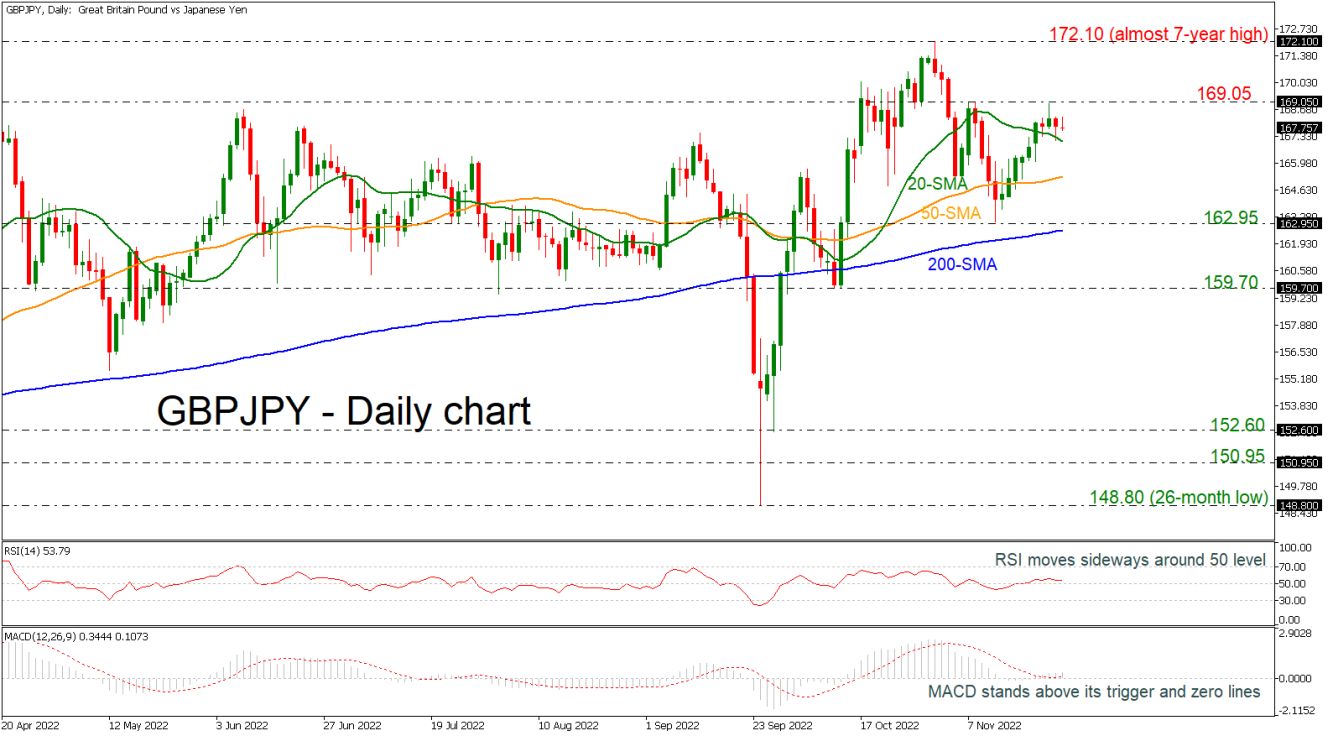

The rebound off the 162.95 support level lasted until the 169.05 resistance level, with the technical oscillators confirming the recent sideways move. The RSI is flattening above the neutral threshold of 50, while the MACD is standing above its trigger line in the positive region, but the momentum is very weak.

Should prices reverse lower, immediate support could come from the 20-day SMA at 167.10 ahead of the 50-day SMA at 165.27. A drop below this area would take the pair closer to the 162.95 barrier and the 200-day SMA currently at 162.60. Further losses would open the way towards the 159.70 bottom, while a breach of this level would shift the outlook from positive to neutral.

To the upside, there is immediate resistance just above the 169.00 psychological mark, while above that, the next major resistance to watch is the almost seven-year peak of 172.10. If there are further advances, the bulls may extend the upside move towards the inside swing low from April 2015 at 175.00.

To summarize, GBPJPY has been in an ascending movement since March 2020 in the long-term timeframe; however, the short-term picture is lacking a clear direction. Any climbs above the multi-year peak would endorse the broader outlook again.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GBP/JPY Maintains Weak Bias in Near-Term; Broader Trend is Bullish

ByXM Group

AuthorTrading Point

Published 11/25/2022, 04:28 AM

Updated 02/07/2024, 09:30 AM

GBP/JPY Maintains Weak Bias in Near-Term; Broader Trend is Bullish

GBPJPY is retreating somewhat above the downward sloping short-term simple moving averages (SMAs).

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.