As we noted in our FOMC Preview report, there was never really any question that the Fed would leave monetary policy unchanged at yesterday's meeting, so traders quickly skimmed past the steady 0.00%-0.25% interest rate and ongoing asset purchases to the more impactful aspects of the release:

1) Monetary policy statement

In terms of the official monetary policy statement, there was little in the way of market-moving updates. The only tweak was that the central bank acknowledged that “progress on vaccinations has reduced the spread of COVID-19…but risks to the economic outlook remain.” On balance though, this was merely an acknowledgement of publicly-available information, and the lack of hints about tapering asset purchases any time soon removed one potential hawkish surprise.

2) Summary of Economic Projections

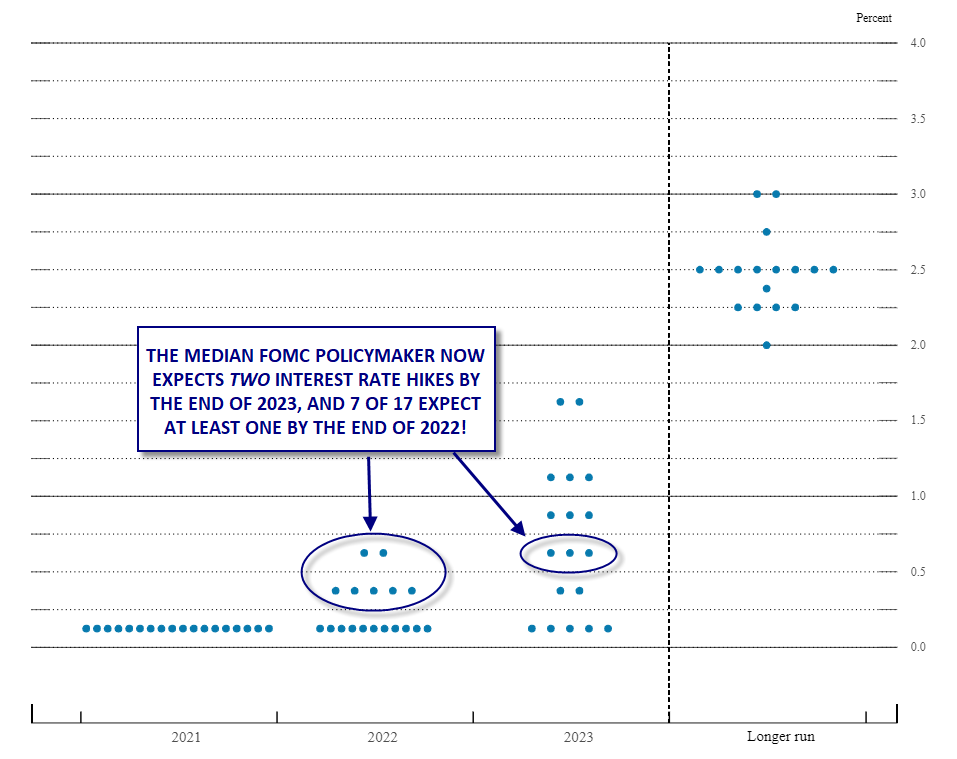

For those who dug into the Fed’s Summary of Economic Projections (SEP) however, there was a pretty big hawkish surprise: The median FOMC policymaker now expects two interest rate hikes by the end of 2023, up from zero in the last meeting. Perhaps even more significantly, 7 (of the 17) policymakers now expect at least one interest rate increase by the end of next year.

At the margin, the central bank’s other economic projections support this hawkish shift. The median Fed member revised down their projections for the 2022 unemployment rate (to 3.8%), while simultaneously revising up their projections for 2021 and 2023 growth (to 7.0% and 2.4% respectively), as well as 2021 and 2022 core inflation (to 3.0% and 2.1% respectively). In other words, the Fed believes the US economy will more quickly approach its dual mandate of inflation averaging 2% and maximum sustainable employment, so Jerome Powell and Company expect to normalize policy more quickly than before.

3) Chairman Powell’s press conference

As usual, it fell on Chairman Powell to “talk down” the market’s initial reaction to the interest rate forecasts. And while he did his usual shtick about the projections “not reflecting a committee decision or plan,” he also repeatedly emphasized the potential for ongoing strength in the labor market.

Highlights from Powell’s speech (as of writing at 3:00ET Wednesday):

- REACHING STANDARD OF FURTHER PROGRESS `STILL A WAYS OFF'

- PROJECTIONS DO NOT REPRESENT A COMMITTEE DECISION

- POWELL: DOTS TO BE TAKEN `WITH A BIG GRAIN OF SALT'

- INFLATION HAS INCREASED NOTABLY IN RECENT MONTHS

- BOTTLENECKS MAY AFFECT SUPPLY, AND THEREFORE INFLATION

- MAY SAY MORE ON TAPER TIMING AS WE SEE MORE DATA

Market reaction

The early market reaction yesterday showed that traders were caught off-guard by the hawkish shift in the Fed’s interest rate projections, with major stock indices selling off, the US dollar catching a bid, and gold shedding a quick 25 points. As we went to press, Chairman Powell’s press conference was doing little to dissuade the market of its initial hawkish interpretation of the statement and economic projections.

Perhaps the most interesting move took place in the bond market, where yields on the 2-year Treasury bond ticked up 4bps to 0.20% while the yield on the benchmark 10-year Treasury bond surged over 10bps to 1.58%. With the world’s so-called “smartest market” expecting a quicker and more aggressive liftoff in interest rates, the fallout from this Fed meeting could continue to drive all markets in the days and weeks to come.