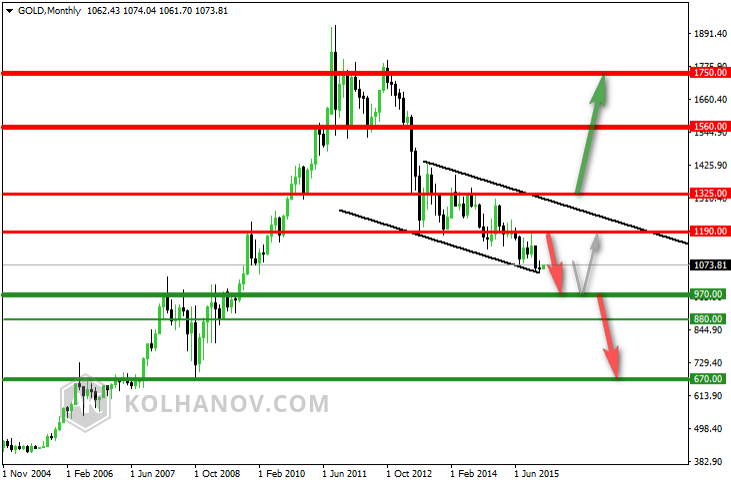

Main scenario:

The pair is trading along a sideways trend between support 1333 and resistance 1338.

The downtrend may be expected to continue in case the market drops below support level 1333, which will be followed by reaching support level 1322.

Alternative scenario:

An uptrend will start as soon, as the pair rises above resistance level 1338, which will be followed by moving up to resistance level 1350.

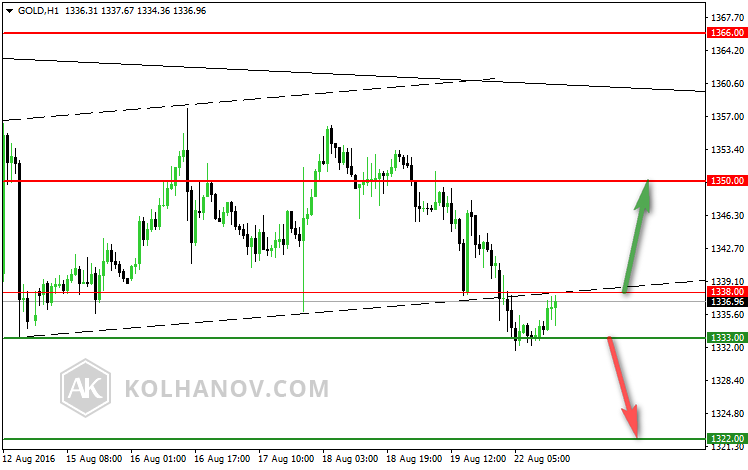

previous forecast:

Weekly forecast, August 22 - 29: downtrend with target on 1322

Main scenario:

The pair is trading along a downtrend with target on 1322, that may be expected to continue in case the market drops below support level 1337.

Alternative scenario:

A downtrend will start as soon, as the pair drops below support level 1350, which will be followed by moving down to support level 1366.

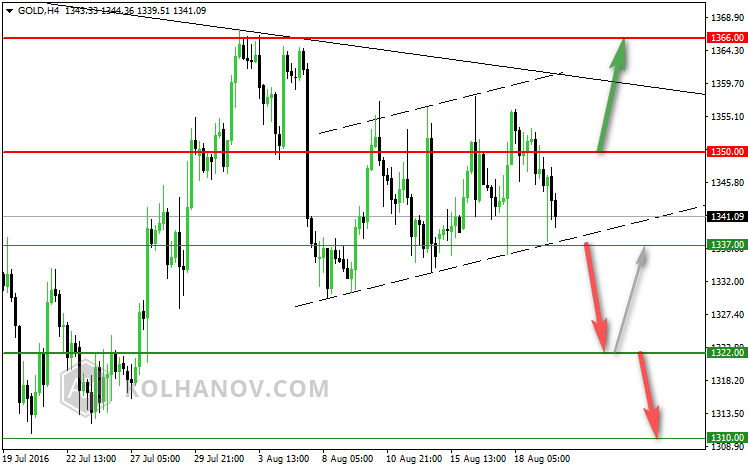

previous forecast:

