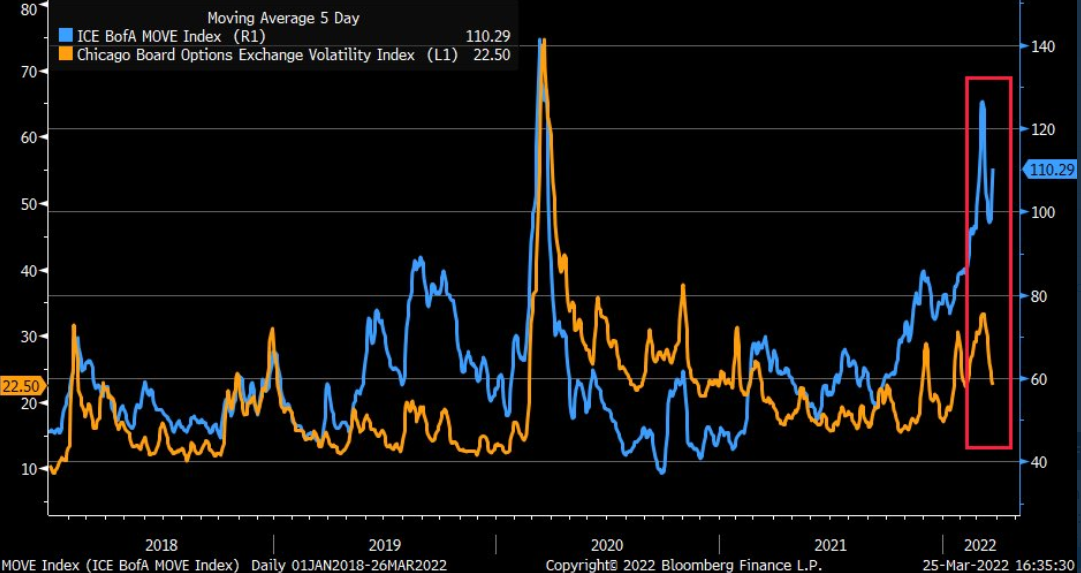

The orange line above tracks the CBOE Volatility Index (stock market volatility), while the blue line above tracks the MOVE Index (bond market volatility). If you analyze the relationship, you can see that stress in the credit market often reverberates across the equity market.

However, if you focus your attention on the right side of the chart, you can see that the pair has diverged in recent days. Thus, while inflation and the Fed’s hawkish disposition have rattled bond investors, stock bulls are behaving as if none of it matters. However, with the GDXJ ETF often suffering during periods of heightened volatility, more uncertainty should weigh on the junior miners over the medium term.

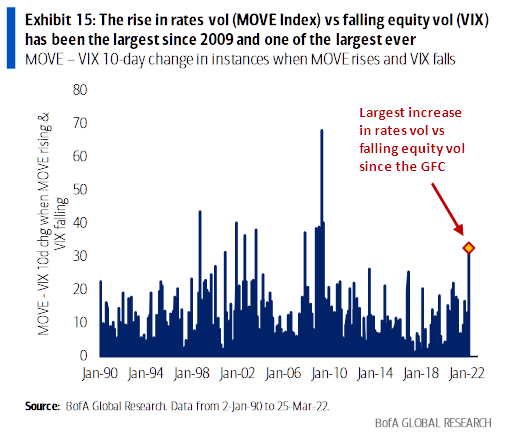

To that point, Bank of America noted how the spread between bond and equity volatility hit its highest level since the global financial crisis (GFC).

Dying A Slow Death

The blue bars above depict the spread between the MOVE Index and the 10-day change in the VIX. If you analyze the connection, you can see that the stock market rarely ignores tremors in the bond market. As a result, with interest rates poised to march higher, it sets the stage for material drawdowns of U.S. equities and the PMs.

However, please remember that there is a profound difference between where we are now and where we are likely heading. For example, with the Fed only on its first rate hike, the implications are largely immaterial. However, when the compounding effect of future rate hikes makes its presence felt, cracks in the U.S. economy should start to show.

