Hardly a day goes by now without more good news for gold investors appearing, and the pace of this news flow is accelerating.

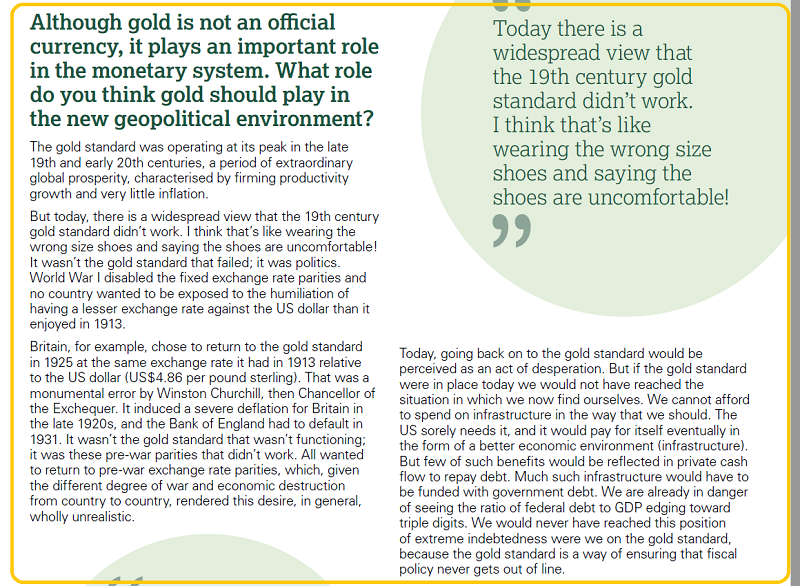

Former Fed chairman Alan Greenspan was interviewed by the World Gold Council in the February edition of their influential “Gold Investor” magazine.

That’s a snapshot of some of the interview. The former head of the Fed gives a magnificent report card to gold as the ultimate asset and currency.

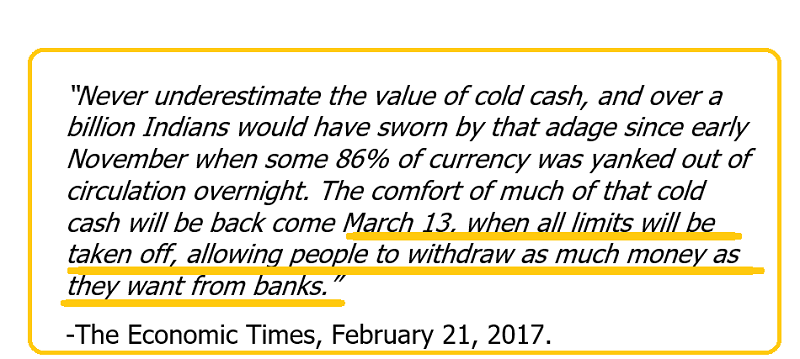

In India, the restrictions on cash withdrawals from banks are set to end on March 13. That’s just two days ahead of the ultra-important US debt ceiling deadline on March 15.

March 15 is also the date of the next interest rate decision from the Fed. The bottom line: gold-obsessed Indians will soon have the ability to purchase significant amounts of gold to bet on ongoing problems for the US government.

America is the world’s largest debtor nation, and as Alan Greenspan notes, the country desperately needs enormous infrastructure spending, but it can’t afford it. President Trump is almost certainly going to press congress to put even more debt on the backs of ageing American citizens to get that infrastructure spending done.

That’s going to create significant inflationary pressure, and the US central bank’s rate hikes are going to exacerbate the problem.

That’s because the bank is in “uncharted waters”; the enormous QE money ball sitting at the Fed has been a huge cause of deflation. It’s put a drag on money velocity by incentivizing banks to hold reserves at the Fed.

Trump is killing the Dodd-Frank bank reserve requirement rules at roughly the same time as the Fed hikes rates again. That creates a powerful incentive for the banks to move money out of the Fed and put it into the fractional reserve banking system.

