The sentiment shift is still subtle, but it’s both real and widespread. After a few years of being ignored and/or dismissed as basically useless, gold is cool again, attracting positive press and increasing accumulation by big investors.

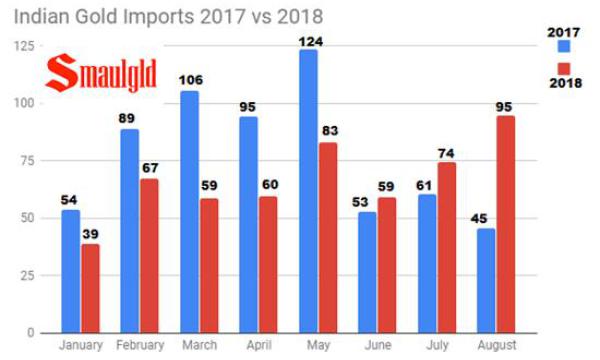

India, for instance, imported less gold than usual in the first part of this year but lately has ramped up its buying, with August imports more than double the year-earlier amount.

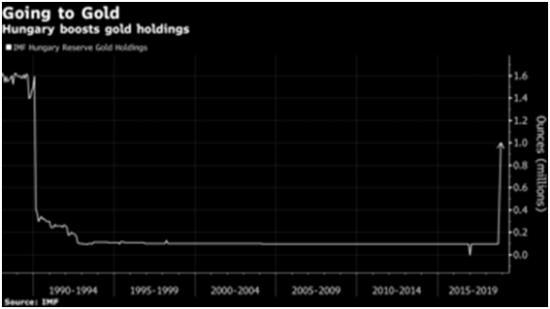

Hungary just did something even more dramatic:

Hungary Boosts Gold Reserves 10-Fold, Citing Safety Concerns

Hungary’s central bank increased its gold reserves 10-fold, citing the need to improve its holdings’ safety, joining regional peers with relatively high ownership in the European Union’s east.

Following a similar move by Poland, the central bank in Budapest now holds 31.5 tons of the metal, taking the share among total reserves to 4.4 percent, in line with the average in the region, according to a statement published on its website Tuesday.

Meanwhile, the long-dormant South African gold miners are seeing sudden interest:

Is the Canary in the Gold Mine Coming to Life Again?

Back in late 2015 and early 2016, we wrote about a leading indicator for gold stocks, namely the sub-sector of marginal – and hence highly leveraged to the gold price – South African gold stocks. Our example du jour at the time was Harmony Gold (HMY) (see “Marginal Producer Takes Off” and “The Canary in the Gold Mine” for the details).

As we write these words, something is cooking in South African gold stocks, that much is absolutely certain. Here is a chart of the JSE Gold Index in ZAR (South African rand) terms:

While we cannot be sure why investors have suddenly become enamored with the precious metals sector, it is probably a good guess that gold stocks are by now so cheap that they are considered a worthwhile target for rotation purposes.

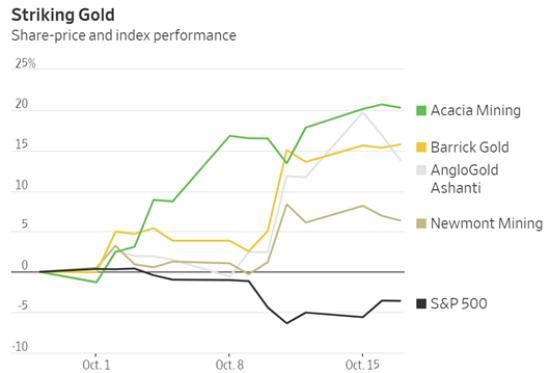

And it’s not just South African miners. The industry’s big names are suddenly outperforming tech stocks. From Thursday’s Wall Street Journal:

Investors Are Digging Gold Again

In times of market turmoil, investors often embrace gold. And when that happens, gold-mining stocks tend to do even better.

That has certainly been the case so far this month. New York gold futures are up about 3% so far in October versus a roughly 4% decline for the S&P 500. Shares of many of the world’s biggest gold miners, meanwhile, have notched double-digit gains.

Companies like Toronto’s Barrick Gold Corp (NYSE:ABX) +0.75% , South Africa’s AngloGold Ashanti NYSE:AU -0.15% and Acacia Mining (LON:ACAA) are all up around 15% to 19% after a bruising summer. The VanEck Vectors Gold Miners (NYSE:GDX) exchange-traded fund and the iShares MSCI Global Gold Miners (NASDAQ:RING) fund–which track indexes of global gold-mining firms–are up around 9% to 11% this month.

Gold-miner stocks allow investors to double down on bets the gold price will rise. These companies have higher fixed-investment costs and can become much more profitable when gold prices climb. Many of these companies pay out hefty dividends, too.

An added bonus: Hopes for further consolidation are adding to the momentum after Barrick Gold in September agreed to buy Randgold Resources Ltd. (LON:RRS) for $6 billion. Investors have poured $278 million into the VanEck gold miner ETF over the past month, according to FactSet, while flows into EPFR-tracked gold funds climbed to an 11-week high last week.

Notice the WSJ appealing to investor animal spirits by touting the benefits of gold miner leverage:

“Gold-miner stocks allow investors to double down on bets the gold price will rise. These companies have higher fixed-investment costs and can become much more profitable when gold prices climb. Many of these companies pay out hefty dividends, too.”

This is the kind of thing that hasn’t been said of gold miners for a long time, because when the metal’s price is declining extreme leverage works in reverse to crush earnings. Now, however, the other, happier edge of the leverage sword is starting to cut.

WSJ also predicts a surge in M&A — which is always exciting because it offers a sudden payoff without the long wait for earnings to accrete over time — and then points out that money is pouring into related ETFs, thus reassuring new investors that they’re not alone, but part of a growing trend. These are the kind statements that get people excited.

If history is any guide, end-of-cycle dynamics should now take over, with rising volatility sending capital pouring out of “risk-on” assets and into safe havens. So expect a lot more media accounts explaining the advantages of sound money and the benefits of miner leverage.

The SPDR Gold Trust ETF (NYSE:GLD) closed at $116.01 on Friday, up $0.09 (+0.08%). Year-to-date, GLD has declined -6.18%, versus a 3.93% rise in the benchmark S&P 500 index during the same period.