A time-tested mantra for the US stock market is, “Sell in May and go away.”

The depth of a stock market sell-off that begins in May depends on where the United States economy sits in the business cycle. In the early stages of the cycle, sell-offs that begin in May are great buying opportunities.

As the business cycle peaks, the US stock market has a nasty habit of not just losing upside momentum in May, but suffering a horrific crash in September or October.

Tomorrow is the next FOMC meeting and there’s clearly a new sheriff in central bank town.

I refer to Ben Bernanke as Dr. Jeckyll and Jay Powell as Mr. Hyde. The bottom line is that Powell is proceeding with aggressive rate hikes and quantitative tightening (QT).

With the Fed now deploying a major hiking cycle while the business cycle is in a late stage, the more appropriate mantra for 2018 could be, “Sell in May or get blown away!”

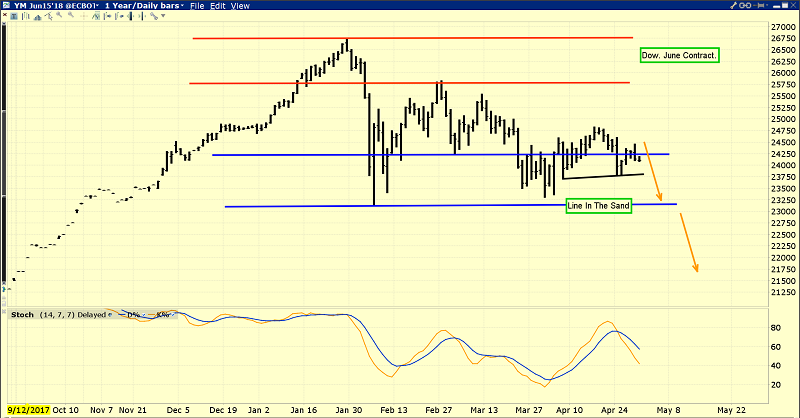

Note the price zone on this Dow chart that I’ve defined as a key line in the sand for the US stock market.

Some Fed speakers have talked about the potential for the central bank to become more aggressive, given the inflationary implication of tax cuts coming at this late stage of the business cycle. If Powell himself makes any such statement this week it could create an institutional investor panic. That would likely send the Dow tumbling under my line in the sand zone.

Stock market investors who bought only in recent years should give serious consideration to the use of put options as a strategy to mitigate the fast-growing risks that the US central bank is putting on their table.

My personal stock market focus is China and India, and to a lesser degree South Korea and Japan. These markets can crash along with the US market, but they are poised to recover more quickly and offer vastly more long-term upside potential than US markets.

Most neocons think that North Korea’s Kim responded to Trump threatening him. I don’t believe Kim or most North Koreans are threatened by Trump at all. Trump did show Kim that if North Korea wants to spew endless war mongering propaganda about America, he can do so too. He simply showed Kim how silly and outdated this propaganda is for the modern era.

Peace on the Korean peninsula is coming not because of silly “hawk talk” from Trump but because North Korea’s government is ready to make economic deals and move away from pure communism. Trump has likely offered significant economic carrots to Kim in return for dialing back its nuclear weapons programs.

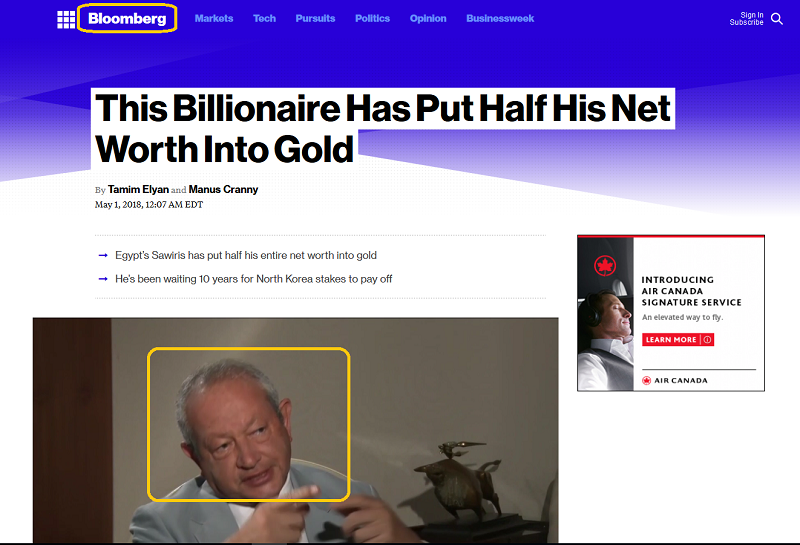

“Some big investors see warning signs ahead for markets but are holding their positions. Egyptian billionaire Naguib Sawiris is taking action: He’s put half of his $5.7 billion net worth into gold.” – Bloomberg News, May 1, 2018.

Sawiris is arguably one of the world’s biggest gold stock investors. He’s a master investor with a target of $1700 to $1800 for bullion.

Sawiris wants to see more hardcore business owners on the boards of gold mining companies. His opinion is that there are too many miners and bankers on these boards, and to really succeed in what I call the “gold bull era”, more businessmen are needed. I agree!

