GBP/USD has started the week with losses, as the pair trades slightly below the 1.28 line in Monday’s North American session. On the release front, British Rightmove HPI rose 1.3 percent in April, down from 1.1 percent a month earlier. CBI Industrial Order Expectations came in at +4, well off the estimate of +9 points. This marked the weakest gain since December 2016. There are no economic releases out of the US. On Tuesday, the UK is expected to post another budget deficit, while the US releases two key indicators – CB Consumer Confidence and New Home Sales.

Although the UK is on its way out of the European Union, the French presidential election is being carefully watched in London’s political and financial corridors. Stock exchanges in Germany and France posted sharp gains in response to the vote, and the London Stock Exchange has followed suit, gaining 3.2 percent on Monday. The first round featured 11 candidates, and the election whittled the field down to just 2 candidates – centrist Emmanuel Macron and far-right Marie Le Pen. Macron garnered 24% of the vote and Le Pen 22%, which was what most polls leading up to the election predicted. Investors breathed a sigh of relief, as the nightmarish scenario of a runoff between two extreme candidates, Marie Le Pen on the right and far-left candidate Jean-Luc Mélenchon, was averted. The runoff vote takes place on May 7 and French voters will have a clear choice between Macron, who served as an economic minister and is pro-business, and Le Pen, who is running on a populist, anti-EU platform.

GBP/USD gained 2.1% last week, as the pound was buoyed by Prime Minister’s May surprise announcement to hold elections on June 8. The pound pushed above the 1.29 line on Tuesday, marking its highest level since early October. The decision caught the markets by surprise, as the government’s term runs until 2020 and May had previously said that she would not call early elections. May’s Conservative Party currently has 330 seats in Parliament, holding a slim majority of just 17 seats. Current polls show May with a huge lead over her opponents, and if this translates into a large majority for the Conservatives come election time, the pound could move upwards.

With the US economy performing well, despite some recent hiccups, the markets are expecting interest rates to continue rising in 2017. The Fed has broadly hinted that it will gradually raise rates this year, but it’s unclear how many times Janet Yellen will press the rate trigger. Most analysts are expecting two more moves this year, but there have been calls from some Fed policymakers for three more hikes. However, soft retail sales and CPI numbers in March are likely to make the Fed more dovish, and on Tuesday, the Atlanta and New York Federal Reserve lowered their outlook for US economic growth for the first quarter. The Fed can point to a labor market that is close to capacity as well as strong consumer confidence, but surprisingly, this has not translated into stronger consumer spending, a key driver of economic growth. The Fed is unlikely to make a move in May, but June is a strong possibility. However, the odds of a June move are showing a surprising amount of volatility, and the latest CME Group (NASDAQ:CME) reading shows the likelihood of a quarter-point hike have dropped to 50 percent.

GBP/USD Fundamentals

Sunday (April 23)

- 19:01 British Rightmove HPI. Actual 1.1%

Monday (April 24)

- 6:00 British CBI Industrial Order Expectations. Estimate 9. Actual 4

- 11:30 US FOMC Member Neel Kashkari Speech

- 15:15 US FOMC Member Neel Kashkari Speech

Tuesday (April 25)

- 4:30 British Public Sector Net Borrowing. Estimate 2.6B

- 10:00 US CB Consumer Confidence. Estimate 123.7

- 10:00 US New Home Sales. Estimate 590K

*All release times are GMT

*Key events are in bold

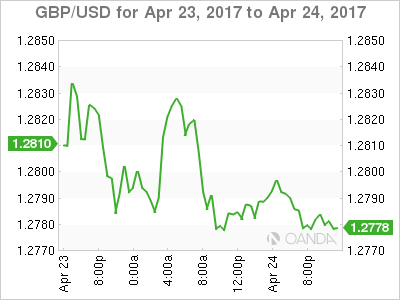

GBP/USD for Monday, April 24, 2017

GBP/USD April 24 at 11:35 EST

Open: 1.2823 High: 1.2833 Low: 1.2770 Close: 1.2780

GBP/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2471 | 1.2571 | 1.2706 | 1.2865 | 1.2946 | 1.3058 |

- GBP/USD edged lower in the Asian and European sessions. The pair is steady in North American trade

- 1.2706 is providing support

- 1.2865 is the next resistance line

Further levels in both directions:

- Below: 1.2706, 1.2571 and 1.2471

- Above: 1.2865, 1.2946 and 1.3058

- Current range: 1.2706 to 1.2865

OANDA’s Open Positions Ratio

In the Monday session, GBP/USD ratio is showing short positions with a majority (56%). This is indicative of trader bias towards GBP/USD continuing to move to lower ground.