GBP/USD continues to head higher on Friday. In the North American session, the pair is trading at 1.3126, up 0.15% on the day. On the release front, there are no data indicators out of Britain. In the U.S, the focus is on consumer spending data. Core retail sales and retail sales are both expected to tick lower, with readings of 0.5% and 0.4%, respectively. We’ll also get a look at UoM Consumer Sentiment, which is forecast to climb to 96.7 points.

The pound is enjoying an excellent week, with gains of 1.5%. Earlier on Friday, the currency hit its highest level since the end of July. Investor risk appetite has improved after reports that the U.S and China could renew trade talks, as well as signs from the EU that it may be more flexible in the Brexit negotiations.

As expected, the Bank of England opted to hold the course on monetary policy, keeping the benchmark rate pegged at 0.75%. In August, the BoE raised rates for only the second time since 2007. In the rate statement, policymakers noted that there had been little change on the domestic front since the August rate hike, but added that there was “greater uncertainty” in the financial markets over the Brexit withdrawal next March. The BoE may decide to stay on the sidelines and hold rates until after the UK leaves the European Union in March, in order to minimize the expected disruption that the Brexit will have on the British economy. A lack of rate hikes will make it tougher for the pound to gain ground, unless the British economy shows stronger growth than expected.

In the U.S, the red-hot labor market continues to be the envy of industrialized countries around the globe. The unemployment rate is at a remarkable 3.8% and unemployment claims were almost unchanged at 204 thousand, another excellent reading. Despite the strong employment front and a booming economy, inflation remains well short of the Federal Reserve’s target of 2 percent. In August, CPI and Core CPI came in at 0.1% and 0.2%, respectively, falling short of their estimates. The markets are braced for soft consumer spending data on Friday, which could send the dollar lower.

GBP/USD Fundamentals

Friday (September 14)

- 6:00 BoE Governor Mark Carney Speaks

- 8:30 US Core Retail Sales. Estimate 0.5%

- 8:30 US Retail Sales. Estimate 0.4%

- 8:30 US Import Prices. Estimate -0.2%

- 9:15 US Capacity Utilization Rate. Estimate 78.3%

- 9:15 US Industrial Production. Estimate 0.3%

- 10:00 US Preliminary UoM Consumer Sentiment. Estimate 96.7

- 10:00 US Business Inventories. Estimate 0.5%

- 10:00 Preliminary UoM Inflation Expectations

*All release times are DST

*Key events are in bold

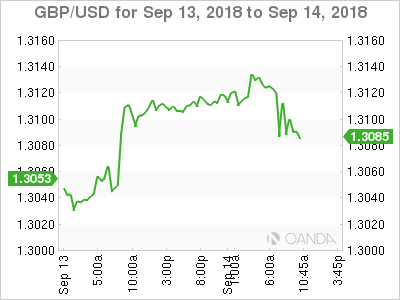

GBP/USD for Friday, September 14, 2018

GBP/USD September 14 at 7:35 DST

Open: 1.3106 High: 1.3139 Low: 1.3101 Close: 1.3112

GBP/USD Technicals

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2852 | 1.2966 | 1.3088 | 1.3173 | 1.3301 | 1.3458 |

GBP/USD ticked higher in the Asian session. In European trade, the pair posted further gains but has retracted

- 1.3088 is providing support

- 1.3173 is the next resistance line

- Current range: 1.3088 to 1.3173

Further levels in both directions:

- Below: 1.3088, 1.2966, 1.2852, 1.2706

- Above: 1.3173, 1.3301 and 1.3458