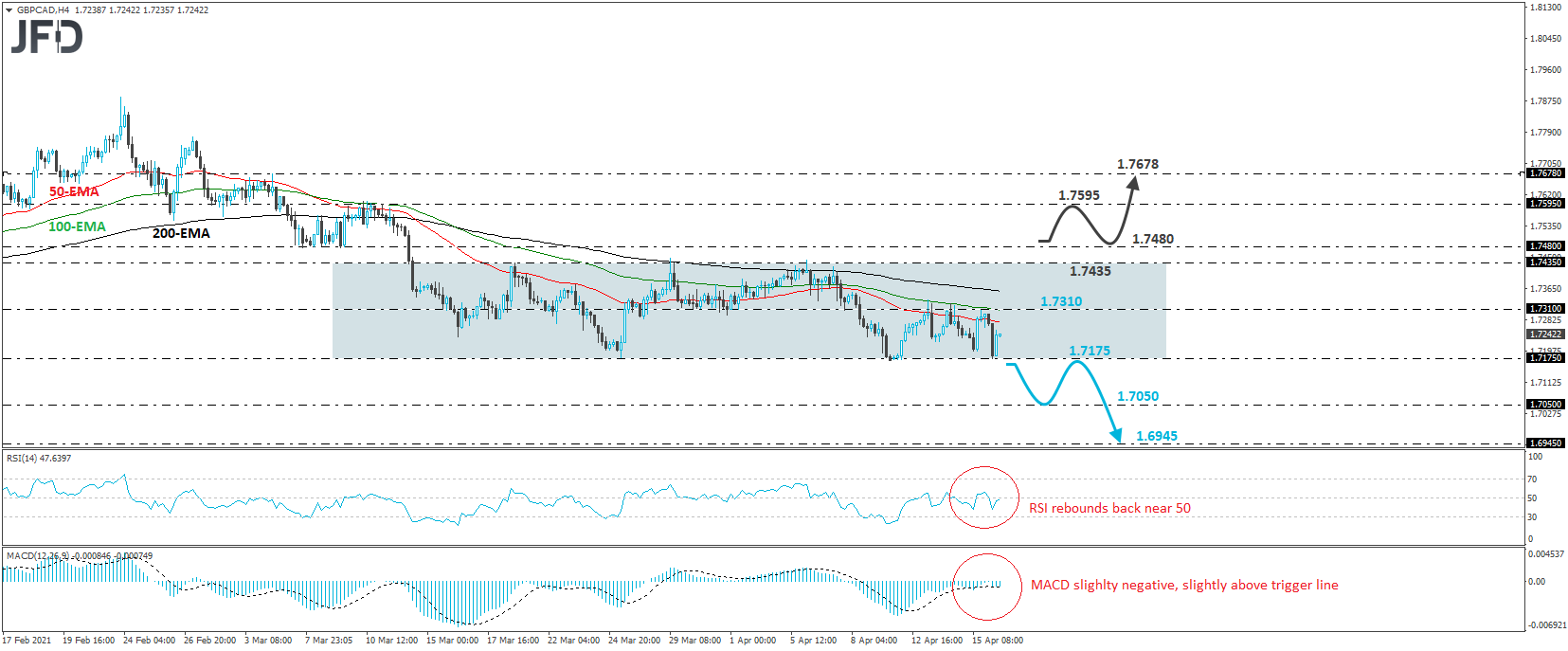

GBP/CAD traded higher yesterday, but hit resistance at 1.7310 and today, it pulled back. Overall, the rate has been trading within a sideways range, between 1.7175 and 1.7435, since March 12th, and thus, we would consider the short-term outlook to be neutral.

In order to start examining whether the bears have gained the upper hand, we would like to see a dip below the range’s lower bound, at 1.7175. This would confirm a forthcoming lower low and may pave the way towards the 1.7050 support zone, marked by the low of Dec. 21. If the bears are not willing to stop there, then a break lower could see scope for extensions towards the low of Dec. 15, at around 1.6945.

Looking at our short-term oscillators, we see that the RSI rebounded and now runs near its 50 line, while the MACD lies fractionally below zero, but slightly above its trigger line. Both indicators are near their equilibrium levels, detecting lack of directional momentum, which supports our neutral view.

On the upside, in order to start examining whether the bulls are in the driver’s seat, we would like to see a break above the upper bound of the range, at 1.7435, or even better above the 1.7480 territory, which provided strong support between Mar. 5 and 9. This may encourage the buyers to drive the battle towards the 1.7595 obstacle, marked by the high of Mar. 11, the break of which could extend the advance towards the high of Mar. 4, at 1.7678.