Summary

Gold Standard Ventures Corp (NYSE:GSV) is in the midst of releasing a ton of drilling results.

Lots of potential price catalysts later this year.

Gold weakness could undercut market response, however.

I’ve been following the development of Gold Standard Ventures (GSV) for years. In 2014 I took a tour of their property on the Carlin Trend in Nevada to get a sense of the potential value for investors.

Gold Standard Ventures is an exploration-stage resource company with a massive district-sized property in one of the most prolific gold-producing regions in the world. That part of its story is well-known by now to those that follow this industry.

What’s interesting about the company now is that we’re getting results from its massive $25+ million drilling program for 2018. And now the question is, “Was the money well spent?” If the results released so far in June are any indication, that answer is, “Yes.”

The company’s whole property is known as Railroad-Pinion, it is more than 80 square miles that the company has systematically obtained over the past seven years, adding to its original land package.

There are multiple targets zones, three of which, Pinion, North Bullion and Dark Star, have initial resource models associated with them. There are others, including the latest, Dixie, which have promise as well.

At this point, Pinion and Dark Star make up most of the company’s value with the 43-101 compliant resource estimates topping more than two and a half million ounces. Both of these are near surface oxide formations with proven high gold recovery yields from simply heap-leach operations. Recent step-out and infill drilling results indicate Pinion is open to further expansion.

Most of the drill results for Pinion have been reported for Pinion and this program should lead to a Preliminary Economic Assessment (PEA) of the project later this year. And it’s the PEA which will determine, ultimately, what the buy-out potential for this company is.

Dark Star still has results to report. The latest results show a very promising new high-grade intercept to the north of the main deposit which could add significant size and volume to the whole discovery.

The May 15th press release returned confirmatory intercept to one reported in January of a very high-grade sub-surface region and extends it to the north.

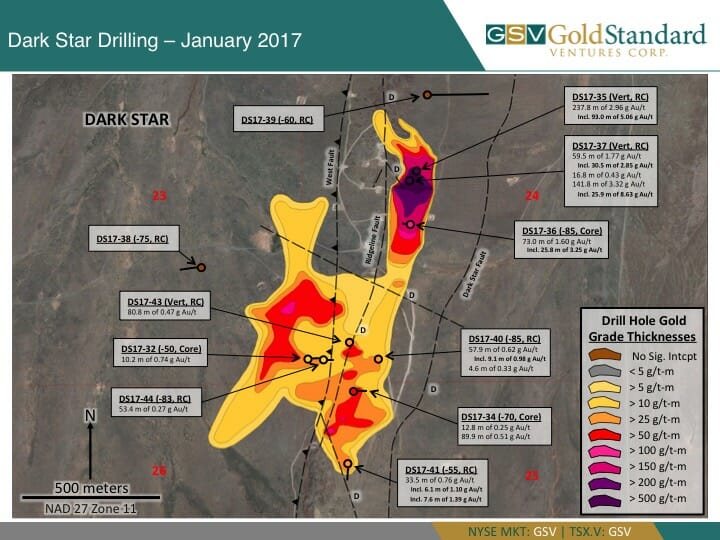

The above is the January 23 rd drilling map published by the company. Hole DS-17-35 is the drill hole that forms the northern boundary of the known resource. May 15 th’s press release included results from hole 18-26, which is just to the north of 17-35 and confirms that the high-grade zone below 200 meters continued and further sharpens the resource estimate for the upcoming PEA this fall.

There are still 145 holes to be reported from Dark Star from this year’s drilling program.

The focus of this program was to advance GSV’s resource model from the exploration stage to the economic one. GSV has two major strategic investors holding more than 25% of the company. OceanaGold Corporation (OTC:OCANF)) at 15.6% and Goldcorp Inc (NYSE:GG) at 9.9%.

The company has never had a problem raising money or attracting institutional investors, who own another 45.5% because of where it’s located and the lack of true high-quality, low-cost gold deposits available in reliable jurisdictions.

This is why I’ve been watching this company on and off for more than five years. Management has always executed well, consolidating its land position over the course of this bear market while raising capital to advance each new target methodically.

The market knows that this company represents one of the last big opportunities on the Carlin Trend and as such would always be there with a new chunk of money to move the ball down the field another few yards.

The second half of this year will have a number of potential catalysts, including the rest of Dark Star’s results, more initial results from Dixie and the issuance of the PEA.

The big question now is when will gold (GLD (NYSE:GLD)) cooperate to reward investors’ patience?

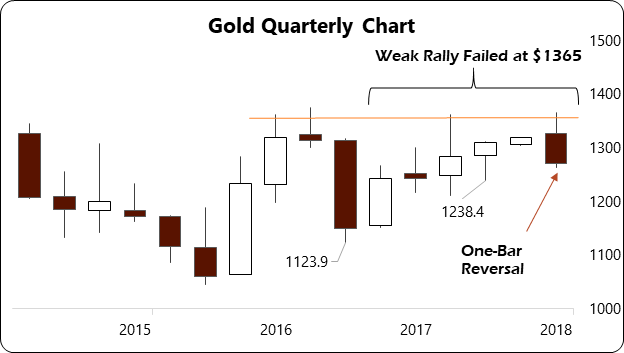

With the current weakness in gold prices heading into the end of Q2 the prognosis isn’t good. After a five quarter rally on a weaker USD, gold failed to break through strong overhead resistance near $1365.

The collapse in prices in Q2 on a firmer dollar means that dollar liquidity issues current putting pressure on emerging markets is outweighing safe-haven demand from Europe as the euro (FXE) flirts with a breakdown below support at $1.155.

This week’s price action will tell the tale for gold into Q3. A rally back above $1300, specifically the Q1 low of $1304 would negate the one-bar reversal signal currently in play and create a short-term, interim low. But, continued weakness into month-end will signal a weak Q3 and a move back towards $1238 and then $1206.

If there is any kind of panic this summer over Italy’s debt or the fall of German Chancellor Angela Merkel in Germany then it’s possible we’ll see a short-term panic in gold prices which could take it back towards the 2016 low at $1124.

For Gold Standard Ventures, it will track with gold prices with only outstanding drill results from Dark Star or Dixie yielding an upside surprise. Weakness in gold and gold shares, however, in my mind, should be viewed as buying opportunities as any huge washout in gold will be accompanied by the kind of financial crisis that defines major trend changes.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.