The next US central bank announcement is tomorrow, and

whatever happens is win-win for gold.

If the Fed surprises most analysts and hikes rates, the stock market probably crashes, and gold stocks rally strongly.

If the Fed does nothing and makes another statement that QT could end this year, the stock market likely rallies a bit and gold stocks outperform.

It’s a clear win-win situation for gold bugs around the world.

I’m adamant that the US stock market would already look somewhat akin to the 1929 bear market if the Fed had not killed its “QT on auto pilot” and “rates are years away from being normalized” statements.

In contrast, there was/is no QE in China or India. In addition, interest rates are twice as high in China as America, and three times as high in India.

The bottom line: Stock markets are propelled significantly higher or lower by central bank policy. Chinese and Indian central banks have vastly more long-term ability to “juice” their stock markets higher than the Fed does.

This leaves aside the “minor detail” that there are three billion citizens in Chindia. The Chindian population absolutely dwarfs the US population. The citizens are gold-oriented workaholics growing their economy at 6%-7% annually.

Most incredible of all: This growth is happening against the background of a quasi-communist government in China and a mafia-like government in India.

What happens as those governments transition to the more business-friendly type of government that exists in America? Answer: Vastly more wealth and vastly more demand for gold!

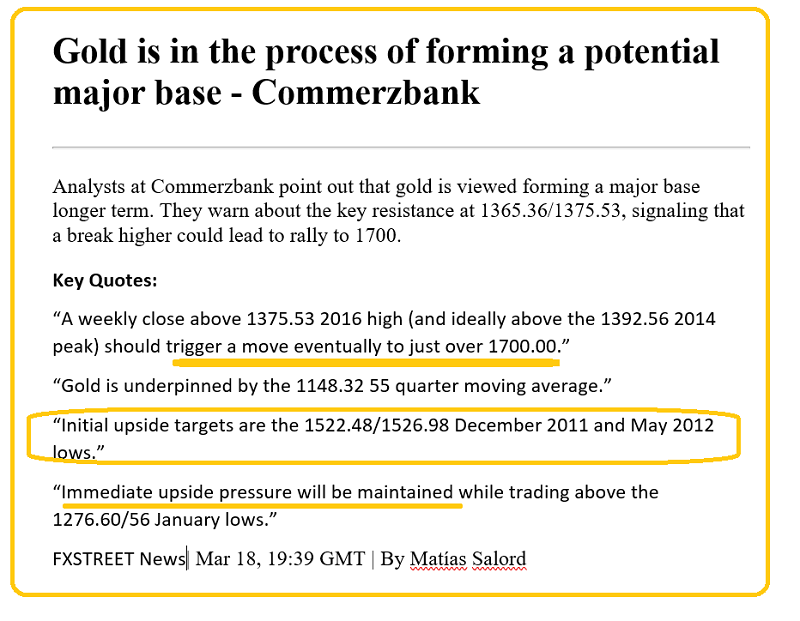

The almost universal enthusiasm for gold amongst elite bank analysts around the world right now is highly impressive.

Their support for gold on this $70/ounce pullback has been unwavering and Commerzbank (DE:CBKG) analysts appear to be predicting that a surge to the $1700 price zone is imminent!

These heavyweight bank analysts influence the decision-making process of institutional money managers. They also affect mainstream financial media. Gold is gaining news coverage as an asset class to be respected.

Bank of America's (NYSE:BAC) elite gold market analysts note the steady progress being made with global de-dollarization.

The bulk of the action taking place on that front involves fresh and steady allocation to gold by central banks. India’s savvy central bank was a massive buyer near the 2009 lows and now it appears to be committing to a monthly buy program.

For gold price forecasting, retail investor sentiment is becoming less important than it was in the past. What matters now is central bank sentiment and bank analyst sentiment. The phrase that describes that sentiment best is: Solid as a golden rock!

