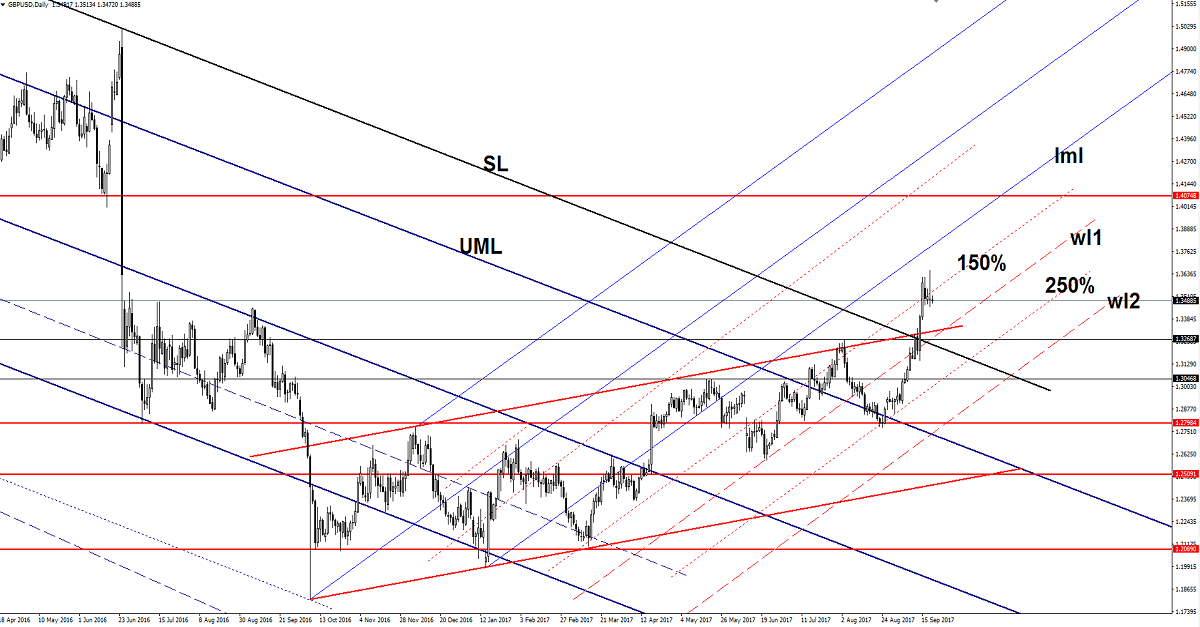

GBP/USD Retreat Favored

The currency pair seems too exhausted to climb much higher at this moment, so it could come down to retest a support level before will reach and retest a support level. It looks undecided right now also because the USDX has decreased a little again. The greenback needs a bullish spark from the United States economy, will receive one if the Unemployment Claims will come in better than expected. The Initial Claims are expected to increase from 284K to 302K in the previous week and could reach the highest level since March 5 2015. The Philly Fed Manufacturing Index is expected to decrease from 18.9 to 17.3 points, while the HPI could increase by 0.4%, more versus the 0.1% estimate. The Consumer Confidence is expected to remain steady at -2 points, while the CB Leading Index may increase by 0.3%, matching the 0.3% growth in the former reading period.

Price failed to stay above the 150% Fibonacci line and now could drop towards the first warning line (wl1) of the ascending pitchfork and towards the upside line of the ascending channel. Technically, it should drop after the failure to reach and retest the lower median line (lml) of the ascending pitchfork. The perspective remains bullish despite a minor decrease, the price is still located in the green territory.

A minor decrease is natural after the impressive rally, but we’ll see how will react after the US data will be sent to the public.