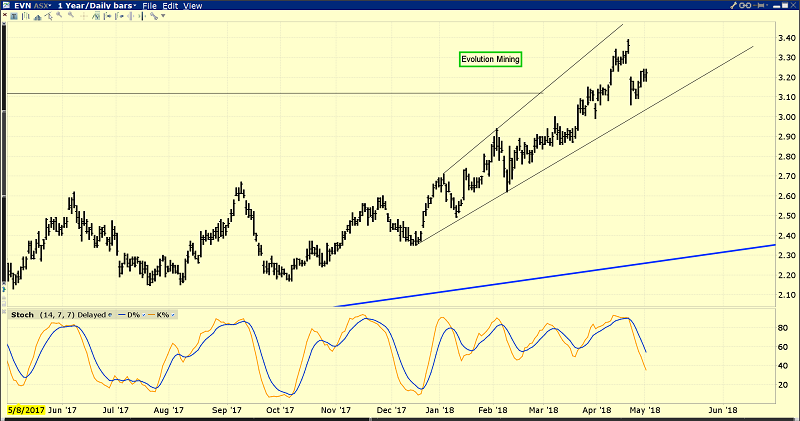

Sawiris is one of the largest shareholders in Australia’s Evolution Mining (AX:EVN) stock, and it’s pretty clear he’s riding a winning horse. Evolution is the number two gold producer in Australia now and it’s magnificently poised to prosper in the China and India oriented gold bull era.

I have a long-term target of $100 a share for Evolution. Investors can be comfortable paying as much as $10 for this fabulous company. In the $5 to $3 area, I’m an eager buyer on every 25cents dip and an eager seller of a third of what I buy on rallies that carry the stock 50cents higher than my buy price.

I cover Evolution (and other key Aussie miners) on my junior miners site at gracelandjuniors.com It’s a key component of my extensive “Thunder Down Under” portfolio.

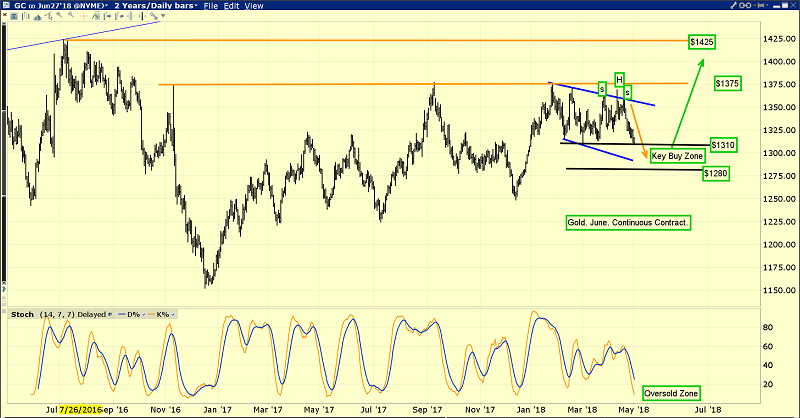

Gold bullion is performing exactly as I’ve projected it would over the past couple of weeks. Excitingly, it’s now entering my key $1310 to $1280 buy zone.

Investors who took my recommendation to buy put options in the $1370 area should begin booking juicy profits on those options now. Book more profits on more options on any deeper weakness under $1300 ahead of this Friday’s jobs report release.

I don’t expect any serious upside gold price fireworks to occur until the Fed’s June meeting is complete. That will almost certainly see Powell oversee another rate hike and a ramp-up of QT. That should shock US stock and bond markets and blast gold higher. Having said that, gold is oversold now. In the days following the jobs report, a decent move higher is likely in the cards for gold price enthusiasts.

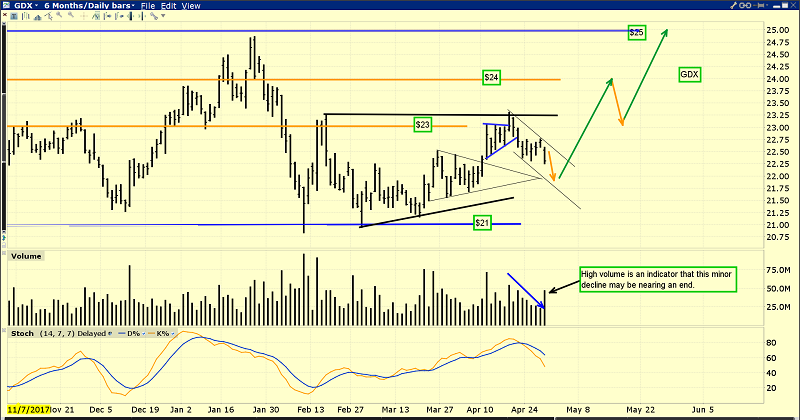

For the past few years, key Chinese gold jewellery stocks and Aussie miners have soared higher while VanEck Vectors Gold Miners (NYSE:GDX) and most Western miners have languished. I think that’s about to change, with GDX set to join the upside fun, regardless of what happens to bullion in the medium term.

Yesterday’s high-volume day should be noted. Days where volume spikes tend to suggest a minor trend rally or decline is almost finished. Some GDX components (like Barrick (NYSE:ABX) have soared higher while bullion has swooned. That hasn’t happened in a meaningful way since the heady inflationary days of the 1960s and 1970s. The inflation that will be created by launching tax cuts in the late stage of the business cycle is only beginning, and investors need to get positioned in gold stocks now to benefit.

Investors should focus any buying of protective put options more on bullion than gold stocks. Regardless, gold bullion is poised for good second half of the year performance, and gold stocks are poised for a great one!

Thanks

Cheers

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?