Gold tests and holds important Fibonacci and 2 year trend line resistance at 1785/90.

Silver has a sell signal after a new high and significantly lower close yesterday. I am watching for a small head & shoulders pattern to form on the short term charts for confirmation.

WTI crude December remains in a volatile sideways trend. Impossible to read day to day as we are up one day, down the next day.

Today's Analysis

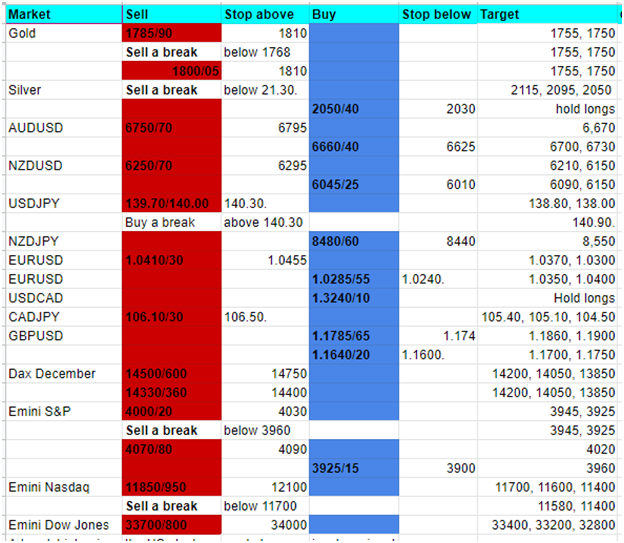

Gold could be on the turn after a very fast $170 rally in just 2 weeks as we test important Fibonacci and 2 year trend line resistance at 1785/90. No sell signal yet but I feel we are due for a correction to the downside. A break below 1768 today should be confirmation of a move towards 1755 and support at 1750/45 for profit taking on shorts.

Strong Fibonacci resistance at 1785/90 then further important 500 and 200 day moving average resistance at 1800/05. I think gold will reverse from one of these 2 areas. A sustained break above 1810 is a buy signal.

Silver holding above the 200 day moving average at 2155/35 was a buy signal targeting 2220/30 which was hit yesterday with a high for the day exactly here. However prices collapsed back to the 200 day moving average at 2150/40. We can trade this 80 tick range while we wait for the next signal.

Yesterday I warned that a bounce today which holds 2200/2210 (a high for the day exactly here yesterday) and then breaks below the neck line at 2140/30 is a sell signal. So sell a break below 2130 today targeting 2115/10 and 2085/80, perhaps as far as strong support at 2050/40.