FOMC minutes to shed some light on Fed thinking

- Today, the main event will be the release of the minutes from the FOMC’s September policy gathering, where the Committee kept interest rates unchanged and announced it will begin to reduce the size of its enormous balance sheet. Importantly, policymakers also kept their “dot plot” unchanged to signal one more rate hike this year and another three in 2018, likely surprising investors that were looking for a downward revision in the rate path due to the recent soft patch in inflation. As a result, the implied probability for another rate hike by year-end surged and at the time of writing, it stands at around 85% according to the Fed fund futures.

- Given the hawkish signals we received from the Committee as a whole at this gathering, we will go through the minutes to examine whether the number of policymakers concerned with low inflation has remained unchanged, or whether it has increased somewhat. Considering a comment by Chair Yellen in the press conference that idiosyncratic factors don’t fully explain the recent softness in inflation, we think this could indeed be the case, despite the dot plot suggesting that even some dovish members anticipate another hike by year-end. As such, we view the risks surrounding USD from this release as likely tilted to the downside. Any signal suggesting that a December rate hike may not be a done-deal, as markets currently expect, is likely to weigh on USD.

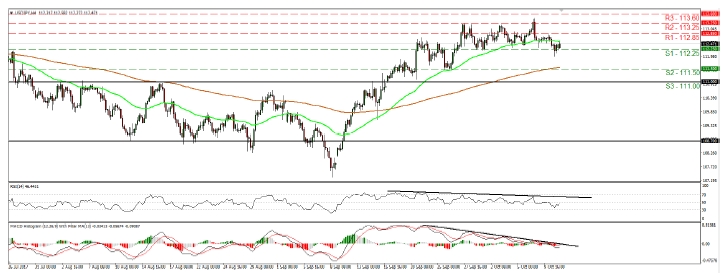

- USD/JPY slid somewhat yesterday. It traded briefly below the 112.25 (S1) obstacle, but it was quick to rebound back above it. The rate has been trading in a sideways manner between that barrier and the 113.25 (R2) resistance since the 27th of September and thus, we see a flat short-term picture for now. A decisive dip below 112.25 (S1) is needed to shift the bias to the downside, something that may open the way for our next support level of 111.50 (S2).

- Zooming out to the daily chart, we see that the pair continues to oscillate within the wider sideways range between 108.70 and 114.30 that has been containing the price action since March. Therefore, we hold a neutral view with regards to the broader outlook as well.

EUR recovers a little as Catalonia seeks talks with Madrid

- Yesterday, the Catalan President and regional leaders signed a declaration of independence from Spain. Nonetheless, they quickly signaled that this will not be implemented for several weeks, and that they want to hold talks with the Spanish government. The signals for dialogue may have lowered the likelihood of further escalation and may have suggested to market participants that a diplomatic solution is the most likely outcome, as opposed to a chaotic secession. As a result, the euro gained for most of the day, recovering some of its recent losses. With political risks seemingly dissipating, at least for now, we think that EUR-traders are likely to begin turning their attention back to monetary policy developments and specifically to the October ECB meeting.

- EUR/USD traded higher yesterday, breaking above the resistance (now turned into support) barrier of 1.1790 (S1) to challenge once again the important barrier of 1.1830 (R1). We still believe that as long as the rate continues to trade below that barrier, the outlook remains cautiously negative. A clear dip back below 1.1790 (S1) could confirm the rejection from 1.1830 (R1) and may set the stage for downside extensions towards the 1.1720 (S1) support. On the other hand, a break back above 1.1830 (S1) would push us to the side lines. The trigger for such a move may be a less-hawkish-than-expected tone in the FOMC minutes tonight.

As for the rest of today’s highlights:

- During the European morning, the economic calendar is empty, with no major events or indicators. Later in the day, we get the US JOLTS job openings for August, but this is likely to be overshadowed by the FOMC minutes.

- We have two speakers on the agenda: Chicago Fed President Charles Evans and ECB Executive Board member Peter Praet.

EUR/USD

Support: 1.1790 (S1), 1.1720 (S2), 1.1660 (S3)

Resistance: 1.1830 (R1), 1.1870 (R2), 1.1940 (R3)

USD/JPY

Support: 112.25 (S1), 111.50 (S2), 111.00 (S3)

Resistance: 112.85 (R1), 113.25 (R2), 113.60 (R3)