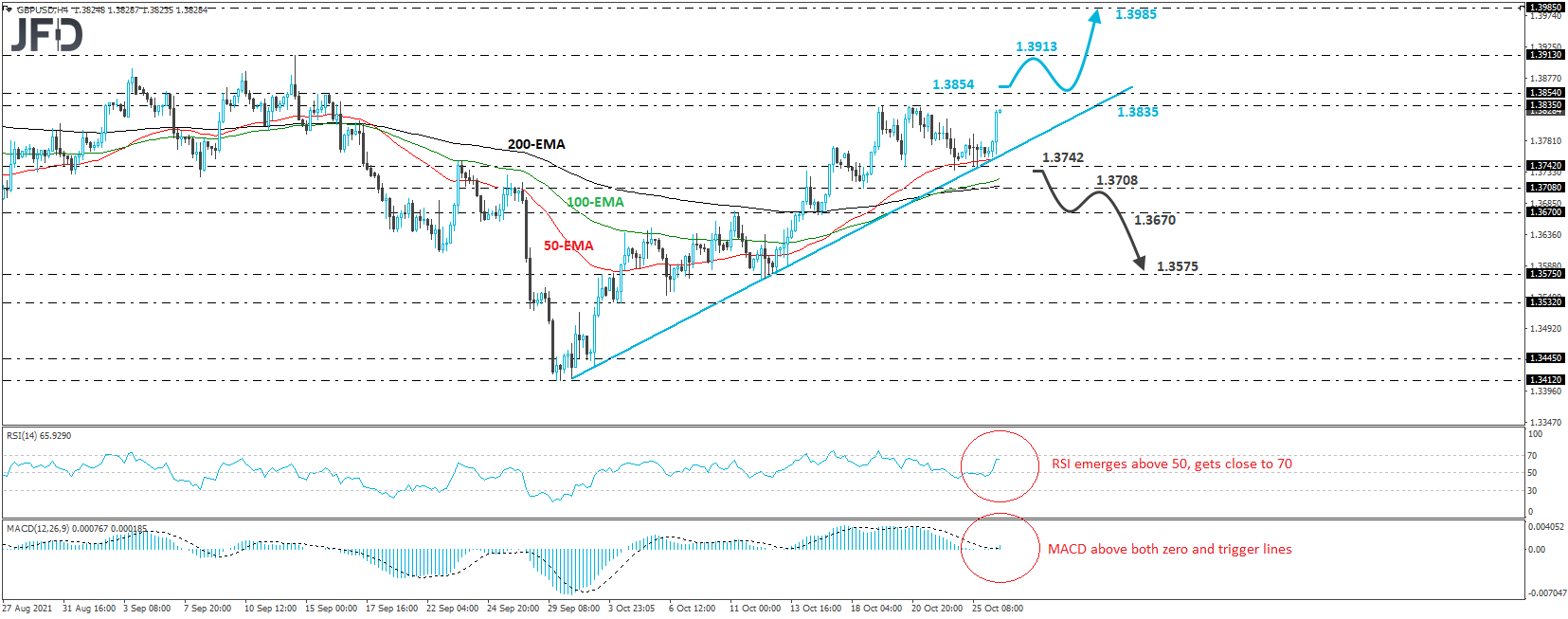

GBP/USD traded higher on Tuesday after hitting support at the upside line drawn from the low of Sept. 30. Overall, the price structure remains of higher highs and higher lows above that line, and thus, we would consider the near-term outlook to be positive.

Bullish View

However, we would like to see a break above 1.3854, the peak of Sept. 16, before becoming confident on a trend continuation. The break would confirm a forthcoming higher high and may initially pave the way towards the peak of Sept 14, at around 1.3913.

If the bulls are not willing to stop there, then a break higher may see scope for more advances, perhaps towards the high of July 29, at 1.3985.

Shifting attention to our short-term oscillators, we see that the RSI emerged above 50 and is now close to the 70 barrier, while the MACD lies slightly above both its zero and trigger lines.

Both indicators detect upside speed and support the notion for further advances.

Bearish View

On the downside, we would like to see a dip below 1.3742 before we start examining the case of a bearish reversal.

This will signal the break below the upside line and a forthcoming lower low on the 4-hour chart. Initially, the bears may target the low of Oct. 18, at 1.3708, or the low of Oct. 14, at 1.3670.

If the bears are unwilling to stop there, we could see extensions towards the 1.3575 area, which acted as a support on Oct. 12 and 13.