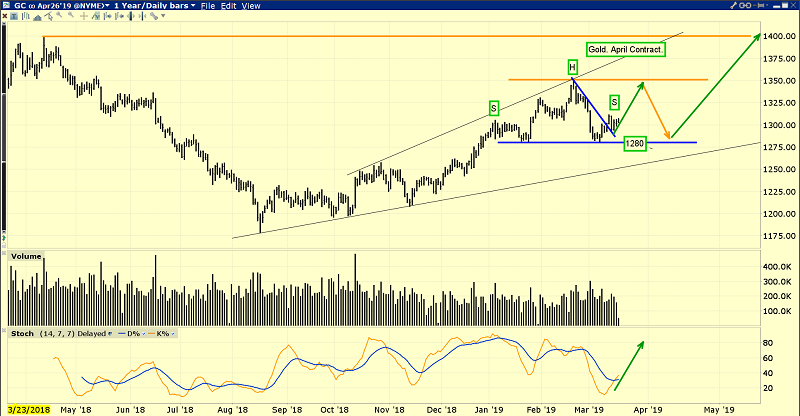

As relentless Chindian demand growth, limited mine supply growth, and central bank de-dollarization all take the centre stage of price discovery in the eyes of the elite bank analysts, negative technical formations like this H&S top will continue be voided, and gold’s uptrend will continue.

As gold pulled back to the $1280 I suggested that could be the new floor for the price. The powerful rally in the rupee taking place against the dollar now is triggering a surge in Indian dealer demand. In turn, that’s causing powerful commercial bank traders to cover short positions.

Trump is working hard to reverse the damage to global stock markets that his tariffs caused and the Fed has become highly supportive with its statements and actions. I see no reason for that to change with this week’s FOMC policy announcement and Trump is going to intensify his efforts to get a trade deal that is friendly to stock markets.

I’m “long and strong” the US stock market, the Indian stock market, the Chinese stock market, and the entire precious metals sector… with a wide array of investment vehicles.

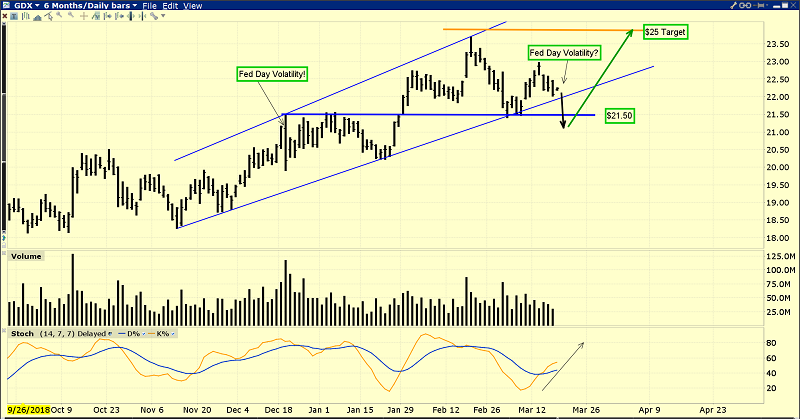

This is the VanEck Vectors Gold Miners (NYSE:GDX) daily chart. While I’m long Direxion Daily Gold Miners Bear 3X Shares (NYSE:DUST) at my guswinger.com swing trade service, that’s a mechanical short-term system designed to produce solid profits during wild volatility events like the Fed meet.

In the big picture, volume is soft on down days for most gold stocks. Volume is rising as the price rises. That’s bullish. Most importantly, the GDX price action can be themed as… “solid”. As gold rallied to $1350, I predicted that many individual miners would keep rallying as gold pulled back.

A big feature of the current $70/ounce gold price consolidation has been the continued rally of many miners. A rise in gold to the $1520 area would turn these miners into cash cows, and a further rally to Commerzbank’s $1700 predicted price should cause an institutional feeding frenzy!

Gold is steadily reclaiming its title as “ultimate asset”, which means it rises in good times and bad. If global stock markets rise, gold rises. If global stock markets crash, gold rises. Owning gold is now the “ultimate no-brainer” tactic for central banks and heavyweight bank analysts. Let’s hope that sentiment envelops 100% of the Western gold community… right here, right now!Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?