The British pound has posted small gains in the Thursday session. In North American trade, GBP/USD is trading at 1.3413, up 0.15% on the day. On the release front, British Halifax HPI gained 0.5%, beating the estimate of 0.2%. In the US, unemployment claims dipped to 236 thousand, below the estimate of 239 thousand. Friday will be busy, with a host of key events. The UK will publish Manufacturing PMI. The US releases three key employment indicators – Average Hourly Earnings, Nonfarm Employment Change and the unemployment rate. We’ll also get a look at consumer confidence, with the release of UoM Consumer Sentiment.

US employment numbers have been steady this week, as unemployment claims and ADP nonfarm payrolls both beat their estimates. However, the stiffer test is on Friday, with the release of nonfarm payrolls and wage growth. The ADP reading slowed considerably compared to the previous release, and the markets are predicting the same trend for nonfarm payrolls, which is expected to come in at 190 thousand. As one of the most important indicators, nonfarm payrolls could shake up the markets, so traders should be prepared for some movement from GBP/USD in Friday’s North American session.

Ireland is in the spotlight on both sides of the Channel, as the UK and European Union scramble to find a solution to the vexing question of the status of the Irish border after Brexit. An embattled Prime Minister May is desperate to move on to trade talks with the EU, but the Europeans want to wrap up the non-trade issues first. There had been hopes of a major announcement following a meeting between Prime Minister May and European Commission President Jean-Claude Juckner. However, these expectations were left on hold, as it became apparent that wide gaps remain on two key issues – Northern Ireland and the European Court of Justice. The European Union is willing to let EU rules apply to Northern Ireland, but the small DUP party, which is keeping the May government afloat, is against any steps which could be seen as separating the UK mainland from Northern Ireland. A solution that will satisfy the UK, the EU and the DUP over the Irish border remains elusive. Another thorny issue is whether the European Court of Justice will apply to European citizens in the UK after Brexit. While the EU is in favor of the court having authority over these citizens, many British lawmakers feel that such a move would undermines British sovereignty. The EU holds a key summit on December 12, and all sides are hoping to wrap up the non-trade sticking points before the meeting.

GBP/USD Fundamentals

Thursday (December 7)

- 3:30 British Halifax HPI. Estimate 0.2%. Actual 0.5%.

- 5:37 British 30-year Bond Auction. Actual 1.81%

- 7:30 US Challenger Job Cuts. Actual 30.1%

- 8:30 US Unemployment Claims. Estimate 239K. Actual 236K

- 10:30 US Natural Gas Storage. Estimate -5B. Actual +2B

- 15:00 US Consumer Credit. Estimate 17.4B

Friday (December 8)

- 4:30 British Manufacturing Production. Estimate 0.1%

- 8:30 US Average Hourly Earnings. Estimate 0.3%

- 8:30 US Nonfarm Employment Change. Estimate 198K

- 8:30 US Unemployment Rate. Estimate 4.1%

- 10:00 US Preliminary UoM Consumer Sentiment. Estimate 99.0

*All release times are GMT

*Key events are in bold

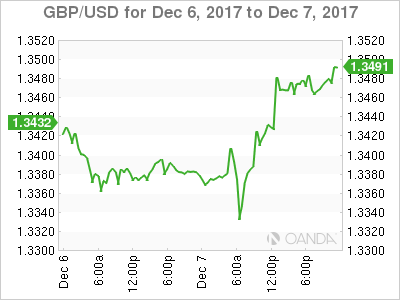

GBP/USD for Thursday, December 7, 2017

GBP/USD December 7 at 12:20 EDT

Open: 1.3392 High: 1.3428 Low: 1.3320 Close: 1.3418

GBP/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.3186 | 1.3321 | 1.3402 | 1.3503 | 1.3655 | 1.3809 |

GBP/USD showed little movement in the Asian session. The pair lost ground in European trade and has steadied in the North American session

- 1.3402 remains fluid. Currently, it is providing weak support

- 1.3503 is the next resistance line

Further levels in both directions:

- Below: 1.3402, 1.3321, 1.3186 and 1.3035

- Above: 1.3503, 1.3655 and 1.3809

- Current range: 1.3402 to 1.3503

OANDA’s Open Positions Ratio

GBP/USD ratio is unchanged in the Thursday session. Currently, short positions have a majority (55%), indicative of trader bias towards GBP/USD continuing to move lower.