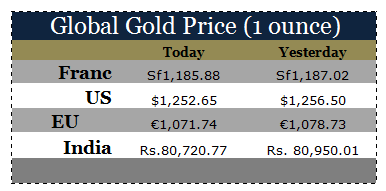

Gold today: New York closed yesterday at $1,257.20.London opened at $1,253.00 today.

Overall the dollar was weaker against global currencies, early today. Before London’s opening:

The GBP/USD was slightly weaker at $1.1654 after yesterday’s $1.1650: €1.

The dollar index was slightly stronger at 93.97 after yesterday’s 93.94.

The yen was weaker at 111.25 after yesterday’s 110.76:$1.

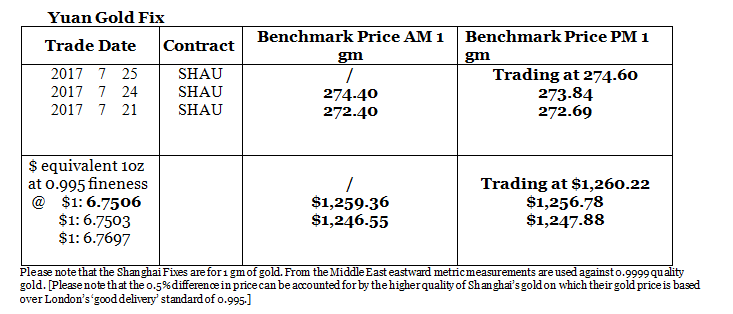

The yuan was almost unchanged at 6.7506 after yesterday’s 6.7503: $1.

The pound sterling was slightly weaker at $1.3031 after yesterday’s $1.3041: £1.

New York closed $0.50 higher than Shanghai on yesterday with London opening $7 lower than Shanghai. This keeps open arbitrage opportunities with Shanghai. Once again Shanghai is pointing the way higher for New York and London.

Sales from the SPDR gold ETF become available for shipping to Shanghai implying that should U.S. investors want to return to physical gold they will have to pay up for it.

Silver today: silver closed at $16.40 yesterday after $16.48 at New York’s close Friday.

LBMA price setting: The LBMA gold price was set today at $1,252.00 from yesterday’s $1,255.85. The gold price in the euro was set at €1,074.68 after yesterday’s €1.078.45.

Just after the opening of New York the gold price was trading at $1,252.65 and in the euro at €1,071.74. At the same time, the silver price was trading at $16.46.

Gold (very short-term) The gold price rise should consolidate, in New York today.

Silver (very short-term) The silver price should consolidate, in New York today.

Price Drivers

The gold price continues to consolidate just above support at $1,250. Last time it was here it struggled to hold or move higher. It was at this level that it was attacked and knocked down. The difference this time is that dollar weakness has gained momentum and will contribute to gold’s strength. In addition Chinese demand and the new London based LMEprecious arbitrage market with Hong Kong is letting London feel Chinese demand directly, in addition to the big banks in China doing the same in London. So we are watching to see where the gold price will go today.

As you can see below sales from the SPDR gold ETF continue unabated because of the perception that the Fed will not do anything until the end of the year so equities appear more attractive. You will note that the amount of gold acquired into U.S. gold ETFs since the beginning of the year, has dwindled to only 9 tonnes.

The Fed is deliberating that very matter tomorrow. The market expects Janet Yellen to make an announcement on tapering the Fed’s bloated Balance Sheet today. The market is sensitized to this and will react no matter what she says.

Gold ETFs: Yesterday saw sales of 4.14 tonnes of gold from the SPDR gold ETF but, again, no change in the Gold Trust. The SPDR gold ETF and Gold Trust holdings are at 809.619 tonnes and at 211.86 tonnes respectively.

In the last week heavy persistent gold sales from the SPDR gold ETF have had absolutely no impact on the gold price as it soared up from the bounce straight through the $1,250 “Golden Cross’”.

We expect these sales to halt this week as the gold picture looks so positive.

Since January 4th 2016, 171.537 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust. Since January 6th 2017 9.022 tonnes have been added to the SPDR gold ETF and the Gold Trust.