Gold today –New York closed at $1,255.90 Friday after closing at$1,249.40 Thursday. London opened at $1,245.00 today.

Overall the dollar was slightly weaker against global currencies, early today. Before London’s opening:

- The USD/GBP was weaker at $1.1199 after Friday’s $1.1145: €1.

- The dollar index was weaker at 97.25 after Friday’s 97.36.

- The yen was weaker at 111.49 after Friday’s 111.21:$1.

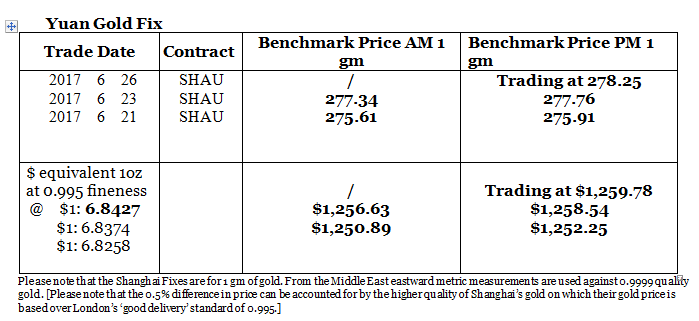

- The yuan was weaker at 6.8427after Friday’s 6.8374: $1.

- The pound sterling was stronger at $1.2751 after Friday’s $1.2732: £1.

Shanghai is leading the way up again as New York closed $2.60 lower than Shanghai’s close on Friday. This morning Shanghai started the week nearly $4 higher than New York’s Friday close as the yuan weakened against a weakening dollar. We note that the PBoC has stated it wants to trade against a basket of currencies not just the dollar but today while other currencies are stronger against the dollar the yuan is weaker. We do not draw off conclusions from daily changes, but realize that a pattern over a period establishes a currency’s behaviour.

The week’s tone in Shanghai continued Friday’s positive tone as the gold price confirmed its turnaround from the slipping pattern of the week before Friday. But when London opened it quickly fell $10 to $1,245 quickly.

Silver today –Silver closed at $16.70 Friday after $16.50 at New York’s close Thursday.

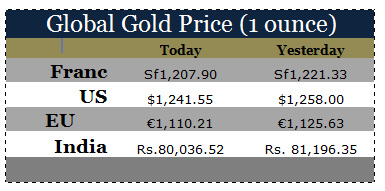

LBMA price setting: The LBMA gold price was set today at $1,240.85 from Friday’s $1,256.30. The gold price in the euro was set at €1,109.88 after Friday’s €1,124.21.

Ahead of the opening of New York the gold price was trading at $1,241.45 and in the euro at €1,110.21. At the same time, the silver price was trading at $16.50.

Gold (very short-term) The gold price should consolidate, in New York today.

Silver (very short-term) The silver price should consolidate, in New York today.

Price Drivers

At the opening of London today and through the early part of the morning the gold price fell to support at $1,240 in a straight line. This must have been a large physical sale. But unlike U.S. ETF sales or purchases, we cannot identify the amount sold.

While oil prices moved into a bear market last week, global markets have yet to fully factor that in. The oil price can confuse many investors as its fall means falling inflation something that troubles the Fed. However it is stimulative, as costs are reduced across the economies of the world. The important impact on the gold market of this is on the monetary front, as we mentioned last week. It goes directly to the demand for and the role of the dollar in world finance.

The declining oil price from well over $100 to around the mid $40 area describes just how the use of dollars in the oil world has declined in the last couple of years. The use of the dollar as the world’s global reserve currency is declining but remains as the world’s reserve currency. Until the Yuan and other currencies make inroads into the overall use of the dollar visibly, the recognition that the world has moved into a multi-currency system will not be made.

When the euro arrived on the scene at the turn of the century, the percentage of U.S. dollars in reserves dropped from over 83% to 63% as central banks switched from the dollar. While the euro is now firmly established as a global currency, countries like Czechoslovakia do not want the euro as their currency because, as the likely leader of that country said, “The euro is bankrupt”.

But the change to include the yuan in central banks reserves is a slow process that will take some time, but when recognized, it will have a dramatic impact on the gold price. The build up to it and the unobtrusive increase in gold’s importance as a reserve asset will slowly move the price higher over time, meanwhile.

Having said that a currency crisis can open up at any time. Today, we are seeing the Italian government rescue another two Banks after the two they have just rescued. How many more. And now the Bank of International Settlements [the central bank of central banks] has announced the Canadian and Japanese banks have over-extended themselves massively on dollars with around $1 trillion long positions in dollars. Can such position suppurate into a currency crisis? Of course, most observers will be saying ‘it can’t happen!” They may well be right, but as we saw in 2007 what was ridiculed did suppurate into a crisis. One signal we are watching is that the velocity of the U.S. dollar is at its lowest level on record.

Where are we in that process now? We note western central banks have stopped selling under the Central Bank Gold Agreements in 2009, despite their renewal of the Agreement in 2014. China and Russia continue to acquire gold both into their reserves and in China to integrate gold into their financial system as an active asset. With demand for gold from Asia now greater than the supply of newly mined gold [which appears to have peaked] there is no room for other central banks [or very large investors] to acquire gold now.

Gold ETFs – Friday saw sales of 2.958 tonnes of gold from the SPDR gold ETF and in the Gold Trust we saw purchases of 0.45 of a tonne. Their holdings are now at 851.022 tonnes and, at 208.41 tonnes respectively.

Since January 4th 2016, 247.684 tonnes of gold have been added to the SPDR gold ETF and to the Gold Trust. Since January 6th 2017 46.978 tonnes have been added to the SPDR gold ETF and the Gold Trust.