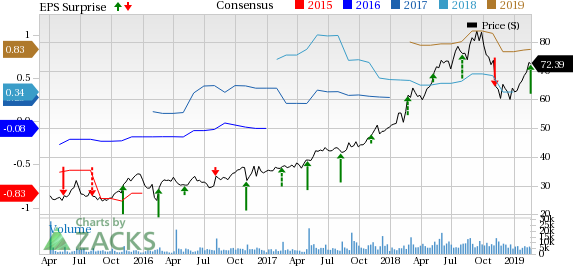

GoDaddy Inc. (NYSE:GDDY) delivered fourth-quarter 2018 adjusted earnings of 28 cents per share (excluding acquisition costs) beating the Zacks Consensus Estimate by 15 cents.

Further, per the company, earnings of 28 cents per share were up from 8 cents in the previous quarter but significantly down from 54 cents in the year-ago quarter.

The company generated revenues of $695.8 million, increasing 2.4% sequentially and 15.5% year over year. The top line surpassed the Zacks Consensus Estimate of $693.2 million.

The top line was driven by strong performance of product segments. Moreover, growing subscription of GoDaddy’s mobile-optimized website builder, GoCentral contributed well throughout the reported quarter.

Additionally, the company’s customer base reached 18.5 million at the end of the fourth quarter. Notably, the figure advanced 6.8% from the prior-year quarter. Further, average revenue per user (ARPU) was $148 in the reported quarter, up 6.6% on a year-over-year basis.

This can primarily be attributed to the company’s solid momentum across United States and international markets. Moreover, growing website adoption in the emerging markets aided customer base growth.

Coming to the price performance, shares of GoDaddy have gained 30.6% over a year against the industry’s decline of 19.6%.

.jpg)

Segment Details

GoDaddy generates revenues from three segments — Domain, Hosting and Presence, and Business Applications.

Domain: The company generated $314.3 million revenues (45.2% of the total revenues) from this segment. The figure improved 11.6% from the year-ago quarter driven by strong liquid domain aftermarket and renewals.

Hosting and Presence: This segment generated $270 million revenues (38.8% of the revenues), surging 18% on a year-over-year basis during the reported quarter. This can be primarily attributed to robust feature engagements, bookings and appointments within this segment. Further, well-performing GoCentral remained a major positive.

Business Applications: Revenues from this segment came in $111.5 million (16% of the revenues) increasing 21.4% year over year. This was driven by strong Workspace renewals and growing momentum of Open-Xchange in emerging markets. Further, GoDaddy’s partnership with Microsoft (NASDAQ:MSFT) for Office365 contributed well.

Booking (NASDAQ:BKNG)

GoDaddy uses total bookings as a performance measure, since payment is usually collected at the time of sale, and recognizes revenues ratably over the term of customer contracts. In the fourth quarter, total bookings of $732.4 million increased 11.3% year over year.

Operating Results

Gross margin was 66.9%, up 50 basis points (bps) from the prior-year quarter.

Operating expenses of $365.6 million increased 14.8% year over year.

Balance Sheet & Cash Flow

As of Dec 31, 2018, total cash and cash equivalents, along with short-term investments were $951.3 million compared with $852.2 million as of Sep 30, 2018. Accounts and other receivables were $26.4 million compared with $22.5 million in the last reported quarter.

Long-term debt was $16.6 million in the fourth quarter, down from $16.7 million in the previous quarter.

Net cash provided by operating activities came in $128.5 million compared with $154 million in the third quarter.

Additionally, adjusted free cash flow was $126.8 million during the reported quarter.

Guidance

For first-quarter 2019, the company expects revenues to lie within the range of $705-$715 million. The Zacks Consensus Estimate for third-quarter revenues is pegged at $717.07 million.

For full-year 2019, revenues are expected to be within $2.97-$3 billion, representing year-over-year growth of approximately 12-13%. The Zacks Consensus Estimate for full-year revenues is pegged at $2.98 billion.

Additionally, free cash flow for 2019 is projected between $730 million and $745 million, reflecting year-over-year growth of 18-20%.

Zacks Rank and Other Stocks to Consider

GoDaddy carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology sector are Benefitfocus, Inc. (NASDAQ:BNFT) , Square, Inc. (NYSE:SQ) and Etsy, Inc. (NASDAQ:ETSY) . While Benefitfocus sports a Zacks Rank #1 (Strong Buy), Square and Etsy carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Benefitfocus, Square and Etsy is currently pegged at 25%, 25% and 15%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Etsy, Inc. (ETSY): Free Stock Analysis Report

Square, Inc. (SQ): Free Stock Analysis Report

Benefitfocus, Inc. (BNFT): Free Stock Analysis Report

GoDaddy Inc. (GDDY): Free Stock Analysis Report

Original post

Zacks Investment Research