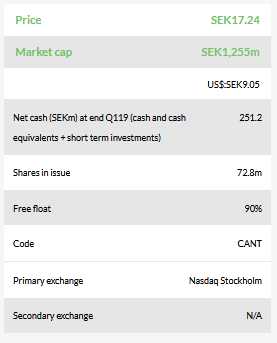

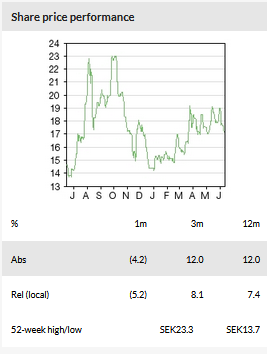

Cantargia AB (ST:CANTA) presented full data (n=22) from the Phase I part of the CANFOUR study at ASCO on 2 June 2019. These data (safety, biomarker and early efficacy data) were consistent with the interim data presented previously and so did not have an impact on the share price. The recent directed share issue (March 2019) raised SEK106m (gross) primarily from long-term institutional investors. This will fund the Phase IIa part of the CANFOUR study, expansion of the most promising subgroup, initiation of a new US study and efficacy study preparations. Our valuation is slightly higher at SEK2.62bn, but lower on a per share basis at SEK36.0/share.

Full Phase I data confirm CAN04 is safe (n=22)

Cantargia gained useful exposure by presenting its Phase I data as an oral presentation at ASCO. The full data were consistent with interim data previously presented and show that CAN04 is generally well tolerated. The highest dose of 10mg/kg was established and is being used in the Phase IIa. The biomarker data showed a decrease in IL-6 and c-reactive protein (CRP) serum levels following treatment with CAN04. According to Cantargia, this demonstrates target engagement since IL-6 and CRP are markers of disease progression. Although this study was not an efficacy study, Cantargia observed that nine out of 21 patients had stable disease following treatment with CAN04. One patient had seven-month progression-free survival (PFS) and another patient that had five-month PFS.

