The British pound has jumped 0.82% today, as the currency has rebounded somewhat from its worst week of the year. GBP/USD plunged 2.53% last week, as the US dollar found its mojo after weeks of beating a retreat. GBP/USD has climbed today after US New Home Sales dropped to 511 thousand in July, down from 585 thousand in August and well below expectations.

UK Manufacturing Slides

The UK Manufacturing PMI crashed into contraction territory in August. The index fell to 46.0, down from 52.1 in July and shy of the estimate of 51.1. The dismal reading is part of a pan-European downward trend in manufacturing, which has been made worse by the prolonged war in Ukraine. Output has been hampered by higher costs, a drop in demand and supply chain problems.

CBI Manufacturing Output fell by 7% in the three months to August, according to the CBI, down from +6% in the three months to July. This was the first decline in output since February 2021. Manufacturers are also affected by rising energy bills and higher interest rates, and the situation is only expected to get worse. The energy cap will rise in October and the BoE will have to continue raising rates in order to defeat inflation.

There was better news from Services PMI, which was almost unchanged at 52.5, pointing to weak expansion (52.6 prior). Still, it’s hard to see how the UK can avoid a recession with weak growth and spiraling inflation. Business optimism is dropping, and that will likely lead to a cutback in spending, hiring and investment, which won’t help the economy one bit.

There is plenty of anticipation ahead of Jerome Powell’s speech at Jackson Hole on Friday, but investors shouldn’t overlook some key events prior to Powell’s speech. Durable goods orders will be published on Wednesday, with the headline reading expected to slow to 0.6% in July, down sharply from 2.0% in June. Thursday brings US GDP for Q2, which is expected to come in at -0.8% QoQ, after a 0.9% reading in the first quarter. With the Fed stating that US data will be critical in determining its rate policy, the dollar could show some movement after these releases, just as it fell sharply today after the soft New Home Sales reading.

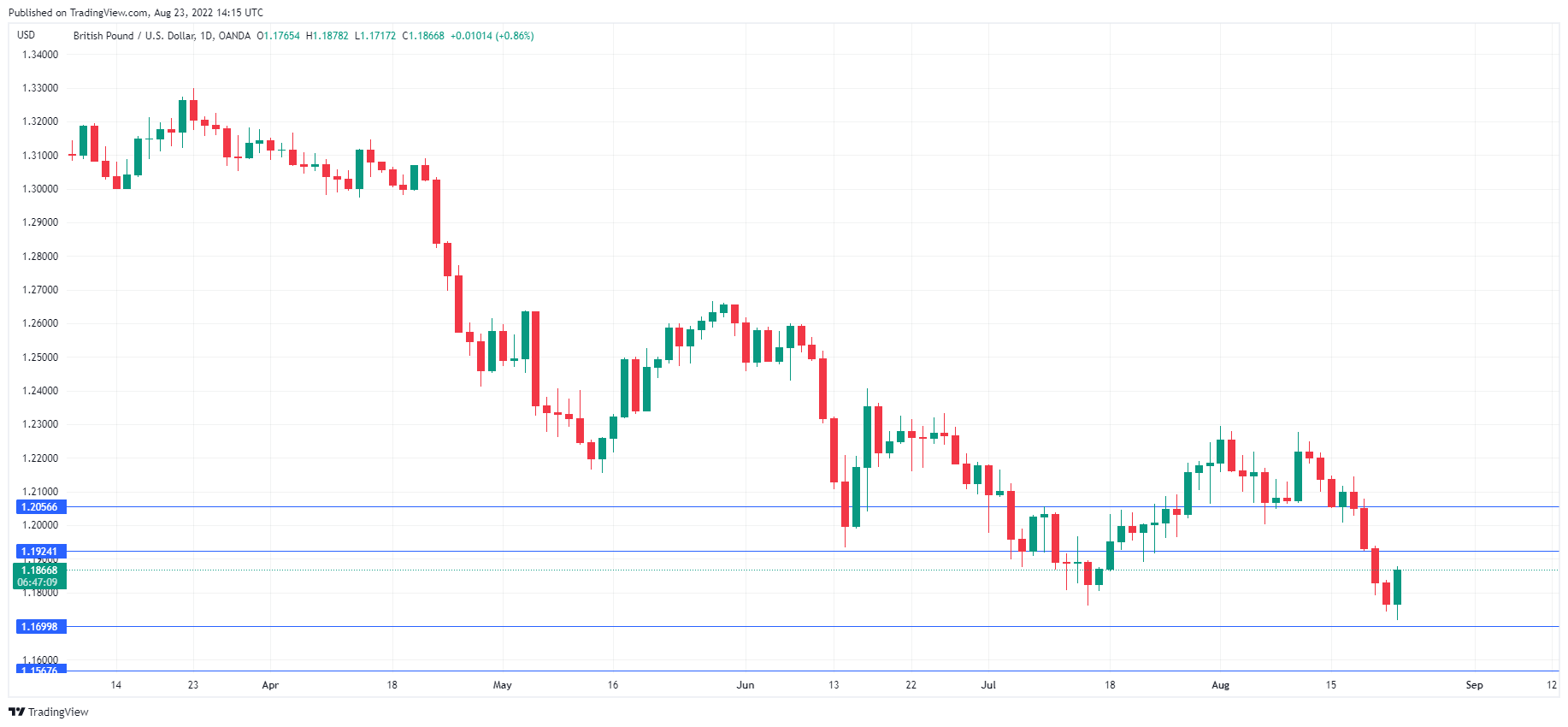

GBP/USD Technical

- GBP/USD faces resistance at 1.1924 and 1.2005

- There is support at 1.1699 and 1.1568