The British pound has posted losses in the Monday session. In North American trade, GBP/USD is trading at 1.2740, down 0.32%. On the release front, British Rightmove HPI declined 0.4%, breaking a string of five straight gains. In the US, there are no economic indicators. On Tuesday, BoE Governor Mark Carney will speak at an event in London.

A full year after the Brexit referendum, which shocked Britain and the continent, British negotiators are meeting with their European counterparts on Monday in Brussels. Just a few weeks ago, Prime Minister Theresa May was confidently peddling a hard Brexit, putting Europe on notice that if she didn’t like what the Europeans were offering, the UK would leave the European Union without a deal. However, May was humiliated in the UK election, and will be forced to govern with a minority government that is dependent on the support of a small Irish party. May’s defiant tone has been replaced by a more conciliatory Philip Hammond, the British finance minister. Hammond has said that he wants a business-friendly and pragmatic Brexit and that no deal would be bad for the UK, although he won’t accept an agreement that is aimed at punishing Britain. For their part, the Europeans have insisted that there will be no negotiations about a new trade deal, prior to progress being made on three key issues: (1) the legal status of EU citizens in the UK; (2) the status of the border between Ireland and Northern Ireland; and (3) the financial obligations of the UK to the EU. On the weekend, the EU’s Economic and Financial Affairs Commissioner Pierre Moscovici, said that the European position was not ‘hard ‘ or ‘soft’. but rather ‘amicable and firm’. There is little doubt that the EU will be firm, but given the bad blood between the two sides, it will be a pleasant surprise if the negotiations are indeed ‘amicable’. With only two years earmarked for a Brexit agreement to be reached, the talks need to become substantive very soon if an agreement is to be reached.

Earlier in the day, Federal Reserve of New York President Charles Dudley cautioned the Fed against halting its tightening cycle, adding that current levels of unemployment and inflation were satisfactory. Dudley’s hawkish remarks boosted the US dollar. Friday’s US releases were a disappointment, as construction and consumer confidence reports missed expectations. Building Permits dropped to 1.17 million, its lowest level since August 2016. Housing Starts were also week, as the reading of 1.09 million marked the lowest since November 2016. There is concern that the soft construction numbers could weigh on second-quarter growth. There was more bad news from UoM Consumer Sentiment, which dipped to 94.7 in May, marking a 7-month low. This is significant, as it is the indicator’s lowest reading since President Trump took office, and points to consumer unease with how the US economy is being handled. There are troubling signs that the June UoM report could be even lower, coming after the Comey testimony which has damaged Trump’s credibility even further.

GBP/USD Fundamentals

Sunday (June 18)

- 19:01 British Rightmove HPI. Actual -0.4%

Monday (June 19)

- 8:00 US FOMC Member William Dudley Speaks

- 19:00 US FOMC Member Charles Evans Speaks

Tuesday (June 20)

- 3:30 BoE Governor Mark Carney Speaks

*All release times are EDT

*Key events are in bold

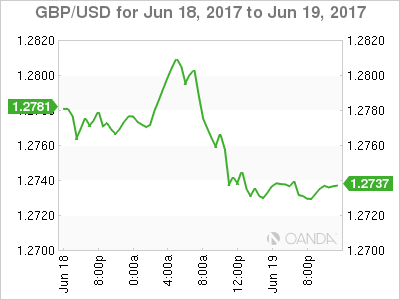

GBP/USD for Monday, June 19, 2017

GBP/USD June 19 at 12:00 EDT

Open: 1.2781 High: 1.2815 Low: 1.2723 Close: 1.2790

GBP/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2401 | 1.2571 | 1.2706 | 1.2865 | 1.2946 | 1.3058 |

- GBP/USD was flat in the Asian session. The pair posted small gains in European trade and is steady in North American trade

- 1.2706 is providing support

- 1.2865 is the next line of resistance

Further levels in both directions:

- Below: 1.2706, 1.2571, 1.2401 and 1.2313

- Above: 1.2865, 1.2946 and 1.3058

- Current range: 1.2706 to 1.2865

OANDA’s Open Positions Ratio

In the Monday session, GBP/USD ratio is showing short positions with a majority (59%). This is indicative of trader bias towards GBP/USD reversing directions and moving higher.