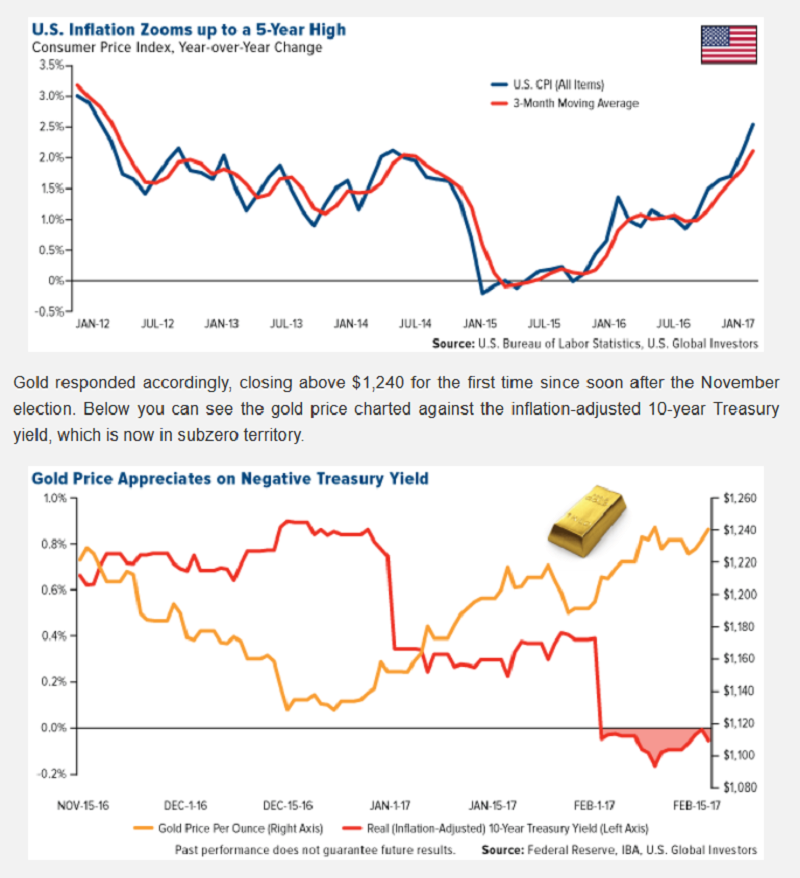

As that happens, money velocity is going to reverse and it could literally “skyrocket”. Back in 2013 I predicted that the Fed was beginning preparations to taper QE to zero, to be followed by a long rate hiking cycle. I also predicted that US real interest rates would go negative as the Fed began raising rates.

Clearly, that’s exactly what is happening, and I’ll dare to suggest that the gold community’s “inflationary fun” has barely started.

This is the gold chart. Short-term price enthusiasts can be buyers at my $1220 support zone, and sellers at $1245.

Gold has “attacked” the $1245 area twice, and another inflationary rate hike from the Fed and/or a hike in the debt ceiling from Trump is almost certainly to be the catalyst that Indians and bank FOREX traders use to bid gold through that resistance zone.

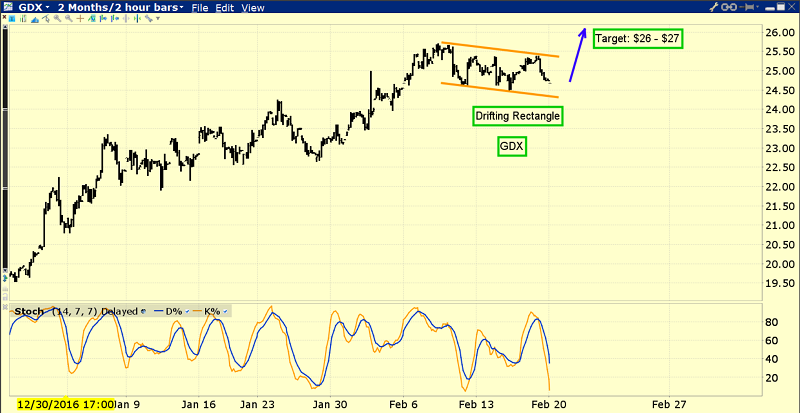

This is the GDX chart.

Gold stocks are drifting sideways in a loose rectangle formation. Technically, the odds of an upside breakout are about 67%, using the classic Edwards & Magee handbook on technical analysis.

The only way to make an ageing debtor great is to force the debtor to pay what they owe and reduce their debt levels.

Unfortunately, the Trump administration appears to be under the impression that using strategies designed to work superbly in a low-debt environment will work equally well in a high-debt environment.

It’s not just the American government that is embarking on a protectionist agenda. It’s happening in many countries, and institutional money managers clearly see that as positive for gold.

Horrifically, ageing American debtor citizens have used most of their savings for daily living expenses because of low interest rates. Now, surging inflation with only modestly higher interest rates is set to ravage the purchasing power of the remnants of those savings.

Wave pressures are substantial, but so far corporations have not passed on the wage inflation to consumers in a major way. More rate hikes will end the stock buybacks game for corporations, and put serious pressure on their ability to finance their business operations.

Businesses will soon respond with significant price increases at the retail level. This is the ABX chart.

When the inflationary grim reaper comes to town, gold stocks and silver are an investor’s best friend. The $19 area represents a convergence of both trend line and horizontal support.

Note the high volume bar in play last week. Volume tends to spike near the end of a minor trend rally, and the upcoming pullback is likely an ideal entry point for all American inflation enthusiasts!

The upcoming March 15 debt ceiling and rate hike fireworks show is just one of many reasons to own gold, silver, and high quality gold stocks for both the short and long term. This is the silver chart. Silver price enthusiasts who want to be on board for a big upside ride as corporations pass on wage inflation to consumers should be eager buyers in the $17.25 area.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?