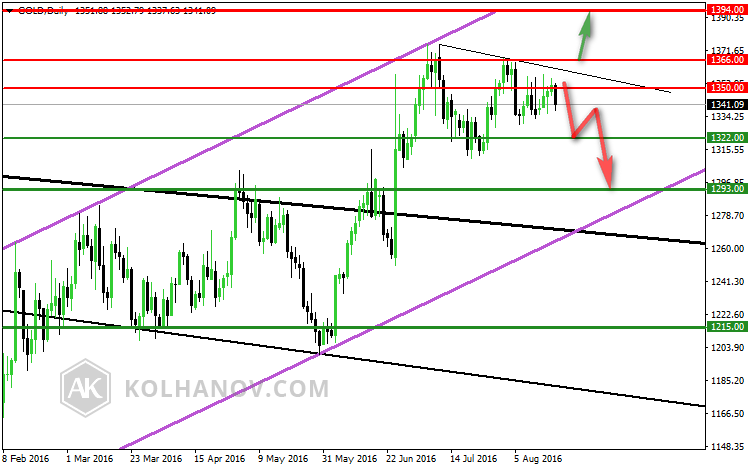

Monthly forecast, August/September 2016: downtrend to 1293

Main scenario:

The pair is rebounded from stongest resistance 1366 - 1350 and now is trading in downtrend with target on support 1293, that may be expected to continue, while pair is trading below resistance level 1366.

Alternative scenario:

A downtrend will start as soon, as the pair drops below support level 1290, which will be followed by moving down to support level 1212.

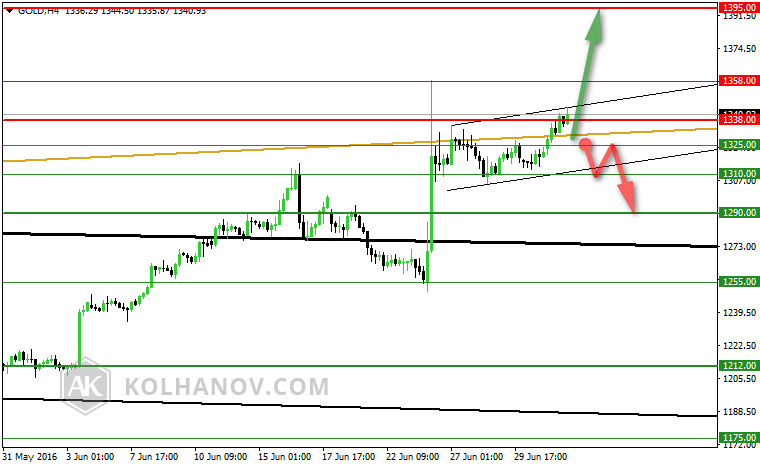

previous forecast:

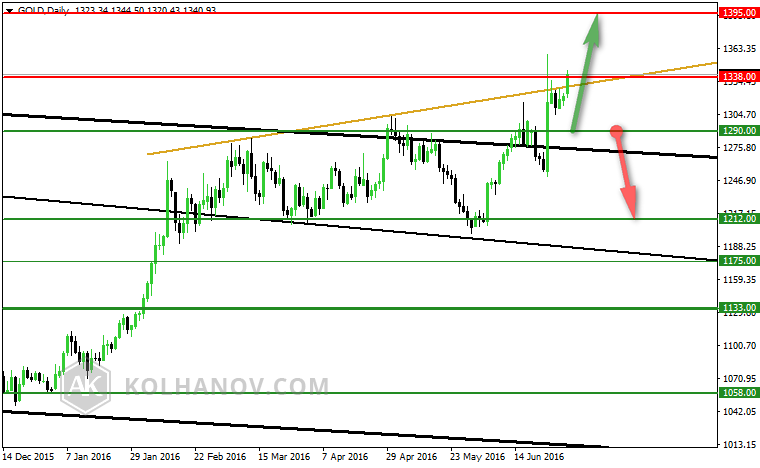

Quarterly forecast, July - September, 2016

Main scenario:

The pair is trading along an uptrend with target on 1470, that may be expected to continue, while pair is trading above support level 1290.

Alternative scenario:

An downtrend will start as soon, as the pair drops below support level 1290, which will be followed by moving down to support level 1212 and 1133.

previous forecast:

Yearly forecast, 2016

Main scenario:

The pair is trading along an downtrend with target on 970, and if it keeps on moving down below that level, we may expect the pair to reach support level 670, but in other way from 970 we can expect correcton on resistance level 1190.

Alternative scenario:

An uptrend will start as soon, as the pair rises above resistance level 1325, which will be followed by moving up to resistance level 1560 - 1750.