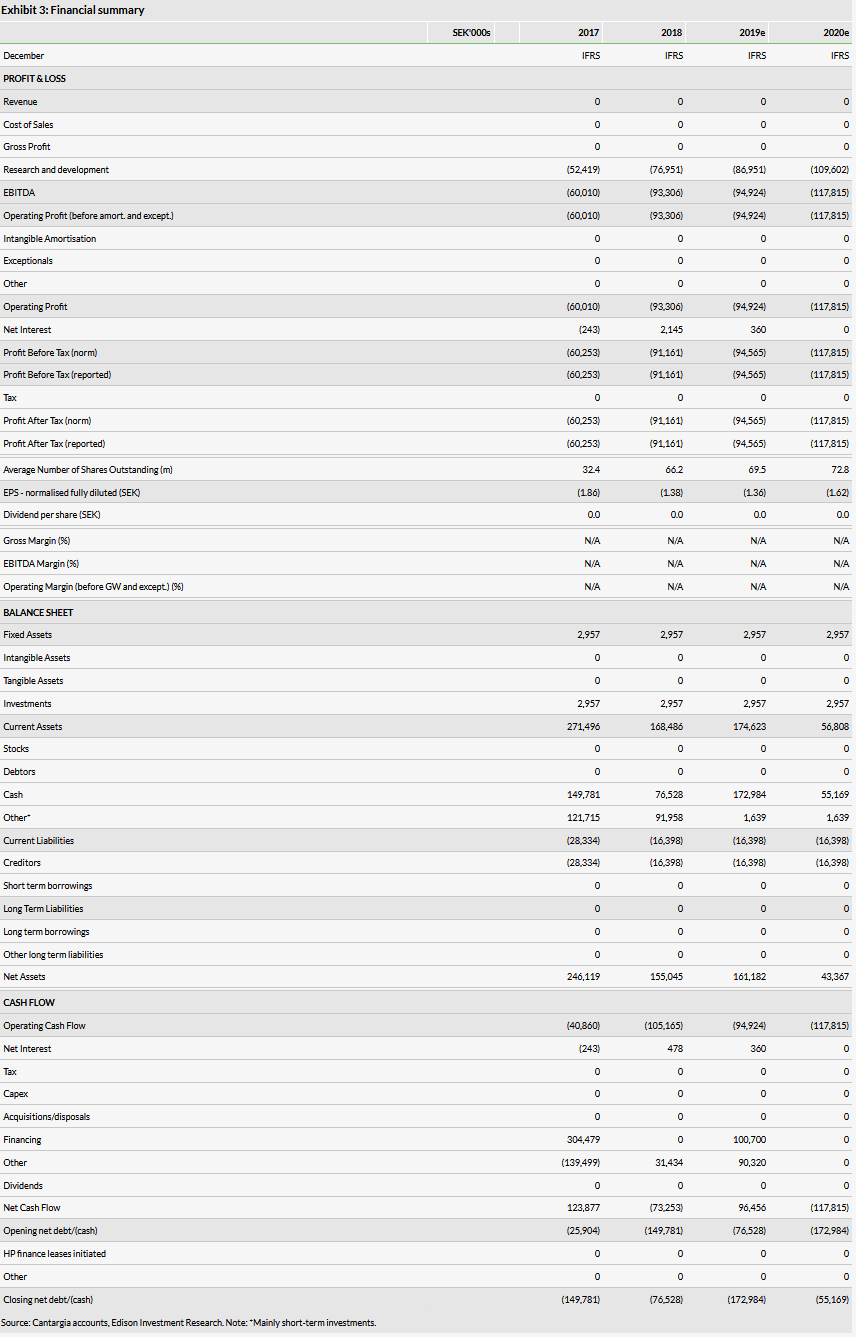

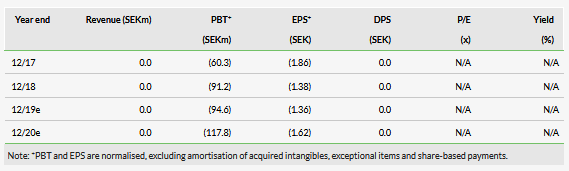

Financials: SEK106m share issue, cash until H121

With its Q119 results, Cantargia reported an operating loss of SEK23.7m vs SEK15.3m in Q118. This is due to increased R&D costs relating to the Phase IIa part of the CANFOUR study. In March 2019, Cantargia raised SEK106m (gross) in a directed share issue, primarily from long-term institutional investors. This brings the net cash position to SEK251.2m at end-Q119 (including short-term investments). According to our model, this should fund operations into H121 (in line with management guidance). The increased number of shares has lowered EPS slightly, but otherwise we make no changes to our estimates.

Valuation: SEK2.62bn or SEK36.0/share

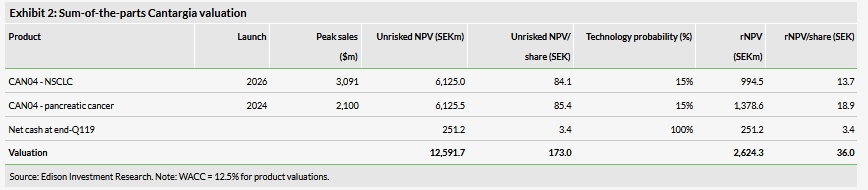

We value Cantargia at SEK2.62bn or SEK36.0/share vs SEK2.47bn or SEK37.3/share previously. The increase in total NPV is due to rolling our model forward, and higher net cash position following the share issue, with the lower per-share value resulting from the increased number of shares. We make no changes to the assumptions described in detail in our initiation report.

Business description

Cantargia is a clinical-stage biotechnology company based in Sweden, established in 2009 and listed on the Nasdaq Stockholm main market. It is developing two antibodies against IL1RAP, nidanilimab (CAN04) and CANxx. Nidanilimab is being studied in a Phase I/II clinical trial, CANFOUR, in solid tumours focusing on NSCLC and pancreatic cancer.

CANFOUR Phase I data presented at ASCO

Cantargia’s Phase I data were selected for oral presentation at ASCO 2019. It is unusual for such early data to be selected and this provides Cantargia with very useful exposure. Out of 22 patients, 12 had received between three and five prior lines of therapy, nine had received between zero and two prior lines of therapy and one patient had received more than six prior lines of therapy. The majority of patients treated had colorectal cancer (12), followed by pancreatic ductal adenocarcinoma (PDAC) (6) and non-small cell lung cancer (NSCLC) (4). There were no patients with triple-negative breast cancer recruited. There were no treatment-related grade 4/5 adverse events (AEs). 55 AEs were potentially related to CAN04, the most common of which were infusion-related reactions, fatigue, constipation and diarrhoea. Measures were taken to reduce the risk of infusion-related reactions. There were three patients with grade 3 AEs, where the AEs were an infusion-related reaction, hypokalemia, leukopenia and neutropenia. 20 serious adverse events (SAEs) were reported, five of which were considered to be related to CAN04: leukopenia, infusion-related reactions and embolism.

The biomarker data were consistent with the interim data presented at ESMO 2018, where there was a decrease in IL-6 and CRP serum levels following treatment with CAN04. According to Cantargia, this demonstrates target engagement since IL-6 and CRP are markers of disease progression, markers of inflammation and are downstream of IL-1 (CAN04 is targeting IL1RAP which sits within the IL-1 pathway). Although this study was not an efficacy study, Cantargia observed that nine out of 21 patients had stable disease following treatment with CAN04. One patient had seven-month PFS and another patient that had five-month PFS.

