GBP/USD still trades inside Nov. 2nd candle shadow with failure to break lower or higher, thus entering eighth trading consolidation session, and remains bearish with heavy selloff wave.

Yesterday, the cable rallied to 1.3179 high but failed to press forward, retreated to 1.3061 low, and closed at 1.3113. Today, GBP/USD is trading narrow with 38-pips price action after plunging to 1.3090 low.

As for Fundamentals, UK is set to release Inflation (CPI) data with high anticipation for a record above 3.1% with 0.2 point basis, but still it is not clear how market will react for such data release especially after the pair was already priced in for last BOE's rate hike. Shortly afterwards Carney will cross wires a long with major governors key speakers.

Analysts at TDS are looking for UK headline CPI to accelerate from 3.0% to a firmly outside the target band level of 3.3% y/y in October, leaving us above consensus (3.1%) and the BoE’s forecast from the Nov IR (3.2%).

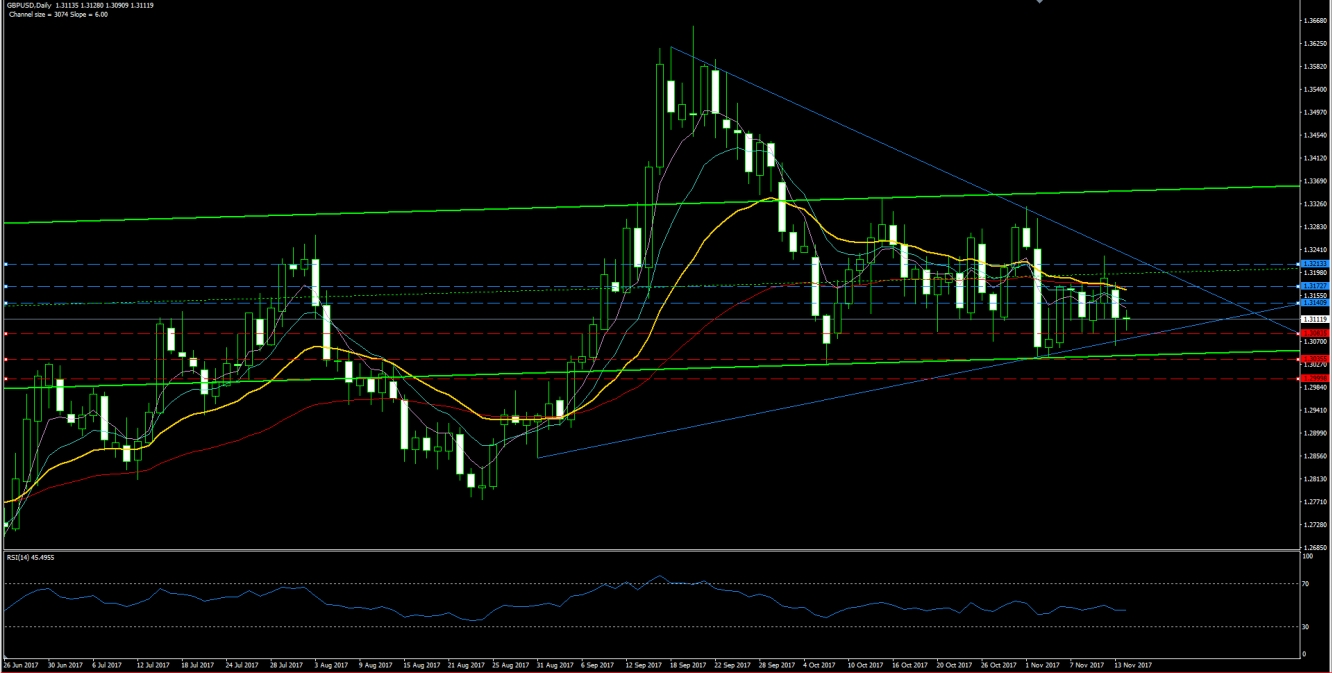

Technical Overview GBP/USD

Current price: 1.3102

Target price: 1.2950

Resistance levels: 1.3140, 1.3170, 1.3200-20

Support levels: 1.1380, 1.3035, 1.3001

Trend: Sideways Down

Comment The market is short term negative and Monday's gap lower highlights a return to down trending action, projecting an initial bear leg to 1.2950-. A close below 1.3080 should release selloffs. Stay prepared for additional near term sideways corrective congestion, but rejected rallies against Monday's gap should bear flag. A close over 1.3210* is needed to signal a trend turn back to the upside.