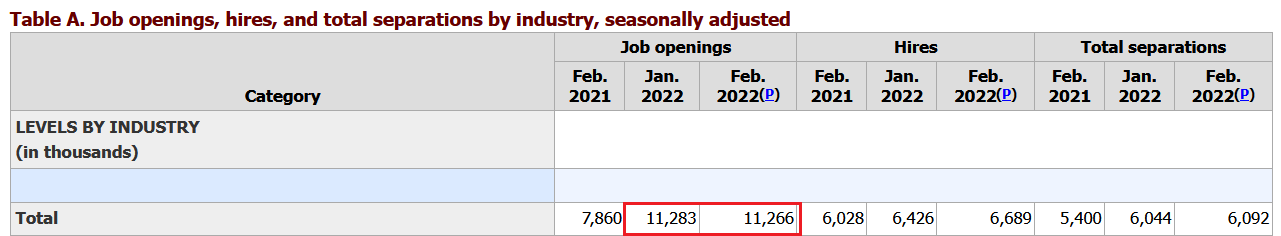

In the meantime, though, U.S. data remains resilient. However, since good news is bad news for the PMs, the better the data, the more hawkish the Fed will be. For example, one-half of the Fed’s dual mandate is maximum employment. With U.S. job openings only declining by 17,000 month-over-month (MoM), the U.S. labor market remains red hot. For context, the consensus estimate was 11 million, so the data outperformed expectations.

Source: U.S. Bureau of Labor Statistics (BLS)

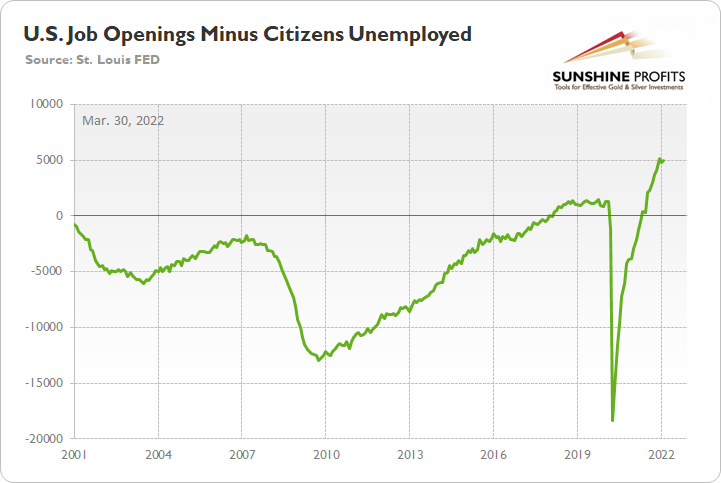

More importantly, though, another resilient report means that there are now 4.996 million more job openings in the U.S. than citizens unemployed.

The green line above subtracts the number of unemployed U.S. citizens from the number of U.S. job openings. If you analyze the right side of the chart, you can see that the epic collapse has completely reversed, and the green line is near an all-time high. Thus, with more jobs available than people looking for work, the economic environment supports normalization by the Fed.

On top of that, The Confidence Board released its Consumer Confidence Survey on Mar. 29. While the headline index remained far from its highs, it increased from 105.7 in February to 107.2 in March. Likewise, finding a job has never been easier in the U.S.

Source: The Confidence Board

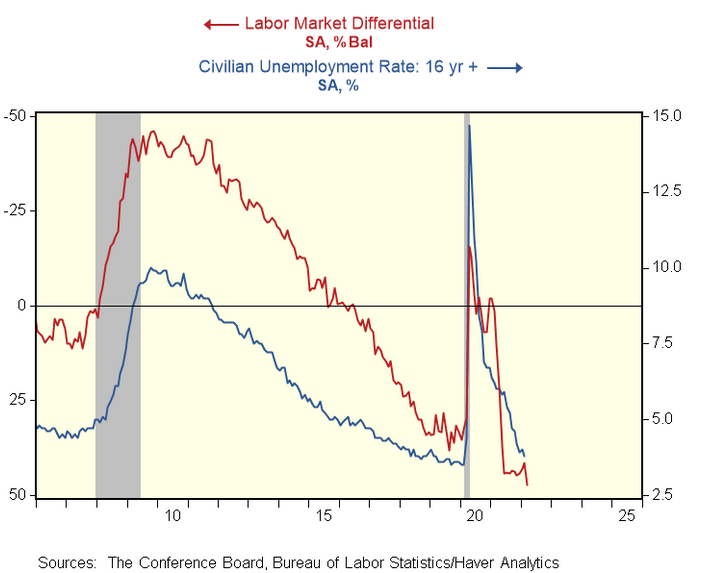

In addition, the Conference Board's labor market differential also hit a new all-time high. For context, the metric subtracts "hard to get" responses from "plentiful" responses. In a nutshell: the higher the value, the more employment opportunities in the U.S.

