When I was younger, I was taught that if you cannot say something nice, don't say anything. When many of you have asked why I have not written about metals in quite some time, and now you know why. But I think that's about to change.

Before we begin, I want to give you a little background about my history in the metals market.

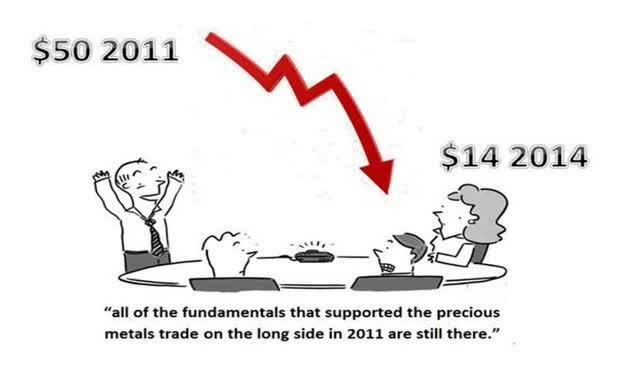

For those who may not remember the action we experienced in the metals market back in the summer of 2011, the market was going parabolic at the time, with some days seeing $50 increases. And the only arguments at the time were regarding how far beyond $2,000 gold would take us.

Yet, on Aug. 11, 2011, I concluded my first gold article on Seeking Alpha as follows:

"Again, since we are most probably in the final stages of this parabolic fifth wave "blow-off-top," I would seriously consider anything approaching the $1,915 level to be a potential target for a top at this time."

As we know, gold topped out at $1,921 and began a 4-year decline until it bottomed at $1,050. But, at the time I was writing about a larger degree top being struck, these are a sample of the comments I received from Seeking Alpha readers:

"With all due respect Avi, you plainly do NOT understand the gold market."

"Your TA is useless. You don't understand the fundamentals because you only look to the past. Gold bulls are forward thinking. The times they are a changing..."

"The problem is that TA is like driving a car by only looking in the rear view mirror... There is no foresight involved; it's all based on past performance. The future of the fundamentals is what you fail to grasp."

"There is no way you can understand what is going on in gold by doing technical analysis. Gold is driven by fundamentals."

"Technical analyses is all well and good, but you cannot apply it to the PM sector which has been artificially manipulated and suppressed for years."

Now, for those who believe that the only reason metals struck a top in 2011 was "manipulation," I hope you do not hate me if I suggest you remove your blinders. Several years ago, I was asked to pen my views on the "manipulation" perspective, and you can feel free to read it here:

Was The Metals Market Manipulated To Drop From 2011 To 2015?

Getting back to the 2011 metals market, I also want to note that I provided my downside targets for gold even before it topped. Yes, I know. Even though gold was still in a parabolic move higher then, I had the chutzpah to provide my downside target expectations.

"Based upon the Elliott Wave Principle, I would expect a very large pullback. In fact, the target for such a pullback will probably be a minimum low of $1,400, it could fall as low as $1000, or even as low as $700. It will depend upon how the decline takes form. But those are very viable targets for gold on the downside."

And the comments regarding my views were basically the same as above, so I will just note one of the more "reasonable" comments:

"There is no way to rationalize $700 gold with 50% debasement of currency expected over the next 5 years as US debt grows to $21 trillion from $14. It makes no sense to my feeble mind. I vote for $3000 vs. $1900 today. That makes sense to my mind."

As you can see, it was clear then that the "fundamentals" kept most metals bulls looking to the long side. And amazingly, those same fundamentals kept the metals bulls looking to the long side of the market during the entire decline.

Source: Elliottwavetrader.net

But what was truly amazing was that as gold was approaching its long-term low struck at the end of 2015, almost the entire market turned bearish and was again "certain" that it would continue in its downside trajectory (just as strongly as they were confident we would eclipse $2,000 in 2011), with most now turning from bullish to predicting a drop below $1,000.

Well, just like everyone was uber-bullish at the highs when we expected a major top, we turned bullish when everyone turned uber-bearish. On Dec. 30, 2015, I urged investors to be moving back into the metals complex as we were looking for a long-term bottom to be struck imminently due to the significant bearishness evident in the market:

"As we move into 2016, I believe there is a greater than 80% probability that we finally see a long term bottom formed in the metals and miners and the long term bull market resumes. Those that followed our advice in 2011, and moved out of this market for the correction we expected, are now moving back into this market as we approach the long term bottom. In 2011, before gold even topped, we set our ideal target for this correction in the $700-$1,000 region in gold. We are now reaching our ideal target region, and the pattern we have developed over the last four years is just about complete. . . For those interested in my advice, I would highly suggest you start moving back into this market with your long term money . . ."

Back in September 2015, when the investor community hated the metals mining companies, I rolled out a service on ElliottWaveTrader specifically to focus on the mining industry. We began urging our clients to buy mining stocks during the last quarter of 2015. I bought stocks such as Newmont Mining (NYSE:NEM) in the $15-17 region at the time. And NEM has been my largest holding in the complex since that time.

Fast forward to 2022, and we have been stuck in a correction in the metals market since a local top was struck in gold back in August 2020. Yet, there were pockets within the market that still rallied into 2022. An example of such outperformance in 2022 included NEM, which went on to strike higher highs in April of 2022.

Yet, when NEM struck the 84-85 region, I outlined to the members of ElliottWaveTrader.net that, for the first time since I bought NEM in 2015, I was selling almost my entire holdings in the company. I set a target of 82-89 when NEM was hovering in the 28 regions. And when we moved into my target region, I stuck with my plan and sold my largest holding in the complex. Since then, NEM has lost more than 50% of its value.

As we stand today, I'm watching this market quite intently, as it seems to be setting up a potentially strong rally for 2023. And I'm looking toward getting aggressive on the long side of the complex again.

From an Elliott Wave perspective, many individual stocks and gold have developed a 5-wave rally off the recent lows. That usually signals that the correction is over and the next bullish phase in the market has potentially begun. Although silver is not quite as clear as of the time of my writing this article, I expect silver to outperform gold in 2023.

So, what I'm looking for in the coming weeks in the metals complex is for a corrective pullback to take shape. Should we see that corrective pullback take shape and then see the market rally over the high struck before that corrective pullback began, that would signal the resumption of the bull phase I expect to see in 2023. But, I'm sorry, I do have to leave the specifics of my expectations to the members of ElliottWaveTrader.net.