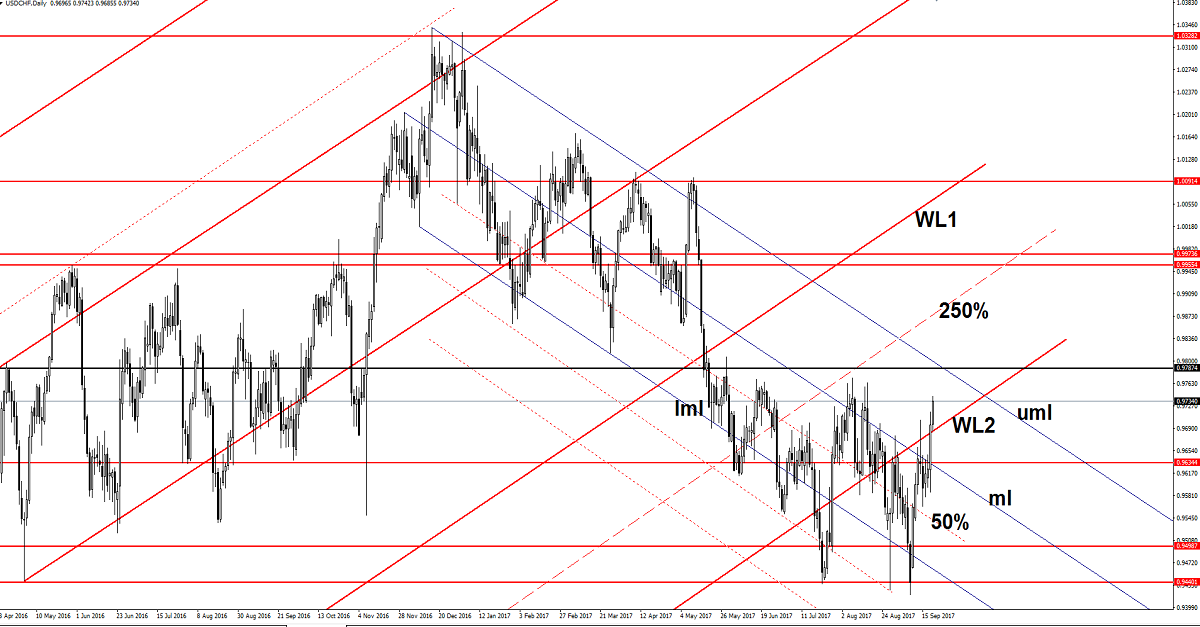

USD/CHF Crucial Breakout In Play

USD/CHF resumes the upside momentum and seems poised to reach fresh new highs in the upcoming period. Has finally managed to make an aggressive breakout, which will lead the rate at least till the upper median line (uml) of the ascending pitchfork.

Has climbed also above the second warning line (WL2) of the former ascending pitchfork. I want to remind you that the rate continues to move in range on the short term, so only a valid breakout above the 0.9787 static resistance and above the upper median line (wl1) will confirm a major increase.

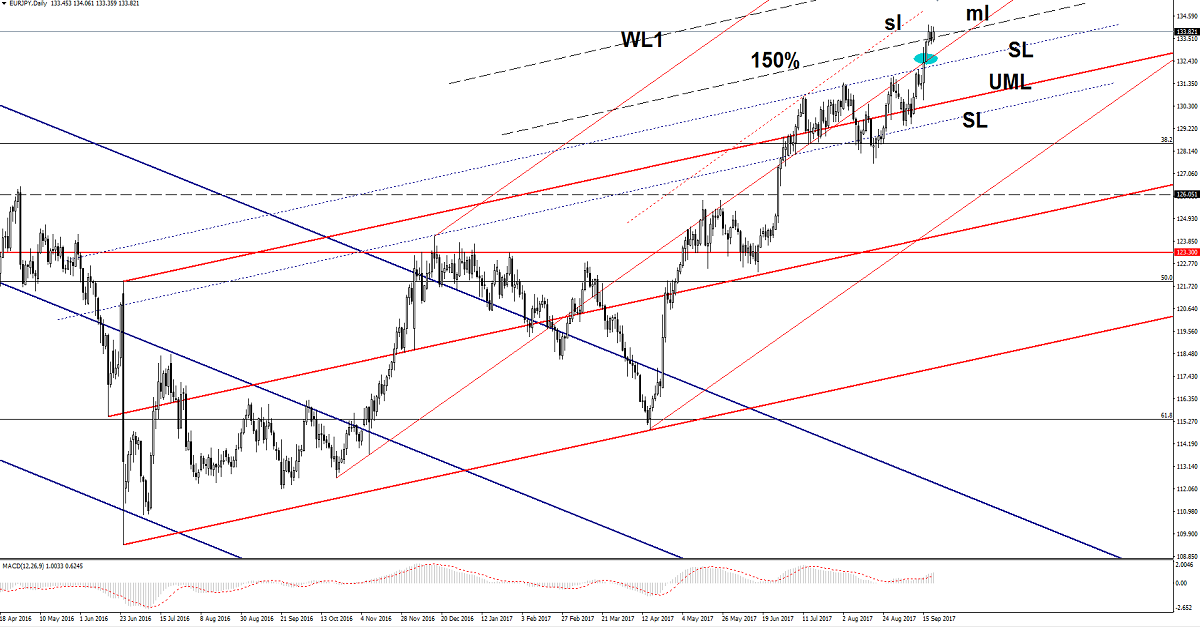

EUR/CHF Likely To Climb Higher

Price is trading in the green after the yesterday’s minor decrease. A valid breakout above the 150% Fibonacci line (ascending dotted line) will confirm a further increase. The next upside target will be at the sliding line (sl) of the black ascending pitchfork, while the major resistance level will be at the first warning line (WL1) of the major ascending pitchfork.

Risk Disclaimer: Trading, in general, is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can’t afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this website.