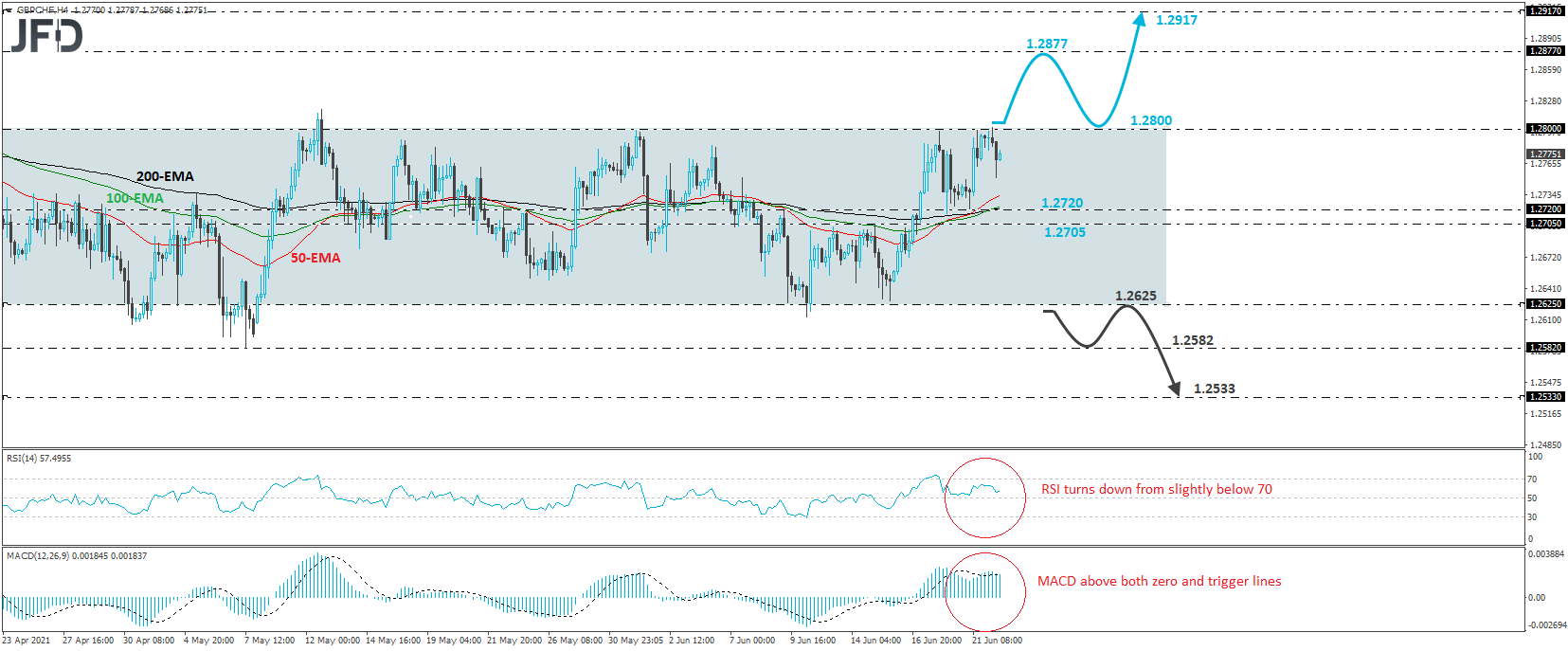

GBP/CHF traded higher yesterday, after hitting support at 1.2720. However, today’ the pair was stopped near the 1.2800 area and then, it pulled back. Overall, GBP/CHF has been mostly oscillating in a sideways range, between 1.2625 and 1.2800, since Apr. 7. Therefore, we will hold a neutral stance for now.

Before we consider the short-term outlook to have turned positive, we would like to see a decisive break above 1.2800. This will confirm a forthcoming higher high and may encourage the bulls to push the action towards the 1.2877 territory, defined as a resistance by the inside swing high of Mar. 23. If that level is not able to stop the recovery, then its break may pave the way towards the 1.2917 zone, which provided decent support on Mar. 29 and 30.

Looking at our short-term oscillators, we see that the RSI turned down from slightly below its 70 line, while the MACD, although above both its zero and trigger lines, shows signs of topping as well. It could fall below its trigger line very soon. Both indicators detect slowing upside speed and suggest that some further retreat within the range may be possible before the bulls decide to take charge, perhaps for another test near yesterday’s low of 1.2720.

Now, in order to start examining whether the picture has turned bearish, we would like to see a clear dip below the lower end of the range, at 1.2625. This may invite more sellers into the game, who could driver the battle towards the low of May 7, at 1.2582. Another break, below 1.2582, could carry more bearish implications, perhaps setting the stage for the 1.2533 obstacle, defined as a support by the inside swing high of Feb. 18.