Gold was the main beneficiary of the U.S. dollar's woes overnight as oil consolidatesrecent gains.

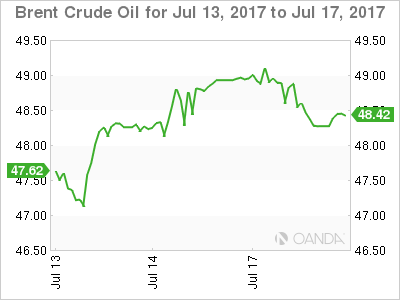

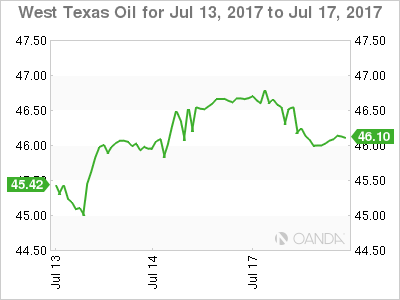

Oil

Crude paused for breath overnight with both Brent and WTI trading in a one-dollar range. It is perhaps unsurprising given the whipsaw nature of the market lately and no doubt open positioning from traders either long or short is much reduced.

Tonight’s American Petroleum Institutes (API) inventory numbers should spark some life back into trading with perhaps the top side more vulnerable if we get another larger than expected drawdown. Both contracts are trading quietly in early Asia near to their New York closes with Brent spot at 48.45 and WTI spot at 46.15 respectively.

Brent spot has initial resistance at 49.15 followed by the more important 49.70/50.00 region. Support appears at 48.00 and then 47.00.

WTI spot has initial resistance at 47.00/47.20 with a close above implying a technical move to test the 100-day moving average at 48.00. Support is just below at 45.80 followed by the more significant 45.00 area.

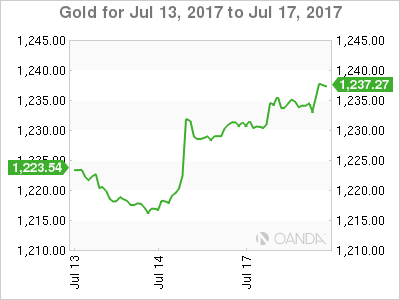

Gold

Gold continued its positive tone overnight, albeit at a more subdued pace than Friday’s rally. Gold traded to a high of around 1236.00, and in the process, comfortably closed above the 200-day moving average at 1230.50, a bullish technical development.

With the Street repricing its U.S. interest rate outlook following soft data and a dovish Yellen, and with President Trump’s reflationary reforms seemingly lost in the legislative Bermuda Triangle of Congress, a weaker U.S. dollar should continue to support gold.

Gold trades positively in Asia, up four dollars at 1237.50 with early Asia physical demand evident. Initial resistance is at the 1240.00 region followed by the 100-day moving average at 1247.50. Intraday support appears at 1232.80 followed by the 1230.00 area.