The British pound is showing little movement in the Wednesday session. In North American trade, GBP/USD is trading at 1.3187, down 0.11% on the day. On the release front, today’s highlight is the Federal Reserve minutes from the September policy meeting. Today’s highlight is the Federal Reserve minutes from the September policy meeting. As well, JOLTS Job Openings is expected to ease slightly to 6.13 million.

Despite pessimistic forecasts from the Bank of England and some analysts, the British economy has weathered the Brexit storm and remains in good shape. However, the Brexit talks have been difficult, and the British and European negotiators remain far apart on a range of key issues, such as the amount that Britain will pay to the EU when it leaves the club.

The British government continues to put on a brave face and insists that the talks have made progress, but European negotiators have sounded less enthusiastic. If significant progress is not made by the end of the year, there will be further pressure on Prime Minister May to take Britain out of the EU without a deal. Senior British ministers are divided in their approach to Brexit, which will only make it more difficult for negotiators to hammer out a deal.

The markets are keeping a close eye on the Federal Reserve, which will release its minutes from the September meeting. At the meeting, the Fed did not raise interest rates but did announce it would begin trimming its $4.2 billion balance sheet in October. This is seen as a vote of confidence in the US economy, which continues to show strong growth. At time of the September meeting, the odds of December rate hike were pegged around 50 percent.

However, the odds have now surged to 91 percent. The primary reason for the huge shift in market sentiment can be attributed to Fed policymakers coming out in support of a rate hike, notably Fed Chair Janet Yellen. The lack of inflation remains the most significant impediment to raising rates, but Yellen and other FOMC members have insisted that strong economic conditions will lead to higher inflation levels. Even if inflation does not move higher before 2018, the Fed now appears ready to raise rates for a third and final time this year.

GBP/USD Fundamentals

Wednesday (October 11)

- 10:00 US JOLTS Job Openings. Estimate 6.13M

- 13:01 US 10-year Bond Auction

- 14:00 US FOMC Minutes

- 19:01 British RICS House Price Balance. Estimate 4%

Thursday (October 12)

- 4:30 British BoE Credit Conditions Survey

- 8:30 US PPI. Estimate 0.4%

- 8:00 US Unemployment Claims. Estimate 251K

*All release times are GMT

*Key events are in bold

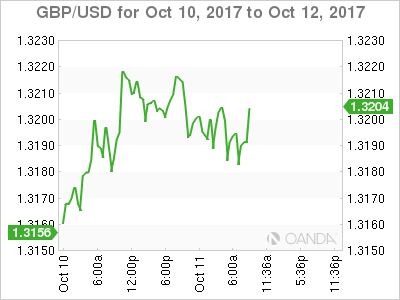

GBP/USD for Wednesday, October 11, 2017

GBP/USD October 10 at 8:10 EDT

Open: 1.3203 High: 1.3222 Low: 1.3176 Close: 1.3187

GBP/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2904 | 1.3022 | 1.3121 | 1.3224 | 1.3347 | 1.3514 |

GBP/USD has showed limited movement in the Asian and European sessions

- 1.3121 is providing support

- 1.3224 is a weak resistance line. It could be tested in the North American session

Further levels in both directions:

- Below: 1.3121, 1.3022 and 1.2904

- Above: 1.3224, 1.3347, 1.3444 and 1.3514

- Current range: 1.3121 to 1.3224

OANDA’s Open Positions Ratio

GBP/USD ratio has shown little movement this week. Currently, long and short positions are an even split, indicating a lack of trader bias as to which direction GBP/USD will take next.