In summary, the full Phase I data are consistent with the interim data previously presented and show that CAN04 is generally well tolerated. The highest dose of 10mg/kg was established and is being used in the Phase IIa part of the study.

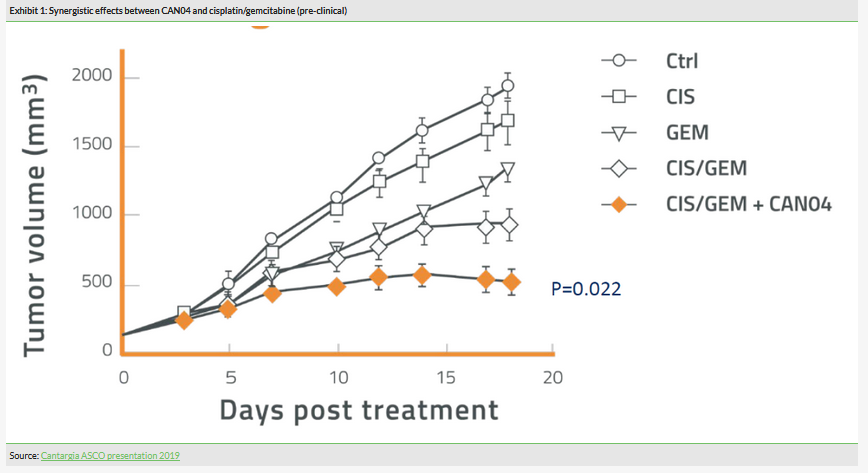

In addition to this Phase I data, Cantargia recently announced new pre-clinical data that support the chosen combinations with platinum-based chemotherapies and the results will be presented later in 2019. Some of these pre-clinical data in a NSCLC patient-derived xenograft (PDX) model were included in the ASCO presentation, and clearly demonstrate a greater reduction in tumour volume with CAN04 and cisplatin/gemcitabine compared with cisplatin/gemcitabine suggesting synergistic effects (Exhibit 1).

Next steps: Phase IIa ongoing, results expected in early 2020

During 2019, Cantargia will continue with the Phase IIa part of the CANFOUR study. The focus is on the combination groups in NSCLC and PDAC, while the monotherapy groups are used to support the combination groups, for example by providing biomarker data.

Results from the Phase IIa study are expected in early 2020. If there is a positive signal in one of these patient populations, Cantargia plans to expand the study by enrolling 30–50 additional patients in the most promising subgroup. This would take another 9–12 months (suggesting full enrolment in 2021). Alongside this expansion, the company expects to start preparations for a controlled study in the most promising subgroup. The controlled study would use similar populations as the Phase IIa study, but could be further refined. The design of a potential controlled study is still unclear, since it will be data driven and decided by future meetings with the FDA/EMA. In the meantime, Cantargia plans to start a new US study around Q319. More information will be released on this trial in the summer once the company has met the FDA and submitted an IND.

Valuation

We value Cantargia based on a risk-adjusted NPV using a 12.5% discount rate and including net cash at end-Q119, which results in a value of SEK2.62bn or SEK36.0/share vs SEK2.47bn or SEK37.3/share previously. The increase in total NPV is due to rolling our model forward and a higher net cash position following the share issue, with the lower per-share value resulting from an increased number of shares. We make no other changes to the assumptions described in detail in our initiation report. Following the Q119 results we make no changes to our FY19 estimates other than adjusting for the estimated net SEK100.7m cash received from the share issue.

In our initiation report we developed a model that reflects the broad potential of CAN04, given there was little information on the patient populations to be targeted. We currently assume relatively large groups of relapsed/resistant NSCLC and pancreatic cancer patients who express IL1RAP. With the new data in hand, Cantargia has been reviewing its plans for late-stage CAN04 development. Based on the updates to the CANFOUR study clinicaltrials.gov entry, and after speaking with management, it seems that the initial patient populations being targeted could be smaller than we currently model. This is fairly typical in novel drug R&D, where companies focus on an ideal subset of patients with the idea that once the drug is on the market, its label can be expanded to other patient groups. For example, large pharma Novartis, with no lack of resources, has initiated three Phase III trials across the full spectrum of patients in NSCLC after the canakinumab Phase III data unexpectedly showed potential in this indication (discussed in our initiation note).

Although, we currently use a larger patient population, we are conservative with the market penetration rate (10%) to reflect the uncertainty about the CAN04 positioning. In general, assumptions such as addressable patient population, market penetration and the pricing of the drug typically would interplay, ie smaller patient population could allow estimating higher market penetration and higher pricing. For now we make no changes to our approach, but we will revisit these assumptions when the company provides further information post their discussions with the FDA and EMA.