Gold Non-Commercial Speculator Positions:

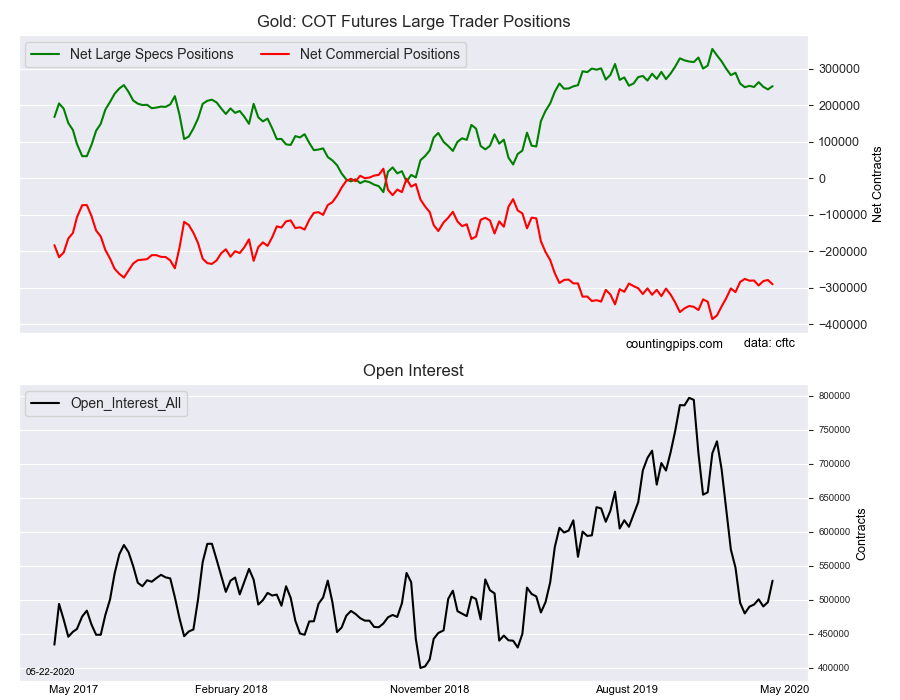

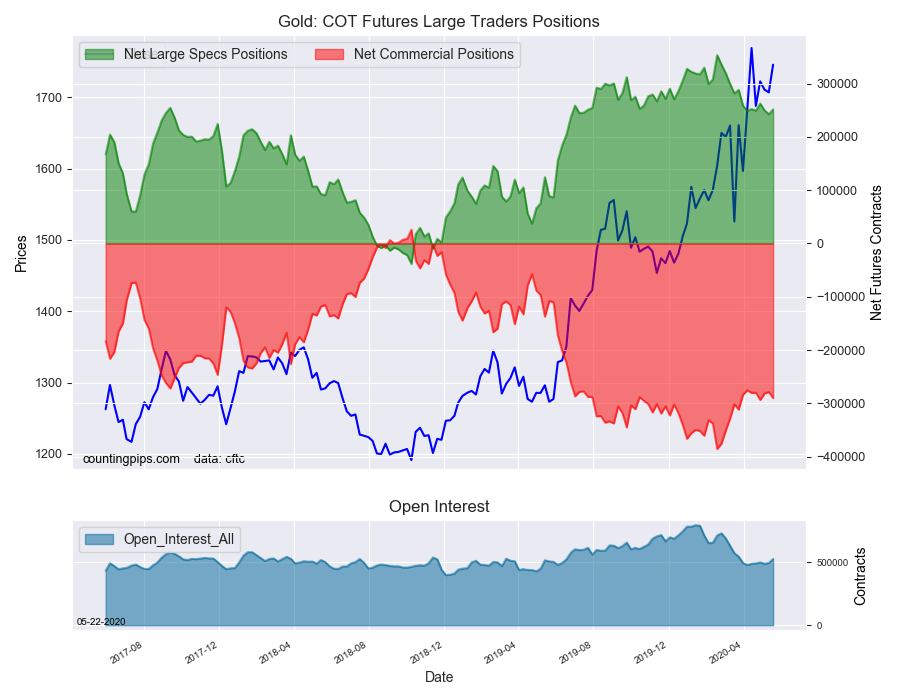

Large precious metals speculators increased their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 251,788 contracts in the data reported through Tuesday May 19th. This was a weekly gain of 8,960 net contracts from the previous week which had a total of 242,828 net contracts.

The week’s net position was the result of the gross bullish position (longs) going up by 17,623 contracts (to a weekly total of 295,394 contracts) while the gross bearish position (shorts) rose by a lesser amount of 8,663 contracts for the week (to a total of 43,606 contracts).

Gold speculative positions rose for the first time in three weeks this week and after bets had declined by a total of -19,901 contracts in the previous two weeks. The gold bullish positions, despite this week’s rise, have not been keeping pace with the price of the shiny metal. The gold spot price has remained near the top of it’s range of around $1,735 an ounce for the past six weeks while gold bullish bets have actually been lower in nine out of the past thirteen weeks.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -290,174 contracts on the week. This was a weekly loss of -11,641 contracts from the total net of -278,533 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1745.60 which was an uptick of $38.80 from the previous close of $1706.80, according to unofficial market data.