The question most gold bugs are probably asking themselves right now is this: How high must gold bullion go before the gold stock ETFs stage their own key breakouts and rally alongside gold?

The answer, quite simply, is: Higher than the price is today. Disappointment and surprise are part of investing.

So is diversification, and at the 2008 lows I was emphatic that the US stock market had to be bought. Now, I recommend investors lighten up, but don’t go 100% to the sidelines.

Stocks, bonds, real estate, and gold are assets. They are not casino chips. Buy them modestly on price weakness and sell them modestly into price strength. It’s really that simple.

Gold looks fabulous. It closed above the September highs yesterday and that’s significant.

The weekly chart. The big picture for gold, both technically and fundamentally, is superb.

The Coronavirus is a serious matter, but it’s simply the newest of many positive drivers for gold. Government debt is the big one. Demographics in the West (and in China) is also a concern.

Every month, more big-name money managers are buying gold as a respected asset, and rightly so!

It’s important for young investors to stay away from people who have a negative view of gold. Keep a positive attitude and everything will be fine.

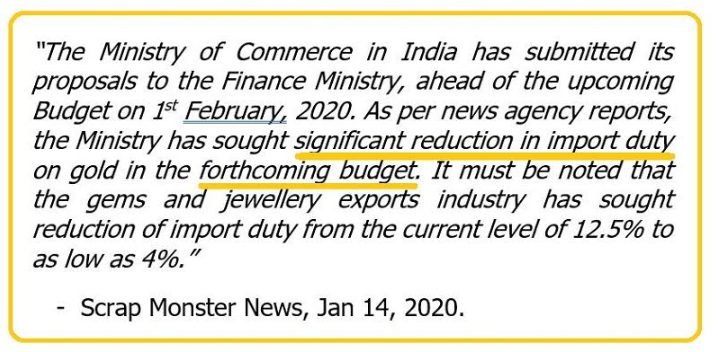

India’s budget announcement is just days away and the gold industry is again pushing the government to cut its draconian import tax.

I’m adamant that the tax is the main cause of the decline in GDP growth, from almost 10% to under 5%. That’s because the tax kills the spirit of Indian citizens. Once an entrepreneur’s spirit breaks, productivity inevitably declines.

Prime Minister Modi is under substantial pressure to reverse the economic decline, so he’s likely to be more open to reducing the duty than in previous years. Western gold bugs should cheer for a duty cut, but don’t count that egg until it hatches.

The VanEck Vectors Gold Miners ETF (NYSE:GDX) weekly chart. There’s an ascending triangle in play with a nice $50 price target.

It’s important the investors change with the times. What happened in the past is not what is happening now. For example, during the run to the 2011 highs, I was adamant that investors should focus on bullion more than the miners.

Now the main focus should be on the miners.

From the early 2016 lows in the $12 area, GDX (NYSE:GDX) has outperformed gold bullion. While bullion is up about 60% from those lows, GDX is up about 140%.

For now, it’s a stock picker’s market. Unknown miners are soaring while a lot of the “good ‘ole boys” (the main holdings of ETFs) are struggling.

This is another look at the GDX (NYSE:GDX) weekly chart. A massive bull flag on the GDX weekly chart is in play.

Some patience is required, because weekly chart patterns take time to develop and activate.

Conspiracy buffs may worry that the “Deep State” (Creep State?) doesn’t want to see gold stocks shooting higher if the US stock market falls. In this scenario, the Creep State wants the government and central banks to be the sole “economic saviours” for the people. Not gold, and certainly not mining stocks.

That’s possible, but I think failed investors are also trying to get rid of gold stocks they bought years ago, and that’s helping create the GDX (NYSE:GDX) flag pattern. These investors are “weak hands”, but not as weak as the investors who sold out into the 2016 area lows.

I believe this weak hand selling is almost done, and the flag pattern supports my prediction.

The U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE:GOAU) chart. I like the “KISS” principle; keep it simple, superstar! For GOAU, buying in the $15 area or on a breakout over $18 is probably the best strategy an enthusiastic investor can employ right now.

A pullback to $15 offers value, and a breakout over $18 offers excitement! Another tool that investors can use, quite frankly, is fine wine or mineral water. Savour the time as gold stocks trade sideways. Sip a drink and enjoy the GDX (NYSE:GDX) bull flag development and GOAU range trade action… then cheer boisterously as the upside breakouts occur!

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.