- Financial conditions have eased dramatically since the middle of October

- This has acted to support stock prices

- However, conditions are likely to start tightening again

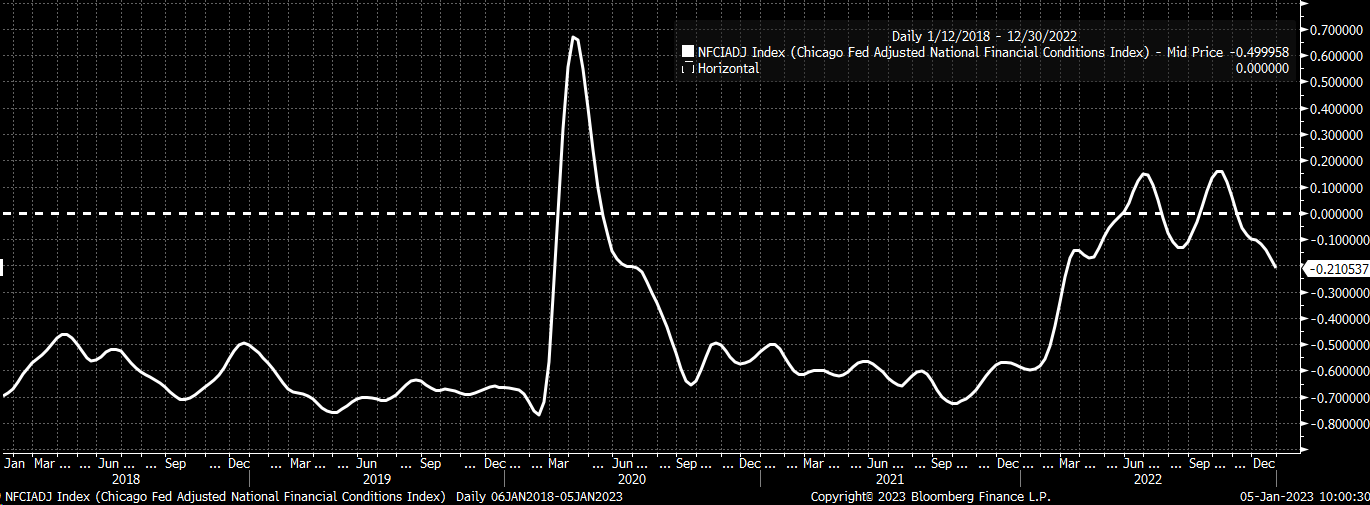

Something seems broken. Despite 425 bps of rate hikes in 2023, the Chicago Fed's Adjusted National Financial Conditions Index (NFCI) is back to its March 2022 level. That is right; despite all those rate hikes over the past ten months, financial conditions have eased dramatically since the middle of October.

The easing of financial conditions is the exact opposite of what the Fed wants: tightening monetary policy and slowing economic growth. Based on the Chicago Fed's data as of December 30, financial conditions are not tight and are accommodative to economic growth.

Not Tight Enough

When the Chicago Fed's adjusted NFCI is above 0, it suggests that financial conditions are tight and restrictive on the economy. When the index is below 0, it means that financial conditions are accommodative and are helping to support the economy. The data shows that the index reached restrictive levels between May and November. However, those conditions peaked in the middle of October around the time of that hotter-than-expected CPI report, along with the most recent lows in the S&P 500.

