GBP/USD is in a 400-pip range today and up 2.5% as the Bank of England held their scheduled monetary policy meeting earlier today and left rates unchanged at 0.1%, as expected. This meeting comes only days after the BoE had two emergency rate cuts and slashed rates to its lowest rate ever. The BoE in recent days also began a 200-billion-pound Quantitative Easing program and said it is ready to do more if necessary. The Great British Pound continued its bid on the European open from yesterday’s intraday low of near 1.1650. In addition, the U.S. dollar has been getting pummelled all day, down 1.5%, pushing the GBP higher versus the U.S. dollar.

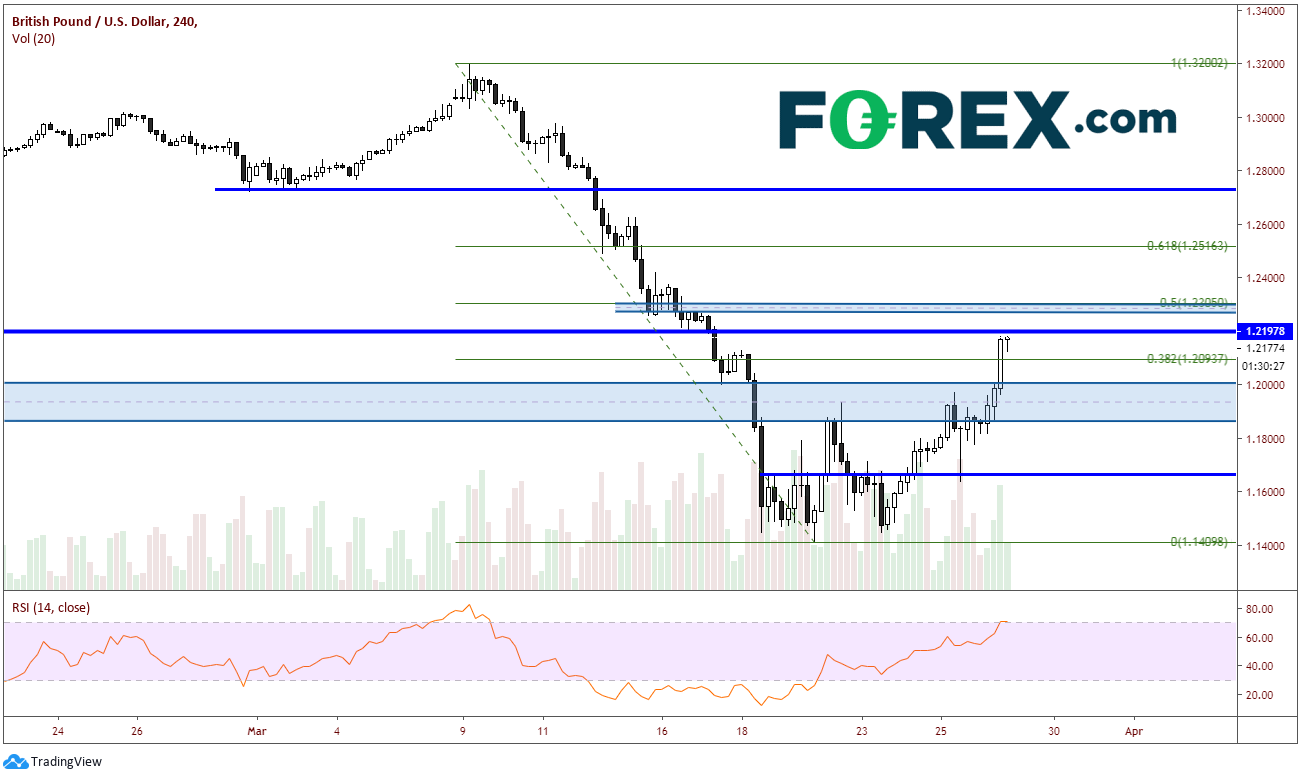

On March 9, GBP/USD put in a high of 1.3200 and began trading lower as it seemed British Prime Minister Boris Johnson was not yet 100% ready to deal with the coronavirus pandemic. Also, at that time, the U.S. dollar became a flight to safety as stock markets around the world began to selloff and move towards bear market territory.

