The British pound is looking for its footing in the Wednesday session, as the currency posted gains but then retracted. In North American trade, GBP/USD is trading at 1.3170, up 0.03% on the day. On the release front, the British Average Earnings Index remained unchanged at 2.2%, just above the estimate of 2.1%. Claimant Count Change gained 1.1 thousand, better than the estimate of 2.0 thousand. In the US, CPI and Core CPI matched the forecasts, with gains of 0.1% and 0.2%, respectively. Consumer spending reports were a mix – retail sales gained 0.1%, shy of the estimate of 0.2%. Core Retail Sales came in at 0.2%, beating the forecast of 0.0%. There was disappointing news on the manufacturing front, as the Empire State Manufacturing Index slowed to 19.4 points, well short of the estimate of 25.3 points. This reading marked a 4-month low.

There were no surprises from British employment numbers on Wednesday. Wage growth remained steady at 2.2%, but this is well below inflation, which means that the consumer is seeing her purchasing power drop, and weaker consumer spending could hurt the economy. The BoE raised interest rates to 0.50% earlier this week, but this move has yet to push inflation lower. Unemployment is at historical lows, and economists expect the robust labor market to produce higher wages. However, the current situation mirrors what is happening in the US, where an employment market running at capacity has not translated into higher wages for workers.

The pound has been under pressure, as the currency dipped below the 1.31 line on Monday and Tuesday. Investors are nervous as Prime Minister May’s leadership is showing large cracks. Two ministers have been forced to resign from May’s cabinet in recent weeks, and Foreign Secretary Boris Johnson has been heavily criticized for comments about a British citizen who is on trial in Iran. May appears to have lost control over her cabinet, with senior ministers openly attacking each other and questioning government policy. On Monday, British media reports said that 40 MPs have signed a letter of no confidence in May’s leadership – a worrisome sign that her days at 10 Downing Street could be numbered.

The Brexit talks remain deadlocked, with large gaps between the sides, such as the size of Britain’s divorce bill. Theresa May’s domestic troubles haven’t helped matters. Her cabinet remains divided on Brexit policy, with senior ministers quarreling over how to handle Britain’s departure from the EU, which is scheduled for March, 2019. May hasn’t been able present a coherent Brexit policy to the Europeans or to the voters at home, raising doubts as to whether May can deliver the goods on Brexit. On Monday, Brexit Secretary David Davis said he would introduce legislation that would allow MPs to vote on the final Brexit deal, but lawmakers would not be able to amend the legislation.

GBP/USD Fundamentals

Wednesday (November 15)

- 3:00 US FOMC Member Charles Evans Speaks

- 4:30 British Average Earnings Index. Estimate 2.1%. Actual 2.2%

- 4:30 British Claimant Count Charge. Estimate 2.0K. Actual 1.1K

- 4:30 British Unemployment Rate. Estimate 4.3%. Actual 4.3%

- 8:00 BoE Deputy Governor Ben Broadbent Speaks

- 8:30 US CPI. Estimate 0.1%. Actual 0.1%

- 8:30 US Core CPI. Estimate 0.2%. Actual 0.2%

- 8:30 US Retail Sales. Estimate 0.2%. Actual 0.1%

- 8:30 US Core Retail Sales. Estimate 0.0%. Actual 0.2%

- 8:30 US Empire State Manufacturing Index. Estimate 25.3. Actual 19.4

- 10:00 US Business Inventories. Estimate 0.0%. Actual 0.0%

- 10:30 US Crude Oil Inventories. Estimate -2.1M. Actual +1.9M

- 16:00 US TIC Long-Term Purchases. Estimate 34.6B

Thursday (November 16)

- 4:30 British Retail Sales. Estimate 0.1%

- 8:30 US Unemployment Claims. Estimate 235K

- 8:30 US Philly Fed Manufacturing Index. Estimate 24.5

- All Day – BoE Governor Mark Carney Speaks

*All release times are GMT

*Key events are in bold

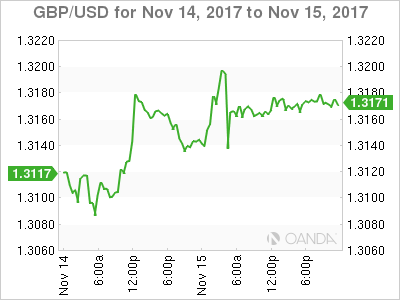

GBP/USD for Wednesday, November 15, 2017

GBP/USD November 15 at 12:00 EDT

Open: 1.3166 High: 1.3215 Low: 1.3130 Close: 1.3170

GBP/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2904 | 1.3022 | 1.3122 | 1.3224 | 1.3347 | 1.3445 |

GBP/USD edged lower in the Asian session. In European trade, the pair posted gains but then retracted. GBP/USD is showing little movement in North American trade

- 1.3122 is providing support

- 1.3224 is the next resistance line.

Further levels in both directions:

- Below: 1.3122, 1.3022, 1.2904 and 1.2811

- Above: 1.3224, 1.3347 and 1.3445

- Current range: 1.3122 to 1.3224

OANDA’s Open Positions Ratio

GBP/USD ratio is showing slight movement towards long positions. Currently, long positions have a majority (56%), indicative of trader bias towards GBP/USD breaking out and moving higher.