As a follow-up to our late-March post about an expected bounce in the gold ETF, we wanted to alert readers that price in the related gold miners ETF also bounced. Now, the gold miners fund has reached an important resistance area where a reversal is possible.

Here's we offer our primary Elliott wave scenario for the VanEck Vectors Gold Miners ETF (NYSE:GDX).

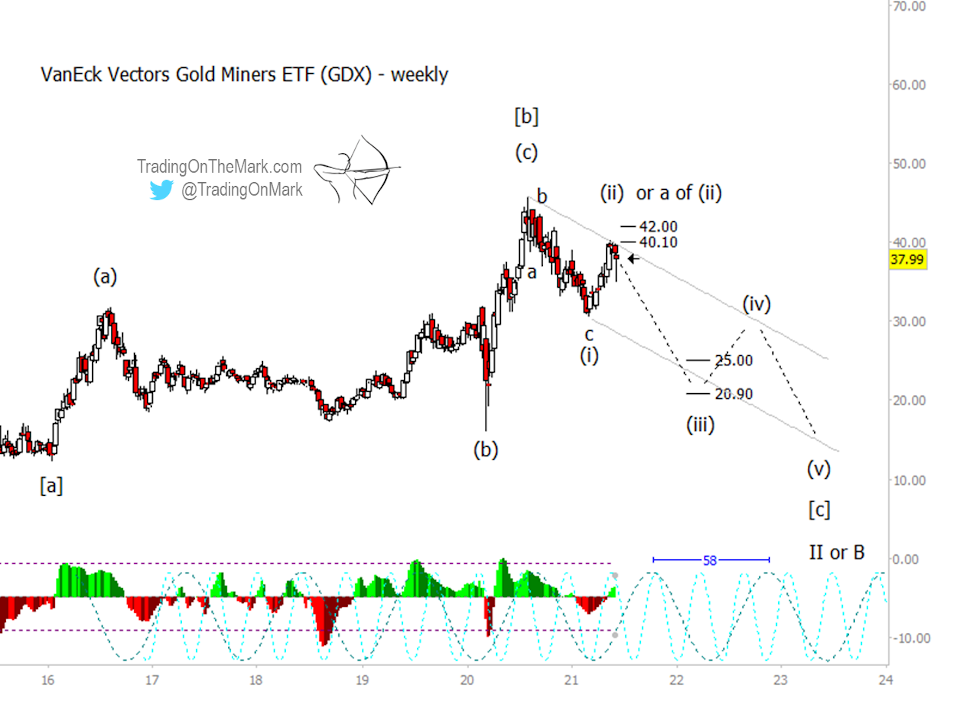

Following the 2020 high in GDX, we're looking for a multi-year downward impulsive structure to develop. That would be consistent with GDX and the metal itself trying to complete the downward/sideways pattern that began back in 2011. A downward five-wave structure would be wave [c] of something – the conclusion of a decade-long structure that might be either a wave II or wave B.

Right now, it's possible that sub-wave (ii) of the downward structure is ending, or at least pausing. Note that price has tested 40.10, which was the higher resistance level we showed in April and is also approximately a Fibonacci 61.8% retrace up to the 2020 high.

While the current area is a candidate for price to embark on downward sub-wave (iii), we also cannot rule out the possibility that sub-wave (ii) will require more time to develop. Thus, current high area might represent just part 'a' of (ii). Another test of recent resistance at 40.10 or possibly even the next level at 42.00 is possible before price can break downward. Thus, we have labelled the current high on the chart as sub-wave "(ii) or a of (ii)".

The weekly GDX chart above sketches out the possibility that the entire downward wave [c] might take the form of an ending diagonal. A diagonal-style overlap between sub-waves (i) and (iv) would allow the entirety of wave [c] to take on the "motive wave" decisiveness that's needed in order to complete the larger corrective structure while also testing near the area of the previous wave [a].

Based on the 58-week dominant cycle – the slower of the two cycles shown on the chart – ideal timing for the lows of sub-waves (iii) and (v) would be in May 2022 and June 2023. Preliminary support areas for sub-wave (iii) include 25.00 and 20.90 based on Fibonacci extensions down from sub-wave (i).

Trading On The Mark provides detailed, nuanced analysis for a wide range of markets including crude oil, the S&P 500, currencies, gold and treasuries.