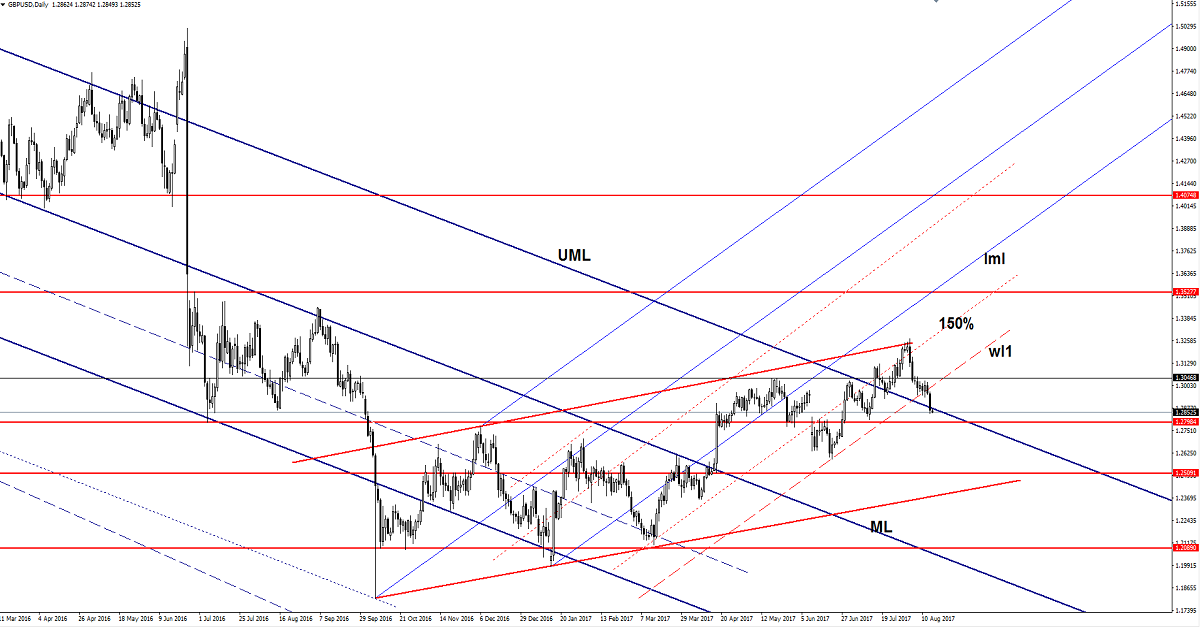

GBP/USD Melting Down

GBP/USD changed little today after the yesterday’s massive drop, could extend the sell-off as the USDX should jump much higher. The USD is stronger again as the dollar index has managed to climb above the 93.81 static resistance and is expected to increase further in the upcoming period. USD received a helping hand from the United States data on Tuesday, we’ll see how will react today after the FOMC Meeting Minutes.

USDX climbed much above the 94.00 psychological level, but failed to stay there, now is expected to pressure this level again. Technically, the index should increase as the behavior changed on the short term (has started to make higher lows).

The UK is to release the Average earnings Index later, which is expected to increase by 1.8% in June, matching the 1.8% growth in the former reading period. The Unemployment Rate is expected to remain steady at 4.5% for the second month in June, while the Claimant Count Change could be reported at 3.2K in July, much below the 5.9K in the previous reporting period.

You can see that is trading right below the upper median line (UML) of the major descending pitchfork, but remains to see if this will be a valid breakdown. A major drop will be confirmed only after a valid breakdown below the 1.2798 static support. You should know that a false breakdown will signal another leg higher after a retest of the UML and maybe the 1.2798 static support.