The blue line above tracks the 16+ civilian unemployment rate, while the red line above tracks the inverted labor market differential. As you can see, the metric points to a substantially lower unemployment rate in the coming months, and the prospect is extremely bullish for Fed policy.

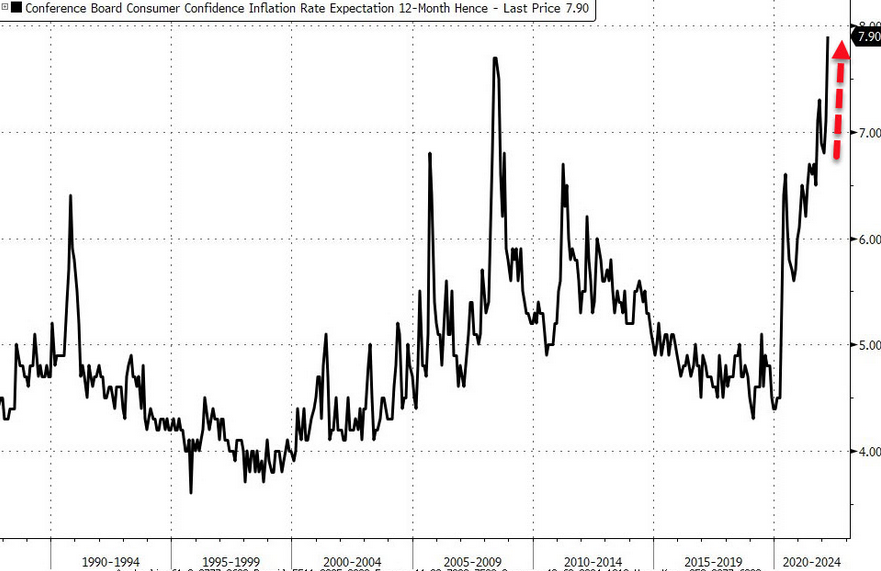

If that wasn’t enough, Lynn Franco, Senior Director of Economic Indicators at The Conference Board, cited

"expectations for inflation over the next 12 months reaching 7.9 percent - an all-time high."

Thus, with inflation and employment boiling in the U.S., the Fed’s rate hike cycle remains alive and well.

Source: Bloomberg/Zero Hedge

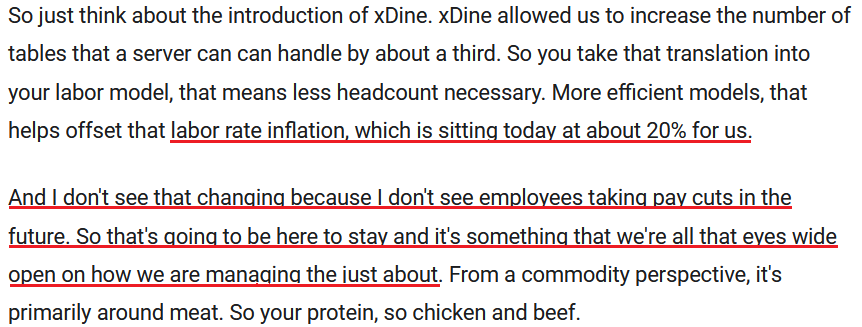

Finally, with investors materially underestimating what the Fed needs to do to calm inflation, the merry-go-round continues to spin. For example, Dave & Buster’s (NASDAQ:PLAY) released its fourth-quarter earnings on Mar. 28. For context, the restaurant and entertainment company has 144 locations in 40 states, Puerto Rico, and Canada.

Moreover, CFO Michael Quartieri said:

"Even with headwinds from wage and commodity inflation, we've continued to grow margins.

"we're able to offset that with a slight increase in pricing on our F&B, which is only about 5%."

Source: Dave & Buster’s/The Motley Fool

The bottom line? I've mentioned that too much of a good thing can be bad. With employment and inflation steaming in the U.S., the Fed's task of calming the pricing pressures without cracking the economy is nearly impossible.

For example, Dave & Buster's wage inflation is running at 20%, and with more money in consumers' pockets leading to more discretionary spending, how does the Fed reduce the metric to 2% without killing demand? As such, investors lack the foresight to see what's required to complete the task, as the Fed may have to orchestrate a recession to stop inflation's reign.

In conclusion, the PMs were mixed on Mar. 29, as mining stocks benefited from the bulls' stampede. However, with investors miscalculating the Fed's fury, it should be clear by now that inflation will not dissipate on its own. With killing demand the only option, Fed officials' war against inflation will likely result in plenty of casualties across the financial markets.