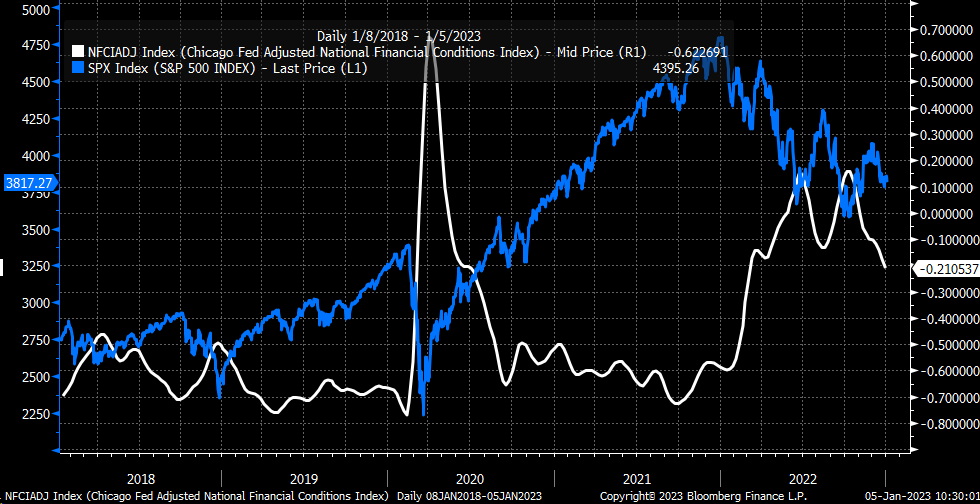

When financial conditions tighten, stock prices fall, and when those conditions ease, stock prices rise. The current easing of financial conditions has certainly acted as a tailwind for stocks in the fourth quarter of 2022. However, now with rates rising again and the dollar beginning to show signs of strengthening, the recent easing of financial conditions could be at its end.

Conditions Need to Tighten

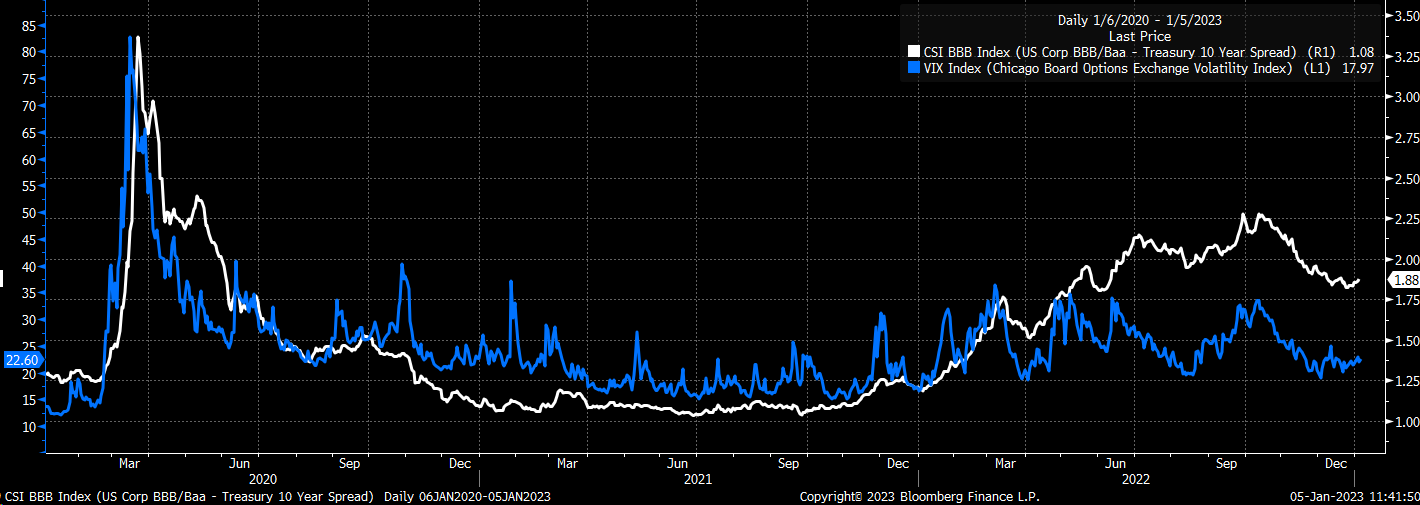

Financial conditions tighten when rates rise, credit spreads widen, the dollar strengthens, and stock prices fall. On top of that, the Fed desires to keep financial conditions tight to slow the economy.

Given this positioning by the Fed alone to raise overnight rates and shrink the size of its balance sheet, it will be hard for the market to fight the tightening of financial conditions the Fed is trying to induce over the long run.

This means the recent easing of financial conditions is likely to unwind, and conditions will slowly tighten again. Just the recent move higher in rates since the end of December has likely started to work to tighten conditions, coupled with the recent surge in the dollar since the beginning of 2023.

These minor moves we have seen so far in rates and the dollar are probably only the beginning of the tightening process as credit spreads begin to widen again, which is likely to result in higher implied volatility levels and lower equity prices. Typically, when the spread between corporate debt and Treasury rates widen, it is accompanied by a rising level on the VIX. The combination of widening spreads and rising implied volatility would suggest that equity prices are falling, which are all working to tighten financial conditions.

At this point, the question for the bulls thinking that stocks can rally is whether or not financial conditions can ease further. Those conditions may ease, but it doesn't seem likely when the Fed has made it clear they want monetary policy to be restrictive.

***

Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment. Michael Kramer and Mott Capital received compensation for this article.