Key Points:

- U.S. RedBook signals slipping Retail Sales data.

- RSI Oscillator remains on an upward trajectory in neutral territory.

- The U.S. Core CPI result is likely to determine the near term fundamental trend.

Gold prices firmed overnight to close around the $1260.75 an ounce mark as the precious metal reacted to a range of increased risk emanating from renewed tension on the Korean Peninsula. However, there is more than just the ongoing North Korean situation fuelling the drive with the latest U.S. Red Book figures showing Retail Sales slipping fractionally to 2.6% y/y. Subsequently, it’s prudent to take a cursory review of the technical and fundamental outlook for the precious metal.

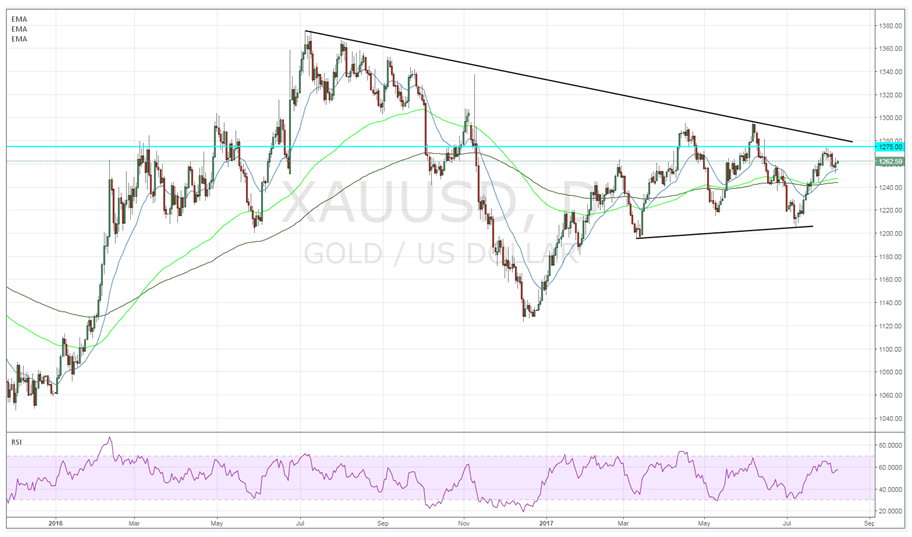

From the technical perspective, Gold has continued to trade within a relatively narrow range with yesterday’s session bringing further consolidation with the top at $1274, from early August, dominating proceedings. In addition, the RSI Oscillator is still exhibiting a longer term bullish trend, on the daily timeframe, whilst it presently remains within neutral territory. At this stage, Gold’s near term support is at $1255, which also represents the Ichimoku cloud bottom, whilst the upside presents a hurdle at $1275 of which a break above could see the metal trading around the $1295 mark. Subsequently, declines back towards the cloud bottom represent key buying areas of which the market is cognizant of.

Fundamentally, Gold has experienced a small pullback following Friday’s stronger U.S. Jobs Numbers and renewed capital flows into the greenback. However, at this stage everything is likely to remain relatively quiet ahead of the inflation data which is due out late in the week. The broad market consensus is for Core CPI to rise to 0.2% m/m (0.1% prev) but expect some variability given the recent slip in retail sales as well as instability within oil markets. Subsequently, the risks are largely on the downside for the result which would send Gold rallying higher to challenge the $1275 resistance point.

Additionally, as perverse as it armed conflict is, Gold typically benefits from its status as a safe haven asset in times of political and economic turmoil. If indeed the present crisis with North Korea turns to armed conflict then Gold will rise strongly as capital clamours for a safe haven amongst the carnage that is sure to come. Subsequently, it would be worthwhile keeping abreast of the crisis because, if/when action occurs, Gold prices will move rapidly.

Ultimately, the forward risks for Gold are weighted to the upside in both the technical and fundamental cases. A likely scenario for the metal would be the release of a less than stellar U.S. Core CPI result which results in some sharp gains for the metal above the $1275 an ounce mark. If this was to occur we could see a renewed bullish leg for the precious metal in the weeks ahead.