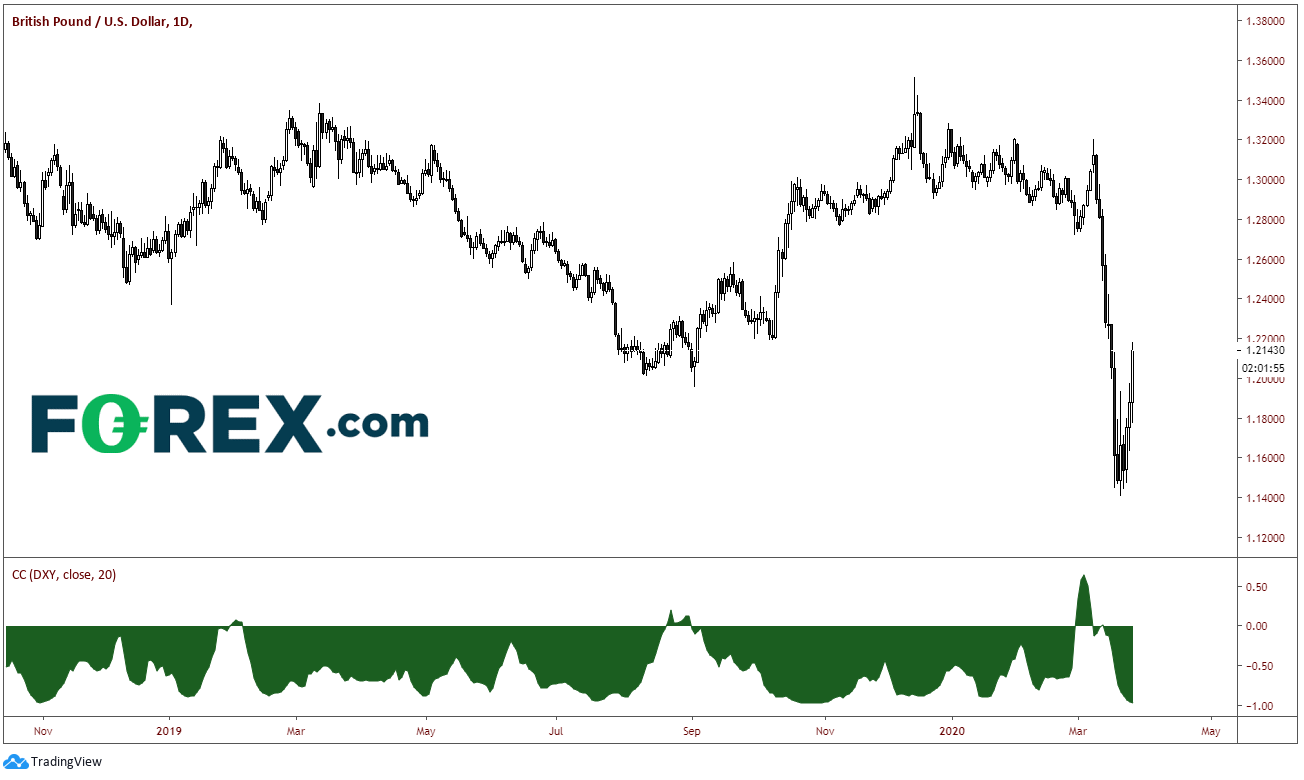

On March 20, the pair out in a low of 1.1410 as the BoE cut rates to 0.1% and the DXY was topping. On the chart below, the bottom portion shows the correlation between the GBP and the DXY. Before GBP/USD peaked on Feb. 20, the pair broke its normal behavior and the correlation was positive. Once price peaked, the correlation coefficient stated moving lower and is currently at -0.97, meaning that the GBP and the USD move are currently moving in opposite directions 97% of the time!

Today’s move in GBP/USD was monstrous. Price broke higher through a large resistance band between 1.1860 and 1.2000. In addition, the pair broke through the 38.2% Fibonacci retracement level from the highs on Feb. 20 to the lows on March 9 near 1.2093. There is strong horizontal resistance just above today’s highs near 1.2200. Above there is a small band of intraday resistance and the 50% retracement level from the same time period between 1.2275 and 1.2305. The next resistance level is nearly 200 pips higher at the 61.8% Fibonacci retracement level near 1.2516.

As for support, there really isn’t much until the psychological round number at 1.2000. Below that is the previous band of resistance between down to 1.1860. There is also horizontal support near 1.1640. The final support level is the low from March 20 at 1.1410.

If traders dare to enter a GBP/USD position, be ready for volatility and some massive moves. Make sure to watch for sudden changes in the DXY as well, as these two currencies are almost perfectly negatively correlated. A change in the direction of the DXY could mean a change in direction for the GBP/USD.