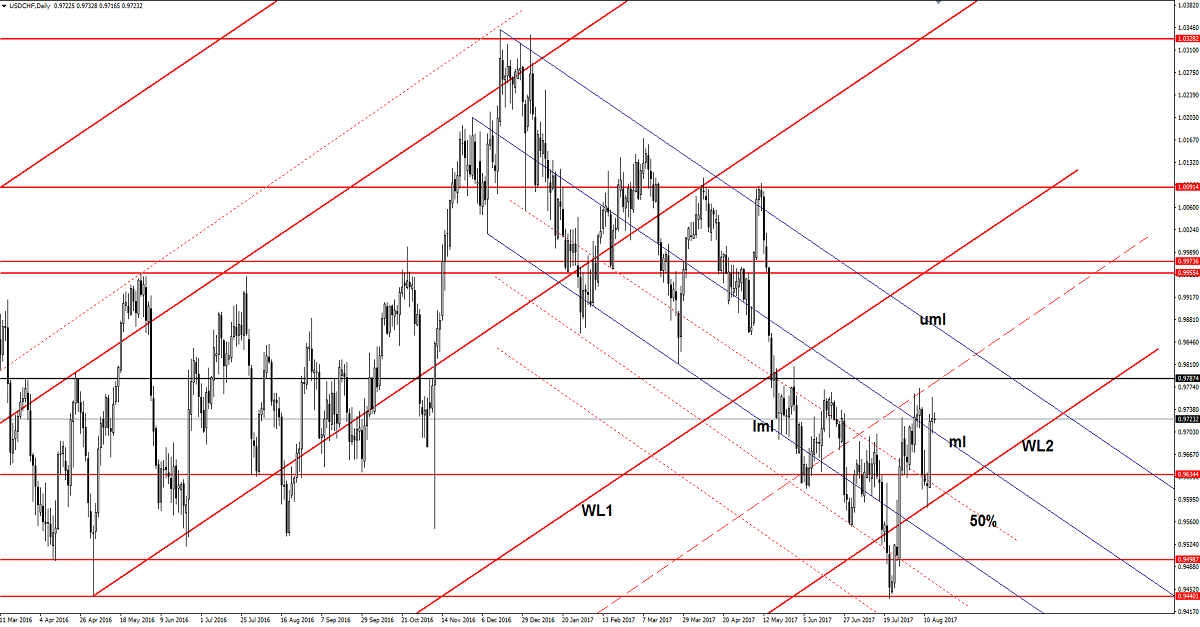

USD/CHF Upside Paused

Price has rallied since Monday, but has found temporary resistance again and now could come back to retest the broken median line (ml) of the minor descending pitchfork. Technically is somehow expected to climb much higher after the failure to close right on the second warning line (WL2) of the major ascending pitchfork.

The next upside targets will be at the 250% Fibonacci line (ascending dotted line) and higher at the 0.9787 static resistance, Could be attracted also by the upper median line (uml) of the minor descending pitchfork.

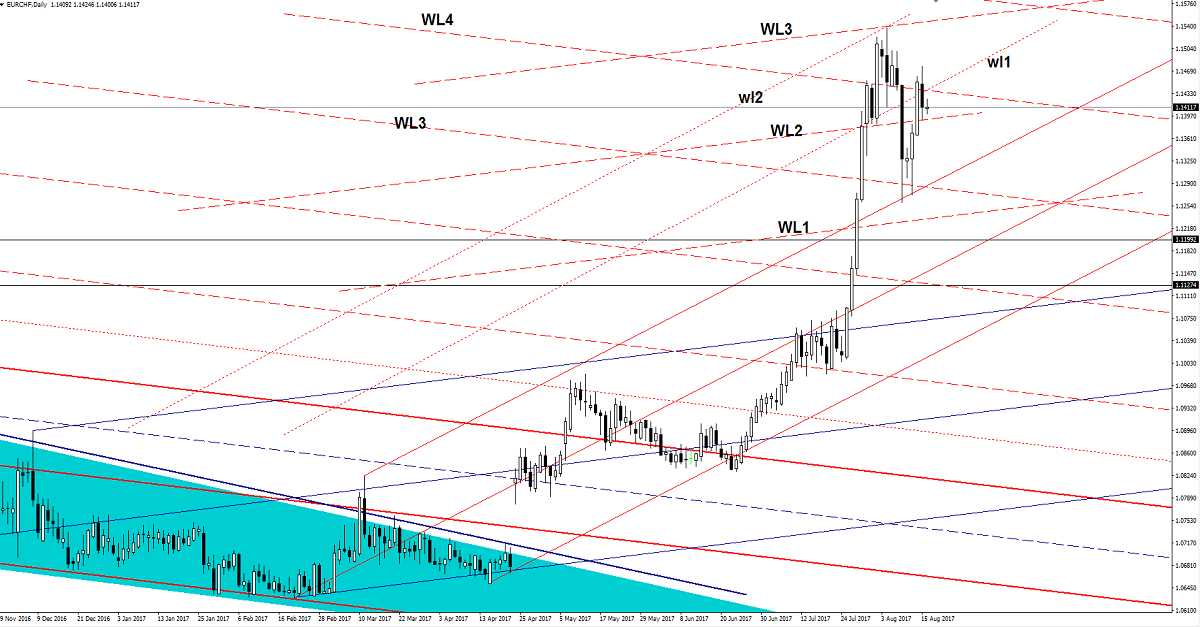

EUR/CHF Upside Uncertain

USD/CHF is struggling to hold ground as the yesterday’s drop invalidated a further upside movement. You can see that we had a false breakout above the first warning line (wl1) and above the fourth warning line (WL4). A failure to climb and stabilize above these levels will send it towards the upper media line (uml) again.

Risk Disclaimer: Trading in general is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can’t afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.