- New reports of widespread financial corruption likely triggered the current sell-off.

- Watch out for market support levels to see if this is a short-term correction or the start of a downtrend.

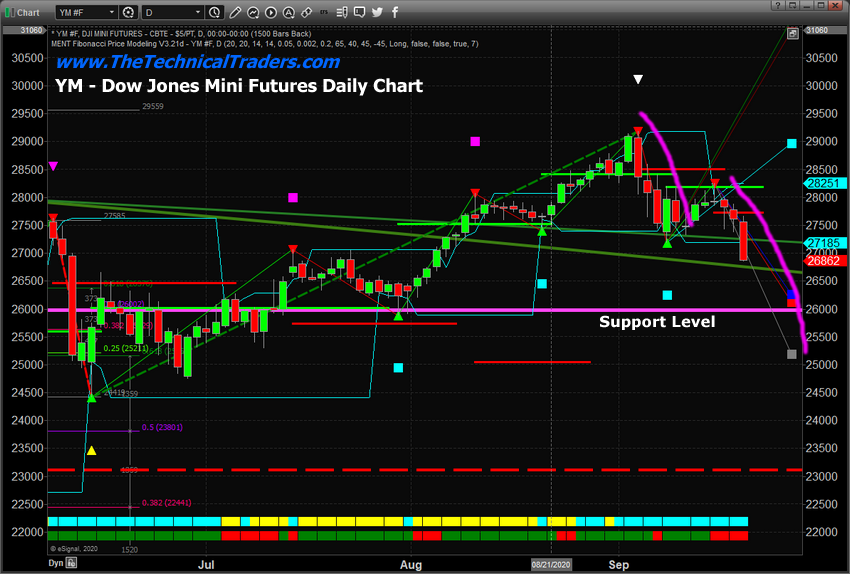

- Support for the Dow is just above 26,000.

- Support for the S&P 500 is around 3,100.

US and global markets were already under pressure over the past few weeks related to COVID-19 issues and global economic expectations. The technology sector had driven valuations to levels not seen since the Dotcom bubble near the end of August and many of the US Indexes has reached or breached all-time highs again. My research team and I warned followers to “stay cautious” throughout much of the price rally as our proprietary price modeling systems suggests the rally was isolated and not organic. The US Fed has spewed capital into the markets and speculative traders piled into the “excess phase” of the market to drive price levels higher.

Before we get into the price charts, we want to highlight the news that is driving much of this selloff in the markets. Early Monday reports (or late Sunday, depending on your location) were published highlighting illegal and nefarious activity by many global banks related to money laundering and supporting criminal rogue elements throughout the globe.

The names of the banks implicated include Deutsche Bank (DE:DBKGn), Standard Chartered (OTC:SCBFF), Barklays, Commerzbank (DE:CBKG), Danske Bank and HSBC Holdings (NYSE:HSBC). It appears the European and Asian banks had the largest exposure to this activity and risk. There is some talk that Russian banks may have been involved as well (unconfirmed at this time by our research).

What this means for traders is that a broad, global financial crisis may be starting to unfold–this time vastly different than the 2008-09 credit crisis. This event will be centered around illegal and corrupt actions at some of the world's largest financial institutions and the far-reaching aspects of rogue government or private elements involved in this activity. We believe the markets will attempt to find support after the shock of this news is digested. Longer-term, I believe a broader market downtrend may continue–it's just a matter of what happens next and how fast global authorities are able to engage in a proper form of legal resolution (indictments).

At this point in time, the news that global banks were acting illegally and improperly may prompt a much broader market downtrend over time. Right now, we believe the initial “shock-wave” will be processed in price and support levels will be found fairly quickly.

Support Levels

This Daily YM chart below highlights the support level near 26,000 that we believe will become the first floor for price as this selloff continues. Our proprietary Fibonacci price modeling system is also suggesting support levels just above the 26,000 are valid (see the RED and BLUE SQUARES on the right side of this chart). My research team believe price will attempt to find support near the 26,000 level as this broad market selloff matures.

This ES Daily chart also highlights the support levels near 3,090 (the lower YELLOW line) and aligns with our proprietary Fibonacci price modeling suggested support levels just above 3,100. We believe this will be the first level of support for the ES if the downtrend continues.

Yes, my team has been warning to stay cautious throughout much of the uptrend and we have highlighted a multi-year Head-and-Shoulders pattern that we believed could prompt a broader market decline. But we were not aware of this illegal activity related to the global banking system. Our research helps to confirm that technical analysis and our proprietary price modeling/research systems can act as clear forward-looking techniques for any skilled traders. The theory that price always internalizes news before or as the news happens suggests that technical analysis will, in almost all cases, highlight the most probable outcome before the news is known. Only in very rare “acts of God” is technical analysis sometimes delayed in reacting to the news.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders.

If you want to survive the trading over a long period of time, then you learn fairly quickly how important it is to protect against risk and to properly size your trades.

While most of us have active trading accounts, our long-term investment and retirement accounts are equally at risk. We can also help you preserve and even grow your long term capital when things get ugly (likely now) with our Passive Long-Term ETF Investing Signals.